BASIC THEORY

ICT-platform that optimize intercorrelation

A medium that fills the Spectrum

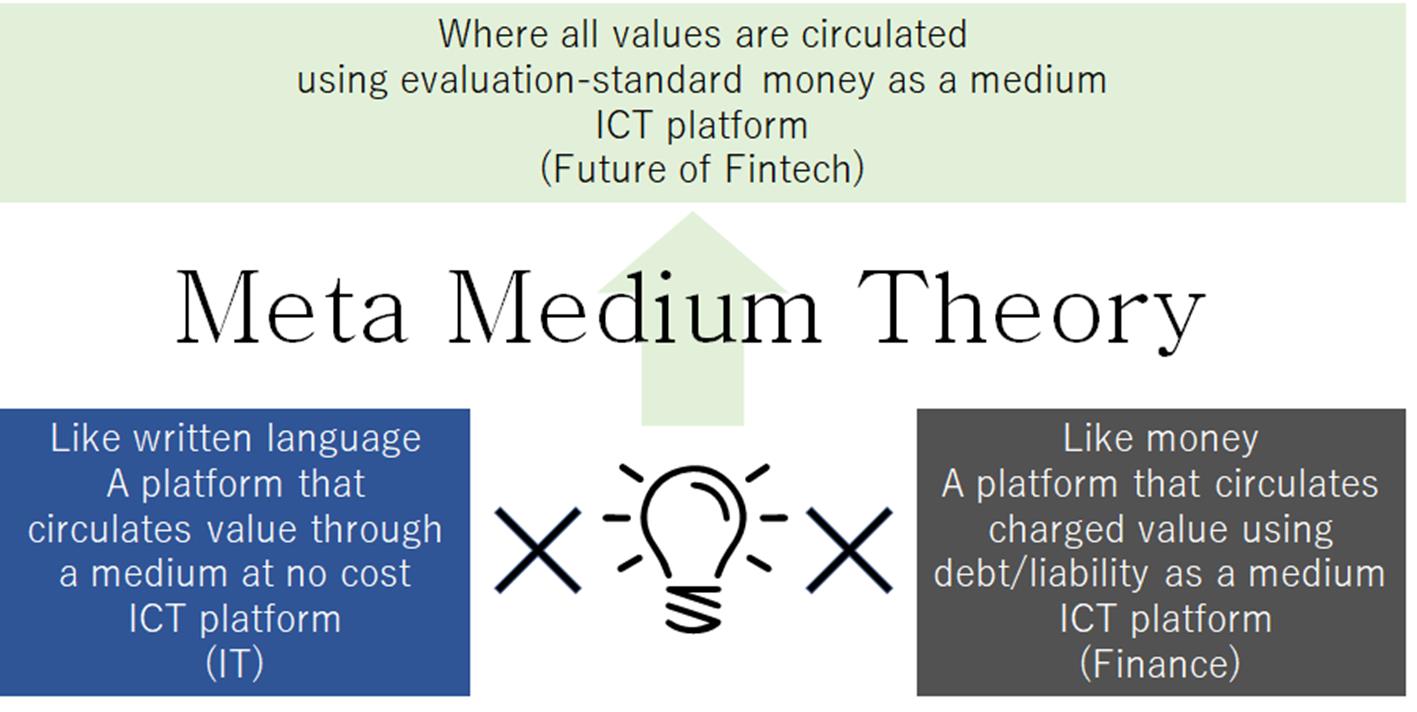

Based on the “Meta Medium Theory,”

the “Evaluation Standard Money” called INTERCURRENCY

and the “Value Exchange domain” called INTERVERSE

1,The evaluation standard money based on the meta medium theory

We at MAXELE have established creating a technology for a pure form of standard money that enables infinite money creation. We call it the Meta Medium Theory.

Through our ICT algorithm for generation and circulation of money, it is possible to fundamentally solve the problems of the conventional currency. It can control the economic value of value scale goods (standard measures of price) based on their evaluation-based purchasing power. The invention has the potential to become the main standardized money and a money-creating value measure (standard commodity or numeraire). It can also become a uniform currency, a key currency, and even a global uniform currency for central bank digital currency (CBDC). Evaluation-standard money, “INTERCURRENCY”, is here.

It is the first true monetary medium in human history.

1-1,Concept of MMT (Meta Medium Theory )

The Meta Medium Theory (MMT) disclosed on this website is based on how both written language and money act as vehicles for the transmission of information; the two are interconnected since they serve as mediums that carry value. In other words, MMT is a theory that considers the various aspects of value exchange mediums.

The theory further suggests that this function of “medium” is not restricted to written language or money, but it extends to many of the ICT platforms, cyberspace and even the countries we live in; in other words, within the human colony, it is the act of mediation itself that influences the interconnectedness of our community. These are the building blocks for the defined “mediums” we depend on in our community, or human colony, such as capitalism, journalism, and even liberalism. It is important to see how these elements took shape. In short, MMT redefines the social and economic mechanism in our community that makes us humans human. In this article, we will unravel the interconnectedness between written language (the language-based mediums) and money (the liability / debt-based mediums). Through this, we hope to shed some light on their intricacies as well as what it means for the future of humanity.

Again, it should be noted that our proposed Meta Medium Theory is not to be confused with the modern monetary system, which is also known by the same initialism of MMT.

The MMT disclosed in this paper is a theory based on the premise of creating and circulating a new monetary system whose features are not tied to the conventional monetary system. This is the decisive difference between the two; the modern money theory presupposes its features based on the operation of a conventional monetary system. However, since the basic concept behind them are similar, melding the two MMT theories into one would be ideal. This is a topic on which we welcome further discussion and exploration.

While reading this article, keep in mind that under the Meta Medium Theory, written language and money are both considered mediums.

The details of the invented ICT algorithm at the core of MMT can be found through the following link (patent application specification).

1-2,Prologue

1-2-1,ICT Platform

ICT platforms, pillars of our society. The way they look is about to change.

・Big Data

・AI

・IoT

・5G

・VR

・Block chain

・Fintech

・Mobility

・Satellite communication

・Singularity

・Information Revolution

We are now living in an era of evolution.

Since ancient times, our ancestors have created communities and by sharing with the people around them, avoiding the dangers of everyday life and inventing useful tools, they were able to enrich their lives. It is through this constant need to innovate that humanity has survived to this day. Among mankind’s inventions, written language and money are considered to be especially important. Even in present day, the two are both social technologies that are indispensable to society. It can be said that humans were able to create and develop modern civilization thanks to them.

On a different note, what comes to mind when you hear “ICT platform?”

Is it SNS? Is it a search engine? Is it an EC site? Is it media? Is it a video or music streaming service? All of the above can be considered as ICT platforms.

Let’s break it down a little further. The “I” in “ICT” stands for “Information.” The “C” stands for “Communication.” The “T” stands for “Technology.” Thus, it refers to an infrastructure comprised of these components: “information” “communication,” and “technology.”

Let’s pause to think a little here. What was the main purpose of creating a written language and money, both of which are considered to be the great inventions of humanity?

As our ancestors lived out their daily lives, there would have been many occasions that called for technology in order to communicate across time and space. Written language and money were found to be invented out of necessity. In other words, they are the foundation of “information communication technology,” and by extension, the ICT platform. As such, the ICT platform is not something that was created by modern advanced technology. It can be said that for us humans, it has been vital for survival since ancient times and remains the reason why humanity is still able to evade extinction.

The ICT platform is about to change.

1-2-2,Written Language and Money

What are written language and money in the first place?

When considering written language and money as infrastructures for information, communication, and technology, or ICT platforms, the common thread is the ability to record and share information unhindered by location or time. Thus, through mediums like SNS, search engines, EC sites, media, content, as well as written language and money, we are able to achieve such ends.

Humans beings have been evolving and advancing ICT from ancient times to present day. Among such technologies, written language and money have played vital roles.

So vital, in fact, that these technologies are actually the ICTs of social infrastructure and the driving forces for developing civilization.

1-2-3,Written Language that Carries the Information Expressed through Language

Let’s first consider what written language constitutes.

Written language exists in connection with languages employed within the community. It is a technology for communicating and transmitting information such as thoughts or events in a community across space and time. If it can not be written or read, the information the language is trying to express cannot be communicated at all given spatial and temporal limitations. So, in terms of maintaining and developing the community, written language is indeed indispensable.

There are many languages in the world, each with their own corresponding orthography. As members of society, we first learn the language used in the community as well as how to read and write it. Then, if there is extra capacity and a conducive environment, we learn other languages outside of this first language. Nowadays, it is possible to communicate across other communities and on a global scale by using a single written language: English.

To this end, translation engines and machine translation technology for written language is advancing. Furthermore, with the advent of AI assistants, audio translation technology is also making great strides. In the near future, we human beings will be able to communicate with people around the world, breaking down the Tower of Babel that had us separated.

In this way, the ICT platform of written language will easily take hold globally in the near future. The world’s ICT platforms that can handle numerous languages and written language are already available, so it’s only a matter of time before everyone can easily communicate with one another.

Our human communication needs, or information transmission needs, have been ingrained in our programming in the process of evolution. This need is a great source of power. And it is this power that is the driving force behind ICT platforms that deal with the accumulation of value by documenting it in the form of written language. This written language is an ICT platform made to circulate the value of information expressed in language among us across time and space.

Written language actually is a value exchange medium.

1-2-4,Currency that Conveys Value or Credit Money Issued as a Liability

Next, let’s consider the money that we also call currency.

※ Detailed explanation of evaluation-standard money (Section 2)

If we delve into it, the money that we use is actually called “credit money,” and it is a social mechanism that is linked to liability. Liability is the proof of borrowing and also becomes what is called a liability asset to the lender of the loan being claimed. Credit money is then created on the lending side as proof of such borrowing. Simply put, credit money is considered to be the origin of it all. It has been generated and circulated within the community through the creation of someone’s “liability,” or “borrowing” a tradition of debt that has existed for over 5000 years.

Thus, credit money, or the information recorded and shared by the ICT platform in the community, is the liability or debt record. It is a token of visualized assets as social mechanisms on the opposite side of debt. In other words, money is an ICT platform to move values such as goods, services and compensation among people in a community regardless of the location or time. Without the money mechanism, value is confined to the limited area covered by the community and the time it takes to traverse it. This illustrates money’s significance in the balance of social order and progression.

Money is, in fact, another value exchange medium.

With the birth of credit money, people have long assumed that money is a token of property.

This is a misconception; we are actually being blind sided as we are told by society to gather more money, a token visible to the naked eye. It is difficult to recognize that the true essence of money is the intangible credit money and debt.

In addition, since credit money is different in nature from commodity money as a numeraire and does not have purchasing power on its own; the value scale function and the value storage function are neither clear nor real. In essence, this means that credit money has no value. There is only the existence of “debt”. We are only collecting the “money” that is created on the other side of the debt that someone holds in order to write off the debt or liability created by someone else.

Ten years ago, we experienced a financial crisis due to the vulnerability of the ICT platform of credit money. ※ Subprime mortgage crisis, Lehman shock, Global financial crisis

It is apparent that the cause is the nature of credit money and how it is perceived.

The solution is a matter of communicative means. In order for ICT platforms of written language to transmit information or values easily across communities, the ICT platform of “credit money”, which transmits debt, must also be enabled to move freely. Already ICT platforms that handle written and spoken language are trying to transform into ICT platforms that also handle money. This is a natural progression, as both written language and money are ICT platforms that record and share information beyond space and time.

This further reinforces the idea of written language and money as value exchange mediums.

1-2-5,What do our future selves want us to do now?

Now is the time to consider our future with regards to the ICT platform, the foundation for the very world we live in.

ICT platforms, the pillars of society. The way they look is about to change.

Since primitive times, humans have not lived on their own, but rather in a community, coexisting with other human beings. By developing ICT and repeating inventions, we have managed to survive to this day. Today, the barriers between communities have become very low, and we all share a common platform, Earth. Together, we live by building relationships while exchanging values across one giant community. In other words, while we belong to the group that is a “nation, at the same time, we belong to a community called “humanity”. This exchange will surely continue to accelerate from here on out. And ICT will also continue to develop in kind.

What is the source of such power for humanity?

Where is humanity heading?

And what exactly does humanity desire?

Here are the results of our research on the ideal approach to ICT in the future based on one hypothesis. We hope that these results will be further applied in future projects and shed some light on solutions for a better tomorrow.

Our future is determined by our current actions.

1-3,Introduction

Money is a means of transferring purchasing power over time and place in society. It serves as an intermediary for the value we create to change hands easily. In other words, money is a value exchange medium and a social technology that facilitates the creation of new value in society. Only when the money is able to effectively circulate that value within society, where new value is constantly being created, will society as a whole become wealthier. This means that money has a very important role in establishing our society.

With this in mind, it is important to note that shifts in the money that we use, such as banknotes and deposits, are beginning to occur. Contributing factors include globalization of the economy due to technological progress, increase in circulation speed and magnitude of value, diversification, fragmentation of value, and debt expansion. Additionally, the fact that the modern monetary theory has begun to be advocated also makes a catalyst in such shifts in how we use money.

We need to be aware that we are now living in a period of change.

MMT (Meta Medium Theory) is centered on evaluation-standard money circulating based on the invented ICT algorithm. It was invented in light of this social background and born from research aimed at solving a number of social issues facing us.

Therefore, this site contains information on the system for controlling the circulation of evaluation-standard money that will be created based on the proposed ICT algorithm. It is a social mechanism that, if realized in the future, would play a large part in revolutionizing information.

In addition, since this site is organized as a white paper, the contents are quite large and I think that it will take a considerable amount of time just by looking at everything, but please have a look until the end, we are truly grateful for your patience.

We greatly appreciate your time and interest in the contents of this white paper.

MAXELE Inc.

Representative Director and Inventor : Kazutoyo Watanabe

1-4,The generation and circulation technology of standard money that can standardize and control the unit exchange value (or standard measures of price) has been invented. This value is based on the purchasing power determined by the evaluation of its economic value.

In terms of value exchange mediums circulation systems (monetary circulation system), systems like the modern monetary system (bank money by money creation system) were only used as a means of calculating wealth and debt conventionally. By applying the FinTech algorithm invented by our company and attaching an economic value (source of purchasing power) to the unit of money, it is now possible to control the size of the economic value that is generated in the monetary unit itself.

In other words, by using our algorithm to apply purchasing power as a value that can be exchanged for other values within a vessel of money units such as “one dollar”, it is now possible for the operating entity to control it arbitrarily in the new monetary circulation system. In addition, the contents as a source of purchasing power to be put into the vessel will be the value of the information circulated free of charge within the community. One preferred pattern of application for this invention is to integrate into the ICT platforms algorithms to visualize the information on economic value that is freely circulated, generate currency from it, and link another currency. By processing these algorithms in a series, the two currencies to be circulated can be allocated to their respective partial functions all while improving their performance. It is intended to work together as one complete and outstanding currency.

In a time when money did not exist, the evaluation economy became embedded at the core of society as we began to develop more sophisticated infrastructures. From this core, we have established a monetary system and circulation technology that have transformed into social mechanisms with global reach in the modern era. As a result, in the new currency system using our invention here at MAXELE, it is possible to control the unit exchange value (standard measures of price) arbitrarily (active control with execution power). This is unique because in the current economy, modern currency does not in itself have intrinsic economic value; it instead fluctuates with economic conditions. This ability to stabilize economic value will enable society to avoid financial crises and economic unrest, which have been plaguing us for ages. Furthermore, it will allow for the control of the velocity of monetary circulation as well as the redistribution of wealth and debt.

This page provides an overview of our work. There will be an explanations categorized into pages that are internally linked on this site. In addition, the patent we filed that is currently pending can be downloaded from the Download page of this site. There, you will find a detailed disclosure document of our technology related to evaluation-standard money, or INTERCURRENCY.

1-5,A new kind of currency called evaluation-standard money, or INTERCURRENCY, is born. It has the potential to become a key currency that also acts as standard money, which measures money-creatable value. It also can become credit money.

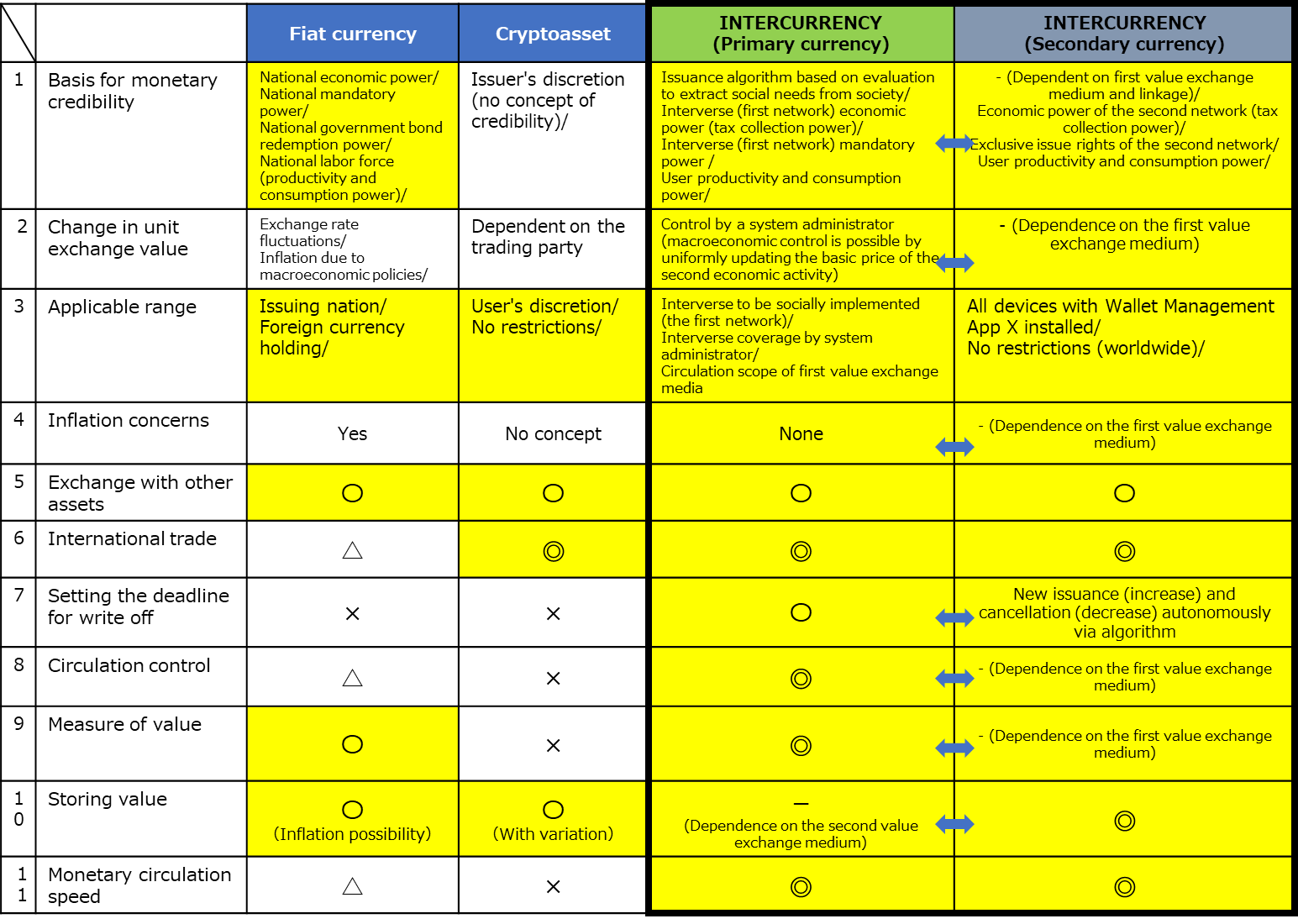

The invention of the unit exchange value, a generative and controllable technology, solves the problem of traditional value exchange mediums, or currency such as digital currency (Cryptocurrency) and Fiat currency. It is a currency whose value is standardized based on the economic value that is transferred freely between economic entities where purchasing power arises. A future currency applicable to central bank digital currency (CBDC) and key currency are born.

1-6,This section addressed the difference between stable coin and central bank digital currency (CBDC) and how evaluation-standard money pertains to these two.

1-6-1,What is evaluation-standard money?

Evaluation-standard money is defined as the source of purchasing power inherent in monetary or currency units. These units are evaluated based on their economic value that will continue to occur indefinitely in a no-charge value exchange scenario in society. This evaluation process separates it from gold-based money, which is backed by gold, and stable coins, which are funded through an initial coin offering, both of whose value depends on external assets. Evaluation-standard money falls under the category of cryptocurrency (crypto asset), which are exchanged only with electronic data. It demonstrates the functions–value scale function, value exchange function, and value storage function–required for money tokens independent of the sovereign’s money and, ultimately, it’s authority. However, evaluation-standard money is superior to conventional value exchange mediums like bank money and cryptocurrency, including central bank digital currency (CBDC), because it can mediate value regardless of whether it is paid or not. It can control the measure of values and has the function to cancel out inflation, but it is not limited to economic activity on the Internet; it is also a means of payment, settlement, debt clearing and compensatory damages in the real world. This includes but is not limited to tax payments, compensation, financing, investments and many other purposes.

First disclosed in the world in 2019, evaluation-standard money is detailed in the patent as a system, program, and information processing device and a method for controlling unit exchange value of value exchange mediums.

1-6-2,Characteristics of evaluation-standard money

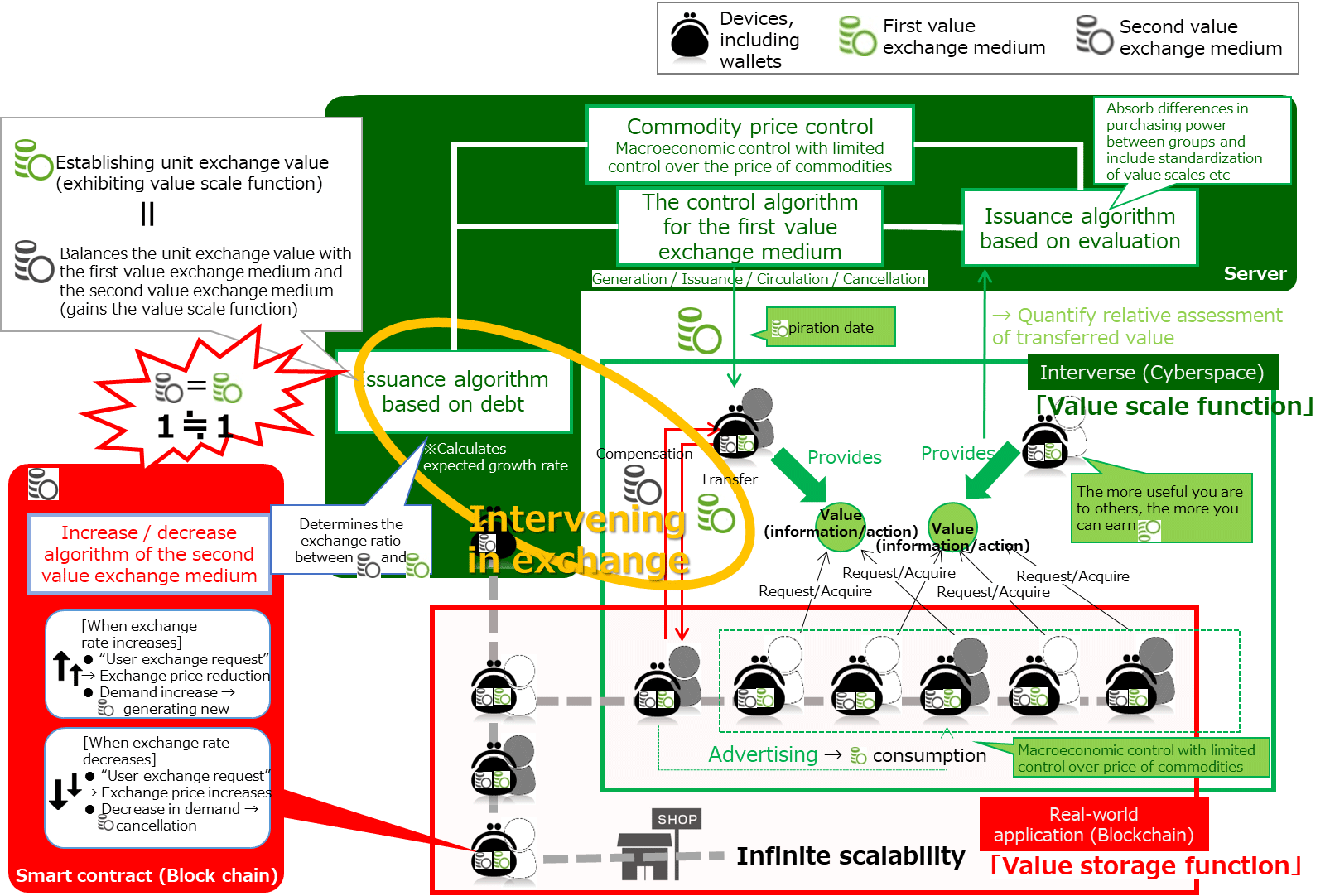

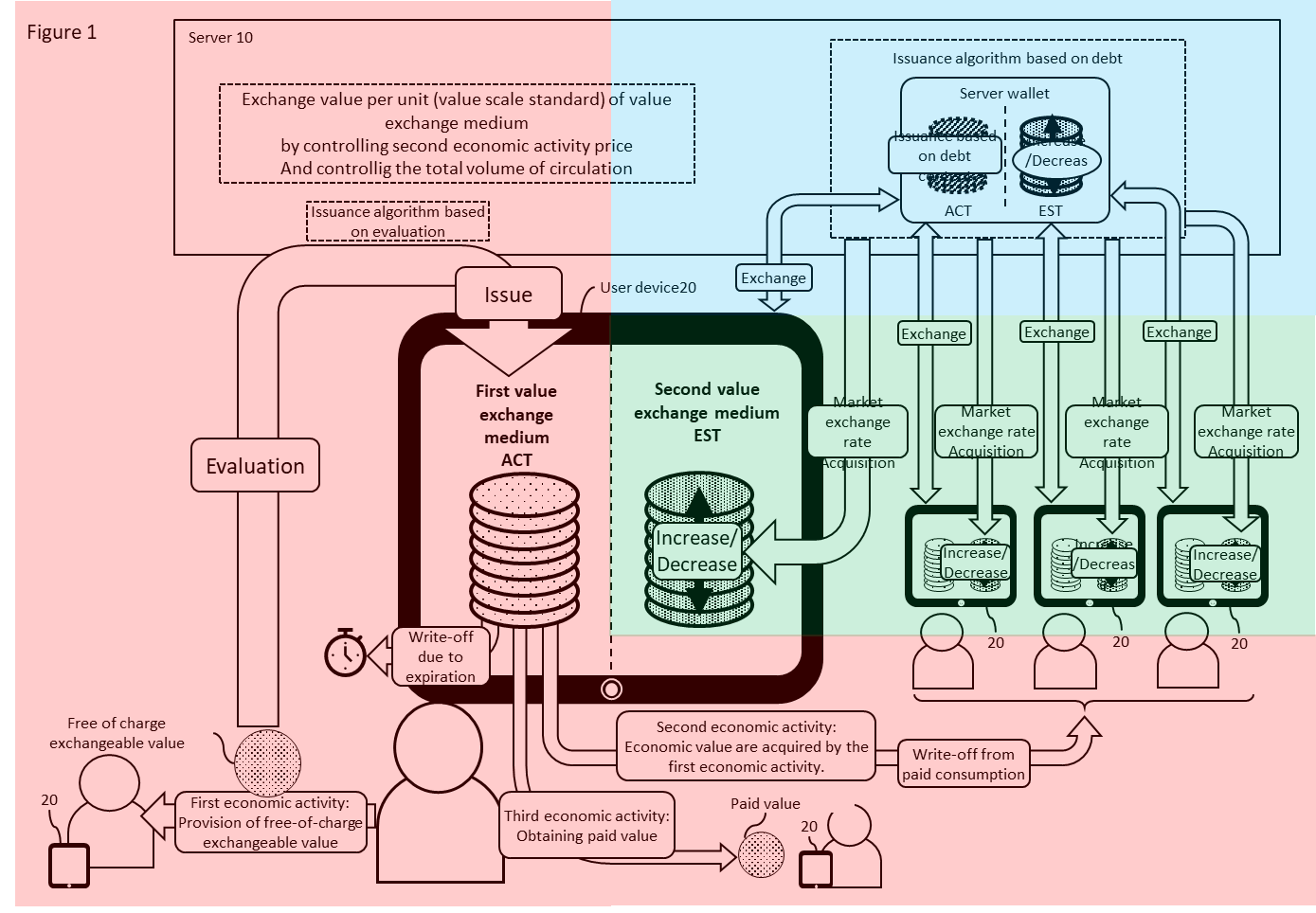

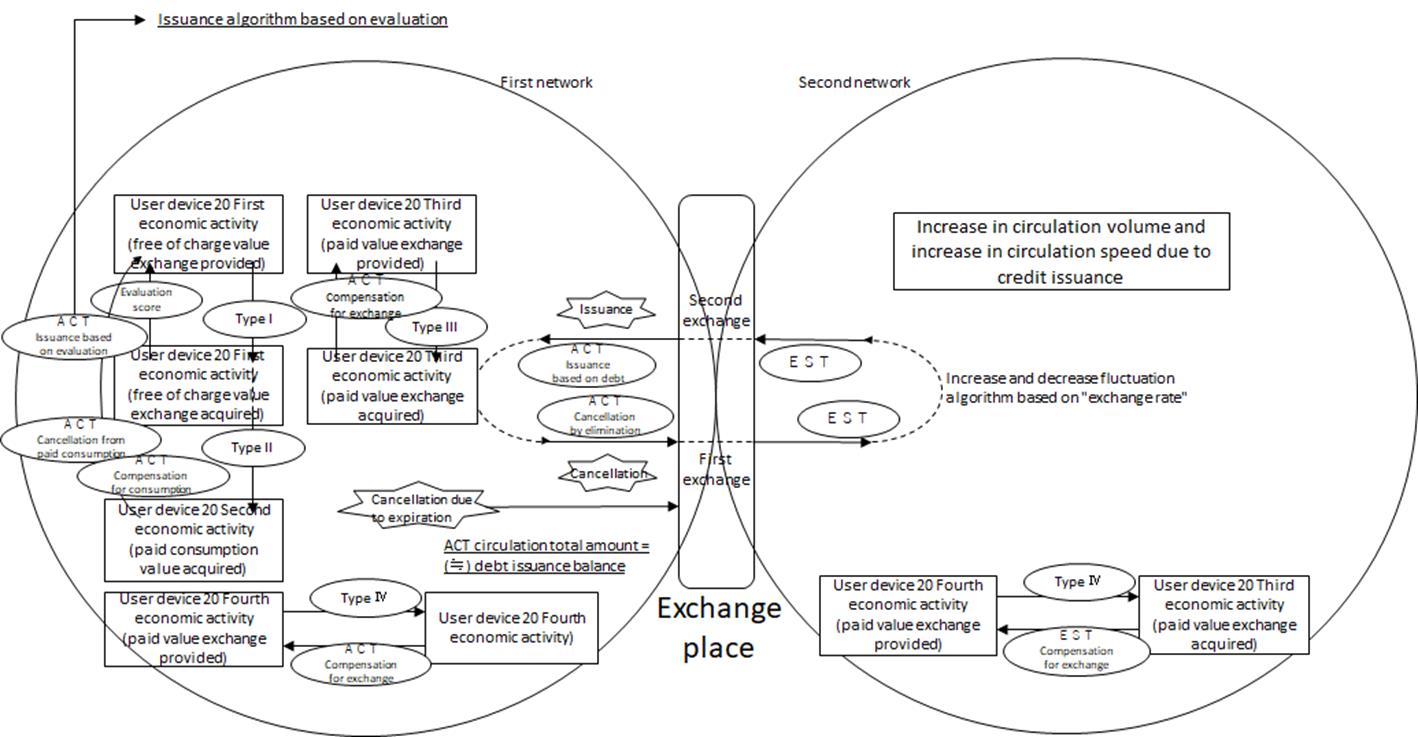

The main feature of evaluation-standard money is that the first value exchange mediums to be circulated in the value exchange domain, or first network, on the Internet and the second value exchange mediums circulated in the blockchain or second network between nodes in the real world circulate and operate as one single entity.

Looking at the history of money for the past 5000 years, money was used as a medium of value exchange at various times and places. Each piece of money had both positive and negative aspects regarding its circulation. The same goes for all the modern forms: the gold standard; Fiat currency, which are based on mandatory circulating power; cryptocurrency, which is based on trust of blockchain; stable coin by ICO and based on credibility of peg asset; and central bank digital currency (CBDC), all of which are being researched for the same reasons.

The evaluation-standard money removes these negative aspects and leaves the good to result in a mechanism that function as one. This is possible with the invention of our algorithm.

In short, the existence of an algorithm that simultaneously establishes contradictory multiple propositions is the pièce de résistance of evaluation-standard money.

1-6-3,Types of Evaluation-Standard Money

There are roughly two types of evaluation-standard money.

One is developed from a stable coin, which is a conventional cryptocurrency (such as Libra), via ICO. A model will circulate the evaluation-standard money as a stable coin. It can then self-proliferate numerical goods while exhibiting the value scale function automatically without relying on the currency creation function, as is the case with bank money. The stable coin model is a strong business model, with the issuing entity playing the role of “platformer.” The stable coin model is configured as a kind of service provided to society and the economy.

The other type of evaluation-standard money evolves from bank money, which is made possible thanks to credit issuance, or money creation. All the while, the value scale reference function is automatically exhibited while the inflation tolerance is provided. This is an aspect of the bank money model in which the evaluation-standard money is circulated as credit money or a new numeraire. The bank money model’s strength lies in its social influence, as the issuer is directly a part of the infrastructure. Should this model be employed, the central bank, or the issuer of the traditional Fiat currency, is assumed to be the provider. In this case, evaluation-standard money can be applied to central bank digital currency (CBDC), which is currently being studied by central banks in various countries. We hope that the technologies being advanced for either kind of ESM will eventually merge and be incorporated into the future of base technology.

1-6-4,Mechanism of Evaluation-Standard Money

The following is a list of points on the evaluation-standard money system.

1. The supply of currency within the parameters of the network is provided by the new issue of the second value exchange mediums to the blockchain network, or second network. In other words, direct currency supply of the first value exchange mediums to the INTERVERSE side (the first network) is not performed. The means of providing currency are as follows.

(1) ICO

(2) Credit issuance (money creation)

(3) Automated new issuances (whether positive or negative) via smart contract

※Here, (3) is important, and with this function, purchasing power of the first value exchange mediums is connected to the second value exchange mediums (the details are disclosed in the patent specification). The main points will be listed in 2 to 5 below.

2. When used in the first network, the second value exchange mediums supplied and circulated to the second network are transformed into first value exchange mediums via the server through both the currency exchange and issuance. This means that in the INTERVERSE (the first network), the second value exchange mediums are not directly circulated, but rather only the first value exchange mediums are.

Since the first network still doesn’t fully contain the function of value exchange medium at this point, the cancellation process based on data accumulated from the users, whether positive or negative, will be proceeded from the second network.

3. The server takes over the second value exchange mediums and newly issues the first value exchange mediums provided to the users. From various sources, the server transfers the second value exchange mediums and cancels the first value exchange mediums provided from users. Here, the server calculates the market exchange rate from the user’s desired exchange rate and creates the user’s exchange requirements fulfilled at the market exchange rate.

4. The smart contract obtains the market exchange rate from the server and generates a transaction that requests a new issuance, whether positive or negative, of the second value exchange mediums under predetermined conditions.

5. The server corrects the user’s desired exchange rate based on the increased or decreased quantity of the second value exchange mediums.

6. The server monitors the first economic activity of the user in the first network and records said activity based on the operation state of the user terminal, the first economic activity basic score of the storage unit, the evaluation value of the free of charge value provided.

7. The server records, in the storage unit, information including the consumption quantity of the first value exchange mediums related to the acquisition operation of the evaluated consumption value, such as a pull or push type, from the second economic activity of the user in the first network.

8. The server calculates an evaluation value relating to the free of charge value based on conditions 6 and 7. It then newly issues first value exchange mediums, which correspond to the evaluation value, to the provider of the free of charge value. At this time, the purchasing power of the gratis value acquirer is reflected in the calculated evaluation value.

9. The server cancels the first value exchange mediums after a grace period.

Although this concept has been summarized briefly with minimal context, the main point is that the purchasing power of evaluation-standard money does not rely on purchasing resources of external assets, unlike other conventional forms such as Fiat currency or gold-based money. Instead, it relies on the purchasing power of the first value exchange mediums circulating within the first network called the “INTERVERSE,” which is part of an ICT platform to be socially implemented.

It has long been said that cryptocurrency cannot become as currency because there is no content ie. it is superficial. However, by using this algorithm, the economic value that arises in the user’s first economic activity, or value exchange act of giftability, in the first network, which is supplied in the market, you can use the means of ICO and create stable coins. Alternatively, it can be standardized to the second value exchange mediums supplied throughout the network as CBDC via money creation.

Therefore, regardless of what we call evaluation-standard money, it can allow the source of purchasing power to be standardized indefinitely, making it the ultimate currency with endless possibilities.

1-7,Conceptual Diagram of the ICT Algorithm

1-8,ICT Algorithm Features

1. Through the value exchange mediums (currency) issued through the ICT platform to be socially implemented, the algorithm has succeeded in standardizing economic value or purchasing power based on an evaluation of communication activity by users.

2. By controlling the magnitude of the economic value (purchasing power) of per unit of the currency, we succeeded in controlling and stabilizing the standardization for measuring the unit exchange value (Standard measures of price).

3. By quantifying the economic value included in the value provided and obtained free of charge among users, we succeeded in generating and circulating a currency that generates the source of purchasing power from the quantified economic value.

4. Over a broad economic zone spanning multiple countries and through the price of commodities and standard measures of prices in individual markets of each country, we succeeded in completely separating and controlling the currency value (standard measures of price) throughout the economic bloc with a standard currency.

5. When circulating a single currency across different regions or multiple nations, we have succeeded in solving the problem that occurred with factors such as purchasing power and economic conditions.

6. The algorithm succeeded in improving the velocity of monetary circulation and reducing money hoarding.

7. Using the algorithm, we made it possible to arbitrarily reduce the size of debts such as government debt and personal debt, which continue to grow over time. At the same time, we succeeded in maintaining the amount of economic value (total purchasing power and total assets) of all the money in circulation.

8. We succeeded in increasing the incentive for the consumption of the currency without reducing the incentive for the user to acquire the currency.

9. While processing together the works of journalists as well as the advertising activities and data collection activities of businesses as a correlation of economic value, we succeeded in completely separating and functioning those relations. This resulted in the realization of pure journalism.

10. We succeeded in realizing “g (growth)” > “r (return).”

1-9,Effect of ICT Algorism

1-9-1,Financial Inclusion

The algorithm provides an environment that allows for all kinds of transactions to be conducted unhindered. With all of the devices connected to the network and without putting a heavy burden on people, it is where people in developed countries and people in developing countries are equal regardless of their economic or social standing. Anyone can engage in economic activity(value exchange activities), regardless of whether they are to pay a fee, as well as finance activities like insurance, loans, investments, and more.

1-9-2,Data Science

Unlike in the past, without data being dispersed and wasted in vain by IT companies, the proportion of big data will be provided to paying users (businesses including IT businesses and research institutes). The data is provided from users free of charge within the ICT platform that is to be socially implemented. The accumulated big data that is free of charge will be largely returned to society as public domain. This movement will provide the foundation of a new data science within this network.

1-9-3,Disparity Correction

The algorithm will be able to control the balance between wealth size (ie. the amount of accumulated purchasing power represented by the quantity of money) and the size of the debt (ie. the amount of purchased purchasing power represented by the quantity of money). This will be able to reduce the economic gap between the rich and the poor. In this respect, for example, it will be possible to impose substantial asset taxation on hoarded money as well as be able to provide substantial subsidies to purchasing power.

It is possible to increase the wealth of society as a whole and at the same time reduce the relative poverty that occurs during the process. Because of the way it is structured, evaluation-standard money is said to fix the earlier problems that exist in the conventional monetary system such as generating wealth from wealth and generating debt from debt. Along with being unable to mediate values that can not be represented by the amount of money, which has already been included in conventional money, all these fatal flaws will be eliminated.

1-9-4,Innovation

As the quality and quantity of value provided and acquired at no cost increases between users (economic entity), the total exchange of value increases, and new value (a new combination) is likely to occur. People will be able to provide and get more value from others at no cost, and the cycle of increasing the value itself created in society is more likely to continue. Innovation is, as Austrian political economist Joseph Schumpeter said, “the driving force behind economic development through new combinations.” Evaluation-standard money, from its constituent requirements, will provide an environment of new combinations that will likely occur within society. These new combinations are the foundation of innovation.

1-9-5,Economic Growth

Freed from conventional barriers, sales and purchasing activities will flourish because not only individual companies and individuals, but also fragmented values (in particular, intellectual creations that are constantly being created) can be paid and exchanged. In other words, values that are constantly created by users can now circulate among users with economic value. This will be true even for small values that continue to be created between people, which have not conventionally been treated as having economic value.

1-9-6,INTERVERSE

The INTERVERSE exists only on the internet and it is here that a semi-closed, intercurricular, free and paid value exchange domain* is born. This world will be interconnected in an orderly state. In other words, with the glocalization (global and local) of markets, a vast cyberspace will open up within the internet. In the INTERVERSE, equally created values will be accessible to people from all walks of life regardless of their economic, cultural, or social differences; with each other’s values evaluation on the same basis, everyone will be able to exchange with one another equally. In addition, if you combine INTERVERSE technology with virtual reality, a “Metaverse” that only existed in science fiction novels will become a reality.

*In theory, an information circulation layer where user authentication is required.

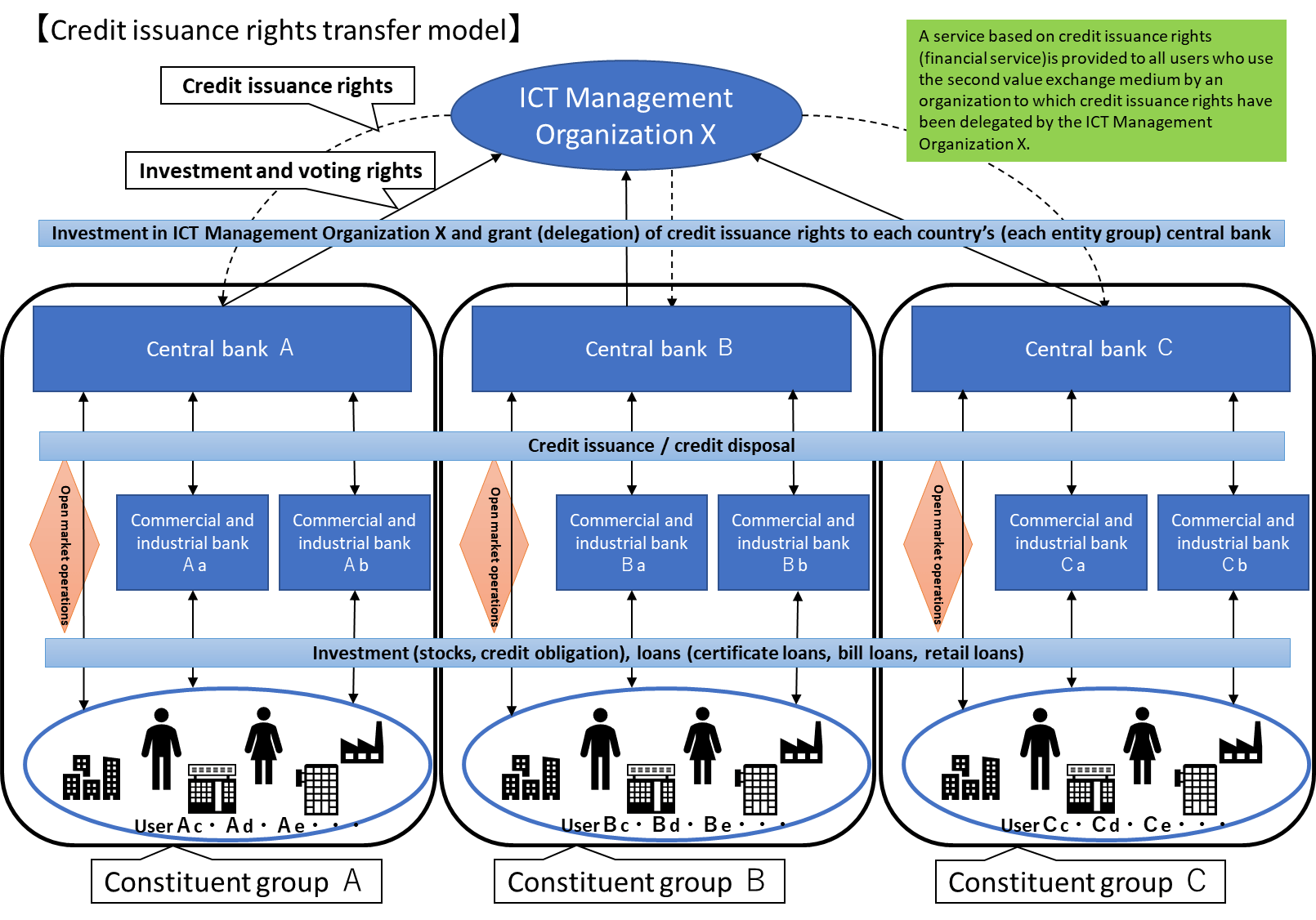

1-9-7,Integration with Conventional Managed Currency Systems

Poised for social implementation, the ICT platform can be equipped with a money creation system function that includes the ability to issue currency by credit and underwrite government bonds as well as money or currency creation. This invention will be able to be incorporated and operated (evolution of a conventional monetary system) in a conventional central bank-managed currency system.

1-9-8,Individual Macroeconomic Policy and Monetary Policy

Once an ICT platform is socially implemented, the sovereign nation becomes part of the broad economic zone using a single currency (Key currency). Logically, so do the fiscal policies related to the issuance of government bonds by governments and the monetary policy related to loans by domestic industrial and commercial banks centered on central banks in each country. Governments and central banks will be able to independently implement policies such as control over commodity prices and the overall economy.

1-9-9,The Handling of Currency Seigniorage

The ICT platform can be operated without the need for seigniorage and external budgets; currency credit issuance rights can be delegated individually to each participating national central banks. This is possible since the operator can collect the remittance fee and the spread profit in the exchange function from the two kinds of currency issued by the ICT platform socially implemented. This is all done without the user having to jump through hoops. As a result, it is possible to assign the seigniorage to the central banks, which they can individually own, which each central bank operating independently.

1-10,The Invention Explained in Simple Terms : An Itemized Breakdown

1-10-1,Concocting an algorithm from only the finest ingredients

INTERCURRENCY, broadly speaking, is superior in its innate problem solving features. As commodity money, it is able to handle value-scaled goods (standard commodities or numeraire) such as gold and rice. It also has the advantage as credit money as a means of payment of bills and loans. It can achieve all this all while possessing the prestige of bank money and it’s authority to create money. The problems inherent in these three are canceled out by their respective functions. In other words, INTERCURRENCY is money with an algorithm that can simultaneously establish multiple propositions. Here, the features of the algorithm are briefly described below.

l For example, bank money type INTERCURRENCY (A) is circulated using blockchain networks in the real world while credit money type INTERCURRENCY (B) is circulated in the INTERVERSE. As standard commodities (numeraire) are circulated using server client networks in the INTERVERSE, these two (A + B) value exchange mediums, rather than just one, function as a single money (C).

l Neither (A) nor (B) function as money on their own, but rather their potential is maximized when factored into the equation together as (C).

l The value scale function is specifically carried out by (B) while the value storage function is specifically carried out by (A). The settlement function is able to be carried out by both (A) and (B).

l Even if the circulation amount of (A) and the circulation amount of (B) are completely different, the algorithm still runs free of problems.

※ For example, 1 million units of (A) may be circulated while only 10,000 units of (B) is in circulation. In this case also, (A) may at any time, any place and with any amount be transformed into (B). Thus, the intrinsic value of (A) is in (B).

l As the unit exchange value of (A) is balanced with the unit exchange value of (B), the function of (A) automatically increases or decreases in quantity accordingly.

※ This is because even if the monetary value is depreciated by the function of (B), the actual purchasing power of (A) in its entirety will be maintained. In other words, the conventional concept of inflation will fundamentally change.

Simply put, we invented an algorithm that enables the best in two types of currency and combined these to create the ultimate money.

1-10-2,Inventing an algorithm for quantifying the amount of economic value in the exchange of gift value within the community

The value of INTERCURRENCY is the amount of intrinsic debt generated by the acquirer within the community, in other words, the exchange of value of gift property in the INTERVERSE (eg. the act of offering and obtaining articles and other creations at no expense). It is quantified based on the size of the inherent debt that arises from the acquirer. At this time, the debt issued to the acquirer of the creation, which was provided free of charge, becomes transferable to another economic entity in a form that is reimbursed by that entity. The entity will then reimburse the provider of said creation, or credit obligation, by using liquidated economic value. The debt is then cleared, just like in settlements through the issuance of INTERCURRENCY to the provider of the creation. In other words, INTERCURRENCY is given to the creditors in order to settle the debt arising from the gift value exchange within the community. In addition, since multiple entities such as the nations are assumed to be a part of the INTERVERSE, a settlement algorithm has been included to reflect the purchasing power difference of each entity.

Since ancient times, people have formed communities without using money; this is natural because it was a man-made invention waiting to be discovered. In developing a community, social technologies like symbiotic instinct, language, numbers, letters, money, and communication also evolve into more sophisticated forms. Hence the development of Information Communication Technology, or ICT. In this way, when trying to grasp the role of money in the evolution of information technology, the question is, what is money? It is but a token of debt as the result of sharing among entities. It appears in the form of debt records, the origin of currency, credit money, and modern bank money. However, even now, people are still attached to the idea of gold as an asset or token of credit. This gives us the illusion that gold (including other mineral resources such as silver and copper) is money as well. It then becomes difficult to differentiate between the two. After all, goods such as “gold” have acted as contained value measurement goods, even though they do not have the value-scale factor that credit money possesses. This is because such goods (gold) only function as value scale goods (standard commodities or numeraire) during periods of transition and in transactions between communities with different sense of values (different cultures and languages) where gold is the common tongue. Another factor contributing to this gold-as-money misconception is that archaeological remains of metallic money are easily found even to this day whereas credit money, especially records, are often lost.

While as profound as these observations may seem, they come from humble origins. The quantification algorithm of economic value we have created in the value exchange of giftability is based on human instinct, as common now as it was thousands of years ago. The basis for our algorithm will be apparent once the idea that the monetary process of using tokens for settlement has evolved into a settlement processing of debt.

2,value exchange medium approaching the true form of money and the economy

As the standard money that is a money-creatable standard commodity (numeraire), what exactly is evaluation-standard money, or INTERCURRENCY?

How does a value get examined by its value-scale reference function to determine economic value based on purchasing power?

What is standard commodity (numeraire) as credit money?

2-1,Money is for “Value Scale, Value Mediation, Value Storage”

Currency is commonly known as,

l Value scale function

(Function as a standard to measure the value)

l Value exchange function & settlement function

(Function to mediate transfer of value)

l Value storage function

(Function to store purchasing power over time)

The three functions (value measure, value mediation, and value storage) are considered to be the fundamentals of currency. Therefore, it is a value measurement material (standard commodity or numeraire) like gold and rice or credit money like bills and sea shells. It is the modern money for our time. The differences between evaluation-standard money (ESM) and stable coin are explained below, along with the characteristics of ESM as a standard commodity (numeraire), credit money, and bank money.

2-2,A good that serves as a measurement basis for ascertaining the value of purchasing power (economic value) at the time the value (standard commodity or numeraire) is exchanged

French economist Leon Walras once hypothesized that money was born as a means to make the barter system more convenient. However, this is only the case when commodity money, such as gold and silver, functions as a value exchange medium or standard commodity (numeraire). In Japan, rice has been used as a medium for value exchange and standard commodity (numeraire) activities within communities in which such transactions refers to the goods that were frequently used as intermediaries measured between economic agents.

In other words, the numeraire goods can be anything; it was just something appropriate at the time due to the location of the transaction. Numeraire goods are often misinterpreted as money that came about from the exchange of value.

However, as there was a time and place in history where standard commodity (numeraire) goods functioned as money, so is the case of the modern era. The gold standard was adopted until recently, meaning there were merits in making standard commodity goods function as money. In other words, numeraire goods are valued as conventional products, acting as a source of purchasing power that can be exchanged for other values. As a result, the standard commodity (numeraire) goods were considered the best basis to measure the value and that the value scale realised from it was stable. In particular, when there is an exchange of values in a manner that spans over different colonies with different cultures, languages and values.

Until modern day, it would seem logical to say that it was not credit money, but commodity money such as gold that has been used as a value exchange medium.

However, there is a big problem with that assumption about standard commodity (numeraire). The fact is that commodity money that functions as a standard commodity differs depending on the time and place where it is used. With commodity money that is limited in quantity, when the total amount of circulation, that is, the total amount of value to be exchanged, increases, that commodity money can run out. Conversely, when the amount of commodity money increases, it seems that there would be a change in the measure of values (standard measures of price) due to a surplus of the product money.

In light of the above, INTERCURRENCY as a second value exchange medium circulated in blockchain networks can be exchanged anytime and anywhere, as well as converted to any value through the first exchange medium.In other words, the possibilities are infinite and unbound with INTERCURRENCY (the currency in the INTERVERSE) as a first value exchange medium (in other words, “variable capacity”) within the INTERVERSE. It can also be exchanged for other values; in the end, consumption is canceled by the second economic activity (acquisition of paid consumption value) and an evaluation is issued and standardized by the algorithm. Here, the value becomes constant and stable as it functions as standard commodity (numeraire) that is based on evaluation. Thus, it now has commercial value with purchasing power. Additionally, just because INTERCURRENCY has the properties of standard commodity (numeraire), there is no shortage of INTERCURRENCY when the total amount of circulation increases, ie. the total amount of value to be exchanged. On the other hand, when the amount of INTERCURRENCY as a second value exchange medium increases, there is no excess of INTERCURRENCY as a first value exchange medium. That is because while INTERCURRENCY is a standard commodity (numeraire) and may be affected by fluctuations in currency circulation, changes in the measure of values (standard measures of price) will not occur. The standard measure of price can be actively controlled regardless of currency circulation.

In addition, cryptocurrency (crypto-asset) is often said to lack substance, so it can not become a currency. With our technology, the opposite of this becomes true.

In this case, as for the lack of evidence, you can say the same about the bank money as Fiat currency as well.

2-3,[Credit Money] as a means of payment for lending and borrowing

Humanity has evolved as a symbiotic organism. It has formed a community to live in, established social groups, and made advancements in technology over time. The individual carves out a niche for themselves in the group, and the group also established itself as a collective of individual roles; individuals are connected to one another, and they function as one. Then, the human colony was formed; the need for communication arises and then the language is developed, along with a concept of numbers and a writing system. This gives way to the exchange of value and information. Value is transferred from one side to the other, leading to the practice of lending (debt) and borrowing (liability) as well as the rise in the need to record and share with the individuals engaging in such practices within the groups. In other words, a record of debt has been created. Debt was shared over time in the human colony, which required an increase in assets as a means of settlement. Then, people began to compete for acquisition of assets that can be used to write off the debt. Hence, the birth of credit money. This is believed to be how money came about more than 5000 years ago.

Even today, the credit money system is utilized in all kinds of situations. It is utilized in credit transactions, bills, broking, promissory notes, loans and debt and more. Even villages far off in the mountains or by the sea do not rely solely on the bank money system. Today, the credit money system has developed to be used in many cases, where value exchange is carried out over time with goods through the system. In addition, from a psychological standpoint, human beings acquire emotional debt of varying degrees. Whether large or small, the human brain records the magnitude of events and debt per instance. Thus, the recording and sharing of loans and borrowings are fundamental functions and are a natural extension of the human condition and its evolution.

Then there is INTERCURRENCY. As the first value exchange medium, it enables the value exchange of gifted property, which is the act of exchanging debts and bonds without money. In other words, we quantify the economic strength of the debt and receivables that arise from the provision of gratis values and acquisition activities, and determine the new issuance volume based on the quantified economic value. This means that INTERCURRENCY as the first value exchange medium is to be issued as credit money to the creditor in order to record and settle the loans as well as borrow without transferring the user’s money within the INTERVERSE. While this is understandable, INTERCURRENCY is also considered to be evaluation-standard money. For more information, please take the time to review the patent specification.

2-4,[Bank Money] via Money/Credit Creation

The basis of the modern money system (managed currency system) lies in the money creation (credit creation) system. It starts with the creation of deposits such as loans made by industrial and commercial banks belonging to central banks. It is a common misconception that banks use their collected deposits and make investments with those deposits. In reality, the opposite is true; banks lend by recording the amounts in the passbook and when it is repaid, the figures will be cleared and what remains will become the deposits. The system is indeed a well-oiled machine. For example, if you want to increase the amount of money circulating in the market during a recession, the central bank lowers interest rates and commence buying. By promoting the increase of loans through industrial and commercial banks, it is possible to increase the amount of money in a deposit amount. On the other hand, at times when it is desirable to reduce the amount of money circulating in the market such as in an overheated market, the central banks can raise interest rates and start selling. It may be possible to reduce the amount of money as a deposit amount by promoting the reduction of loans from industrial and commercial banks. From the beginning, industrial and commercial banks have generated deposits for individuals and businesses who do not have money simply by using “credit” and trust that they will be repaid from the individual. In other words, new money can be issued, loaned to an individual, and money can be lent out by purchasing a value obtained by compensation from other individuals or businesses, and paying money lent out from industrial and commercial banks as compensation. In other words, the deposit loaned from the industrial and commercial banks will be the seller’s deposit. There could not be a more simple and logical system of value exchange mediums for obtaining value through compensation in society.

However, there remains the question of modern currency (bank money): where is the basis of value as purchasing power (the basis that can be exchanged for other values) as found in the standard commodity (numeraire)? In this respect, there is nowhere in the world that can explain this properly, but a popular theory is that it is valuable because it can be used to pay taxes. In other words, this is where mandatory circulating power comes in. For a nation, the law is there to enforce money regarding the payment of payrolls, payment for the delivery of goods and services, payments for various premiums, payment for compensation, and tax payment. Penalties are levied if people do not abide by these terms. In other words, this is what defines Fiat currency. As you may already be aware, in today’s globalized world, economic activity is carried out nonstop across countries, and further, with the spread of the internet, the economy is becoming increasingly influenced on an international scale. On the other hand, however, the “mandatory circulating power” of only the world powers is starting to become relatively weak. In particular, in a country with a small economy, the Fiat currency of that country is at a disadvantage; the nation may succumb to a financial crisis. Though the monetary system is meant to support people and their economic activity, situations have arisen that can adversely affect their livelihoods. On top of that, there is regional hegemony and protectionism. The world is already losing its old boundaries with the advancement of ICT, and the monetary system is no exception. The larger nations with greater influence are becoming larger, and the smaller nations with smaller powers are forming alliances, desperately trying to keep themselves from getting swallowed. Whether the EU is still effective as an economic experiment is also becoming unclear. It could be that the traditional monetary system is not being utilized well in line with the times. Therefore, even with such an efficient money creation system, the fact is that the foundation that runs this system is the primitive “mandatory circulating power of designated money as dictated by the state” approach. It can be unsettling to dwell upon and if something is not done about it, the future before us can only be bleak.

INTERCURRENCY was not invented to deny banking activities realized through money creation. Rather, while recognizing the authority of the system of money creation, it has been devised specifically to focus only on its vulnerabilities. As such, INTERCURRENCY can also function as a standard commodity (numeraire) as a common currency in society, eliminating the conventional problems that reside in modern-day society. It will act as a hybrid system and function as a value exchange medium for a more strategic basic money. In other words, INTERCURRENCY can also be classified as the standard money, like the debt created by banks.

2-5,[Standard Money] The gold standard that sources its value in gold

The existence of gold standard system may be to blame for the public misconception of money. If you would like to know more about the gold standard system, including the history of its application, there are many articles widely available on the subject.

In other words, INTERCURRENCY is also a standard money. However, it is not a currency that creates contradiction like the conventional gold standard system. INTERCURRENCY utilizes the infinite energy of activity that people generate. It does so within a circulated blockchain network as the second value exchange medium, or so-called “superficial bank money,” combined with the first value exchange medium, which is circulated on a server client network where money filled with contents just like gold is available. This algorithm will always able to continue to provide the basis of value to the ever-growing bank money. This is possible with our algorithm technology, even with bank money without “content”, regardless of the increase in the circulation amount, under the premise that “with the gold filled with content, energy is generated infinitely by the people exchanging it.” To better understand how this works, imagine a scenario where the generated gold keeps disappearing while the gold continues to be generated infinitely in the INTERVERSE. This may be likened to the cycle of energy transfer through ecosystems. The details of the algorithm are disclosed in the patent specification published on this site and a downloadable copy is available.

While such a scenario is an oversimplification of the process, the point is that INTERCURRENCY is the source of value in the infinite energy emanating from economic engagement in the community. It has been so since the beginning of time and is what we have dubbed “evaluation-standard money.”

2-6,Summary of Currency Function

Standard commodities (numeraires) are solidly packed, but could not be produced indefinitely without limits like bank money. Bank money can be produced infinitely, but it doesn’t contain substance as standard commodities (numeraires) do. In the case of standard currency, there were no main target assets that could withstand the fluctuations in the demand of currency. While there are cons and pros with these currencies, respectively, there is no such thing as good or bad money. The fathers of our modern monetary system created bank money, attaching to it the “mandatory circulating power mechanism” and devising “Fiat currency.” Our predecessor was none other than the Bank of England. In addition, the modern monetary system is able to demonstrate the function of currency exogenously by combining this with the mechanism of exchange rates based on the international floating exchange rate system.

Evaluation-standard money, or INTERCURRENCY, is money that has content as a standard commodity (numeraire). It has the ability to control the size of the content as credit money; furthermore, it is a money that can be created infinitely without limits, unlike bank money. It is a product of the Fintech algorithm that simultaneously has these contradictions. In other words, INTERCURRENCY is the future of money that humanity, an innovation 5000 years in the making, and it may be the truest form of money itself.

Thus, INTERCURRENCY is an ICT platform in itself that has been created following the advent of the Internet and the blockchain technology; it is a currency that also functions as a measure of value. On the other hand, a simple conventional stable coin like Libra, announced by Facebook recently, can not be considered a standard commodity (numeraire) under the aforementioned conditions. Furthermore, it can not become a standard money nor can it function as bank money; it is extremely limited as a medium of value exchange in terms of being the backbone of the economy. However, the existence of such traditional monetary systems, which could be affected by the immature value exchange mediums (managed currency system), is also considered to still be in a fragile state.

2-7,What is the nature and economic value of money? Sections (1) to (5)

2-7-1, Debt sentiment and community derived from survival instinct

Humanity’s greatest pursuit is survival and avoiding death. To this end, people have historically sought to live ordinary lives.

In order to survive, people have formed groups, created communities, and developed communication technology (ICT). In modern times, we may think that the “ICT platform” was a product of the internet and IoT devices. In fact, it is arguable that the ICT platform has actually existed for tens or even hundreds of thousands of years. In other words, it is a tool that emerged out of humanity’s need to survive.

After forming communities, people take on the various roles needed. They may become hunters, gatherers, fishers, farmers and so on. It is what is produced from these different roles that people play that becomes a product of “value,” which in turn is exchanged (circulated) among them. Here, “value” is, for example, the meat for the main dish, the skills to cook the meat, the ingredients and tools needed for cooking, not to mention hunting deer for meat, the tools for catching it, the technology and raw materials for making utensils, and the labor for mining raw material. All of those needs and requirements become recognized as items and services of “value” in the community; their exchange of such products creates a kind of ecosystem among people.

In short, in order to live, people began to form communities, develop ICT, notice the existence of “value” in their role, and live their daily lives. In this way, people are able to find “value” within the community and within other people; all their roles become essential once people realised the importance of value.

We must keep in mind that at this point in time, numbers have not been invented. Fast forward to present day, if money didn’t exist, the concept of wages would not exist as well. This is all only the circulation of the “value” as a product of a social role; the ecosystem at the time functioned on a systematic “communist system” of participants.

The “Communist system,” in contrast, is a planned society based on the premise that each member plays a given role within the community. Therefore, those who strive to become members of the community back in the day were obliged to fulfill their given role; not being able to carry out one’s duties constituted as committing a sin. In other words, this is how the idea of “liability (debt)” came to be. At the time, debt was synonymous with sin.

Over the course of human history, people have constructed a system that recognizes “value”, leading to the rise of the “Communist community.” This laid the bedrock for the concept of “debt,” which was akin to “sin.” People who have “sinned” lived day to day while carrying shame, liability and atonement as well as feeling indebted to others. Punishing those who have sinned, ie. not fulfilled their duties, was actually effective; it had a significant role in managing the would-be members of the community in order for the community to survive and develop smoothly.

This gives way to the birth of debt guilt. It can be said that humanity has lived for tens of thousands of years being governed by this idea. Humanity would later come to rule over the other living organisms and has made it this far by evading extinction.

2-7-2, Debt amount represented by money amount and money as settlement means

“Sin”, or debt guilt, is a weight nobody wants to carry.

However, for those who are new to the community, it was not always possible to fulfill their duties, and sometimes there were situations where they could not perform the tasks asked of them. Some would fall ill, some were unlucky, some fell into bad company, some even resorted to murder. At the end of the day, everyone goes about their daily business fully aware of their own skeletons in the closet.

As such, there needed to be a way for these people to atone for the sins they had committed–to write off their social debt, so to speak. If they did not, the burden of carrying the “sin” would increase with time, and eventually no one will know what the “sin” was or how long it had been around. The sin is no longer just a “debt;” it is a blemish that could inflict considerable damage on the community. “Sins” are the occurrence of “debts” that cause the parties involved to feel shackled due to the incompletion of agreed to obligations. As a result, a new role came about for people who not only carry out their assigned duties, but also those of others who cannot.

Let’s look at a simple example. Mr. A is a deep hunter who becomes ill and can not go hunting. His partner, Mr. B, takes a risk by going hunting alone and manages to catch a deer. At this time, guilt as “debt (liability)” may be felt by Mr. A, but a form of “lending” has actually occurred from Mr. B to Mr. A. The guilt felt towards Mr. B here is a means to pay back the “debt (liability)” itself that occurs on the opposite side of “asset (credit).”

Thus, Mr. B created “asset credit” against Mr. A. In another example, say Mr. AA murdered a member of Mr. BB’s family. The relationship between Mr. AA and Mr. BB is also the same as above. Assets (credit) credited to the bereaved Mr. BB is created to counter the “debt (liability)” that Mr. AA created.

That is the nature of credit money.

In ancient times, the prototype of money was born, and people became entranced by the magic of money. Even if they sometimes “sinned,” they could make amends by presenting their “credit money” to the other party. This is how the concept of erasure came about. People then turned to earning credit money as a means by which their sins can be cancelled through settlement and liquidation(sins) using credit money. Perhaps it was a kind of insurance. On the contrary, there were people did not sin but still created debt (liability) as they began to “borrow” from others who had accumulated “credit money.”

Thus, even with the primitive era communist community, people generated “debt” in the process of the circulation mechanism of “value.” For them, the “credit money” was an essential asset in order to settle this process.

People began to understand that the “credit amount” directly correlated with the size of their “sin” and the “debt amount” became an “asset.” This helped them become aware of currency quantity and they began to share it among one another.

At that time, processes for “debt transmutation” like “insolvency proceedings” in the present age had not been conceived yet. In that sense, money as a loan should have existed for us to survive. On the other hand, “debt as sin” would have been a dangerous social construct that would threaten life if it increased. That’s where slavery came in.

Slavery is the form of final repayment of debt that came about alongside money. As you can see, slaves would in themselves be a form of money transformed, in lieu of credit money.

Without a doubt, it can be said that slavery is money, and money is slavery.

2-7-3, Amount of credit money represented by monetary amount and size of purchasing power

The total amount of debt in a community is the total amount of credit money that people actually have.

Conversely, the amount of debt that exists in the community is also the total amount of sins that people have commited.

If you offset the credit with the debt, the remainder should be zero.

In addition, in a time without bankruptcy procedures, the idea of slavery came about because “sin” that people committed could not be cleared by means other than “credit money.” In other words, slavery is a kind of currency in itself; the slaves were valuable property of the owner, and the work obtained as a result of slave labor also became the property of the owner.

A miserable environment was developed in which the people burdened by their “sins” or their loved ones were forced into slavery. The disparity between the rich and the poor started here.

This meant that a person who owns a lot of credit money and slavery could use them to acquire a lot of “value” circulated within the community (ie. using credit money as payment consideration or using slaves). On the other hand, those who do not possess credit money or slaves had no choice but to contribute “value” with their own bodies.

For the poor, it would’ve been a tragic reality.

The origin of money is built on a very sad reality and at the expense of countless, unfortunate lives. As we descendents are privileged enough to live in a modernized world, it is crucial to remember how far we have come.

After all, purchasing power as the amount of money represented by the amount of credit is originated from “power.” This power could usurp “value” from the poor, and this “power” is emulated by money itself. The promise of prestige that money carries is precisely what fuels its evil alchemy.

Purchasing power means “power” that can be exchanged (transformed) into other “values.”

2-7-4, The size of the value represented by the amount of money

From the above, it can be understood that “value” circulated in the community is the production value provided by people and the purchase value (consumption value) acquired by people.

Additionally, the “debt (liability) as sin” concept is a byproduct in the process of creating”value” within the community. On the other hand, we also know that “credit money and slavery” are “assets” in the process of acquiring (or in some cases, exploiting) more “value” from other people.

In this way, “value” is not simply an idea represented by a vague amount, but an amount that can be quantified by units of reference.

It can also be acknowledged that there is a system for circulating “value” in the community. At the heart of this systems lies the “credit money system” and “slavery system.”

This ushers in the concept of numbers and currency units.

In maintaining and developing the community, people do not voluntarily issue “credit money” or enslave others using violence. In order for people to circulate “value” smoothly with a mutual understanding of value, the creation of a standard measure (a measure of values) of “credit money” becomes necessary.

With the birth of money as a measure of balance in the community, the perceived size of the “value” circulated to the community becomes quantified as a numerical amount. People began to price the “value”, and therefore an economy was born within the layers of the community.

Thus, in a sophisticated civilization with a thriving economy, the abstract “values” produced individually as a result of the obligations given to the people have shifted. It is now produced and consumed as an “economic value” represented by the amount of money with purchasing power.

Since then, the “value” that has been circulating within the communist community becomes an “economic value.” Soon the communist system came to an end, and the magnitude of “value” produced and consumed in the economy came to be expressed with the amount of money as the magnitude of “economic value.”

This is where the economy originated from.

It is an event that took place thousands of years (or even tens of thousands of years) ago.

2-7-5, Summary of economic value

With the birth of the economy, economic value has become the value that can be expressed in monetary amounts. In other words, economic value is a value that can be priced and transformed into purchasing power.

You may be asking yourself, isn’t the value that is not represented by the amount of money not the economic value itself? Before there was money, didn’t everything have value in the first place? These questions are inevitable. In other words, the structure of the layer of economy within society as a community has resulted in the composition of “economic value> value.” This is a great question even today.

Is this not something that is lost due to the existence of money? This may be the true nature of the question that everyone asks at least once in their life.

In other words, is the proposition of “value = economic value” really possible to achieve?

Evaluation-standard money based on MMT is working to achieve this. We believe that it will provide a solution to the economic woes of society.

2-8,Instinctive Energy Inherent in Humanity in Terms of Coexistence and the Essence of Money

2-8-1,Emergence and evolution due to social roles and community

Human history with the absence of money spans over a great stretch of time and it is difficult for people today to imagine. Conversely speaking, the age of having money itself is very short; it only came into existence recently.

In other words, the period in which human beings lived in the communist community was inconceivably long. Humanity has come a long way by adapting to the environment.

For those of us today, the records and coping mechanisms of the past that have been ingrained in us for so long are still pervasive in society even now.

We provide value to the people around us who are members of the community at no cost.

When we receive “value” free of charge from these members, we feel gratitude towards them. There is no relationship created in such a relationship in terms of credit and the debt represented by an amount of money. What is there is the self-recognition (self-affirmation emotion) of the internal social asset (the value of the role played), the feeling of giving something to others. Through this transaction, this self-recognition (debt guilt) of the internal social debt (the value of the role played is instilled in you. We share this “internal social asset” (a so-called “plus”) and “internal social debt” (a so-called “minus) among the members in the community, and the total amount is positive. As members of the community continue to exchange value in this manner, the total amount of accumulated “pluses” and “minuses” will remain balanced out to zero. Sometimes there will be members whose “pluses” will grow, and some members will sometimes accumulate “minuses”, but as long as the members are trusted by the community, there will be no problems at all and the community will run fine on this system. Members with “pluses” will eventually acquire “minuses” somewhere and vice versa until a zero sum is reached. In other words, whether the value is a “plus” or a “minus,” if you look at the total sum in the community, it will balance out as “zero” in the end. This is made possible by the circulation of “free of charge value” according to each community member’s role.

Given this difference, however, if we compare this primitive communistic community with a modern-day community, there are actually quite a few similarities. That is, the exchange of “value” without money characteristic of modern community is the same as the circulation process of “value” in the community of ancient times.

With this in mind, those who are of a lower caste in the ancient community are aware of all the other members, what is lent and borrowed and how. We also see what may cause friction in the community. Over time, these instances become memories that are shared among people, passed down generation after generation. In addition, the scale of the community in the past assumed by this view is even smaller than the villages scattered in the mountains in the present age. There, the social hierarchy system is sophisticated and similar to a modern-day guild.

From ancient times to modern day, given the process of exchanging “economic value” at a cost using money, which appears later, it is safe to say that the “no-charge value exchange process” that has been “ignored” is, indeed, the true “value” exchange process which is inscribed within us.

We are symbiotic life forms with a sophisticated social structure. This is not just because we invented money to create an economy. We built up a community for want of survival, developed ICT, and thus created a process that effectively circulates “value” for us to be able to thrive to this day.

Survival is the nature of human beings. Thus, the idea of free of charge value exchange has been ingrained in us all this time.

Evaluation-standard money is the ultimate value exchange medium of the past and the future era, as it is a manifestation of a natural instinct in a modern form.

3,value exchange domain where all values can be circulated

What is the INTERVERSE and how does it protect journalism and big data?

What is the value exchange domain (economic activity area) in which evaluation-standard money, value exchangeable domain / INTERCURRENCY circulates like in an imaginary Metaverse?

3-1,INTERVERSE Overview (Is it just like a Metaverse?)

The INTERVERSE is basically a semi-closed cyberspace requiring user authentication to access participation. It exists within the complete open source world of the internet. Users are provided with wallets (or INTERCURRENCY accounts), and people in the INTERVERSE are able to engage in a wide variety of economic activities depending on their intentions. In the INTERVERSE, it is possible to circulate any value regardless of whether it’s paid or free of charge. People will be able to connect with other people with different values on a deeper level, farther and faster than before. The INTERVERSE, in other words, is a glocal large server space. When combined with virtual reality (VR) technology, it becomes a value exchange domain (economic activity area) like the Metaverse, the stuff of science fiction wonder. If the scope of the ICT platform in the future is the same as that of the internet now, meaning that if regional economic zones can operate on a global scale, the range of the INTERVERSE will also extend globally. At this time, people are freed from the limits of location and staggering payment methods, and they are able to provide and acquire the value of creating together without stress. By that time, the communication environment and device capabilities will have improved, and AI assistants and text translations will also be much smarter than they are now.

INTERCURRENCY is a collaborative circulation system of two characteristic value exchange mediums. The first network, the “INTERVERSE,” is to be created in an ICT platform constructed by an integrated algorithm. First value exchange mediums circulate there and the second network, where second value exchange mediums circulate, is integrated with the first. A detailed description of the mechanism, such as how it is constructed, is disclosed in the patent application specification for your viewing. All in all, the “INTERCURRENCY” and “INTERVERSE” born from the technology we developed function as the continuous integrated processing of various algorithms prepared in various places, of each intended function to realize each other. The maximum effect is realized only when these are operated in an integrated manner. Meaning, the “INTERVERSE” is produced by “INTERCURRENCY”, and “INTERCURRENCY” is generated by the “INTERVERSE.” Both of them are brought to life by the economic activity (value exchange activities, whether paid or not) of those participating in the ICT platform. Thus, people are to live vibrant lives within the social infrastructure of the INTERVERSE and INTERCURRENCY.