[Document Name] Written Description

[Title of invention]System, program, information processing device and methods for controlling exchange value per unit of a value exchange medium.

[TECHNICAL FIELD]

【0001】

Relativity of the systems, programs, information processing devices, and methods for controlling the exchange value per unit of a value exchange medium.

[BACKGROUND OF THE INVENTION]

【0002】

In societies where people live while they are productive, consuming, and community-based, with the progress of ICT (Information Communication Technology) have facilitated the circulate of a wide variety of "value," both for and without charge, across times(generations) and places (nations). In human history, not only economies but also our societies have been shaped by the effective transfer of "value" among people. As a tool for effectively distributing such "value" among people, we have evolved "currency". For example, for a long time, a legal currency issued by a state or an organization trusted by the state has been widely used as a major "currency". Recently, virtual currency utilizing a block chain technique has begun to be used.

【0003】

Such a "currency" is said to have, as one of the basic functions, a function serving as an objective measure of the exchange value of products or services, that is, a value scale function. In this regard, for example, Patent Document 1 discloses a technique for fixing the rate of exchanging between virtual currency and legal currency.

[Prior Technic Documents]

[Patent Document]

【0004】

[Patent Document 1] Patent No. 6352463 written description

[SUMMARY OF THE INVENTION]

[Problem to be solved by the Invention]

【0005】

However, in various monetary system currently used by the public, including a virtual monetary system, a mechanism for controlling a variation (e.g., temporal variation, geographical variation, etc.) of a size (exchange value per unit) of a value (e.g., a economic value, a exchange value, purchasing power, etc.) included per unit of currency as a basis of value scale function is not included. Therefore, various adverse effects such as rapid fluctuations of the value of money occur.

【0006】

It is therefore an object of the present invention is to provide the capability of controlling the value exchange medium by size (exchange value per unit), value (e.g., economic value, exchange value, purchasing power, etc.) contained per unit of a value exchange medium on which a value scale function is based.

[Ways for solving the problems]

【0007】

The system according to one embodiment of the present invetion is a system including a plurality of mutually communicatively connected information processing apparatuses in which a first value exchange medium and a second value exchange medium that can be linked to user identification information are distributed, wherein the first value exchange medium and the second value exchange medium are exchangeable between a plurality of user identification information, the first value exchange medium is issued on the basis of operation information of the information processing apparatus for acquiring a first economic value that is set so as not to receive a first value exchange medium as a consideration for transfer between the plurality of user identification information, and the second value exchange medium is increased or decreased in accordance with the exchange rate between the first value exchange medium and the second value exchange medium.

【0008】

According to this aspect, the variation of the exchange value per unit of the second value exchange medium can be controlled by balancing the exchange value per unit of the first value exchange medium issued based on the evaluation amount of the value provided and obtained, free-of-charge. As a result, the variation of the exchange value per unit of the second value exchange medium can be suppressed and the exchange value per unit can be stabilized.

【0009】

A method according to an aspect of the present invention is a method for causing a computer for managing exchange of a second value exchange medium recorded in a second ledger in association with first value exchange medium and user identification information, wherein the first value exchange medium and the second value exchange medium are exchangeable arbitrarily among a plurality of user identification information, wherein the first value exchange medium is issued based on an of a free-of-charge exchange value transferred between a plurality of user identification information, and wherein the second value exchange medium fluctuates by a predetermined amount so as to cancel at least a portion of the fluctuated portion when a market rate of a desired exchange rate, which is an exchange rate between the first value exchange medium and the second value exchange value, is a target exchange rate to the computer A step of accepting a first exchange request for exchanging the first medium exchange value to the second medium exchange medium at the first desired exchange rate, a step of accepting a second exchange request for exchanging the second market rate exchange medium to the first value exchange medium at the second desired exchange rate, a step of generating a first value exchange request for exchanging the first medium exchange value at the medium exchange rate, a step of generating a second market rate exchange request for exchanging the second value exchange medium to the first value exchange medium at the market rate exchange rate, a first value exchange request, a step of executing a first commitment process between the second exchange request satisfying the predetermined first commitment condition, a second medium exchange request, and a step of executing a second commitment process between the first exchange request satisfying the predetermined second commitment condition.

【0010】

According to this aspect, the variation of the exchange value per unit of the second value exchange medium can be controlled by balancing the exchange value per unit of the first value exchange medium issued based on the evaluation amount of the value provided and obtained free-of-charge-of-charge. As a result, the variation of the exchange value per unit of the second value exchange medium can be suppressed and the exchange value per unit can be stabilized.

【0011】

The method according to an embodiment of the present invention causes a computer, which is a node of a network in which a first value exchange medium recorded in the first ledger in association with user identification information and a second value exchange medium recorded in the second ledger in association with the user identification information circulate, to perform the steps of: acquiring a market exchange rate, which is a market rate of a desired exchange rate, which is an exchange rate between a first value exchange medium and a second value exchange medium desired by a user; determining whether a predetermined increase condition related to a market exchange rate is satisfied; and, when it is determined that the predetermined increase condition is satisfied, performing an increase step of generating second update-information for updating the second ledger, which is second update-information for increasing a second value exchange medium associated with at least one user identification information by a predetermined increase quantity.

【0012】

According to this aspect, the variation of the exchange value per unit of the second value exchange medium can be controlled by balancing the exchange value per unit of the first value exchange medium. As a result, the variation of the exchange value per unit of the second value exchange medium can be suppressed and the exchange value per unit can be stabilized.

【0013】

The method according to an embodiment of the present invention causes a computer, which is a node of a network in which a first value exchange medium recorded in the first ledger in association with user identification information and a second value exchange medium recorded in the second ledger in association with the user identification information are circulate, to perform the steps of: acquiring a market exchange rate, which is a market rate of a desired exchange rate, which is an exchange rate between a first value exchange medium and a second value exchange medium desired by a user; determining whether a predetermined decrease condition related to a market exchange rate is satisfied; and when it is determined that predetermined a decrease condition is satisfied, performing a decrease step of generating second update-information for updating the second ledger, which is second update-information for increasing a second value exchange medium associated with at least one user identification information by a predetermined increase quantity.

【0014】

According to this aspect, the variation of the exchange value per unit of the second value exchange medium can be controlled by balancing the exchange value per unit of the first value exchange medium. As a result, the variation of the exchange value per unit of the second value exchange medium can be suppressed and the exchange value per unit can be stabilized.

【0015】

A method according to an embodiment of the present invetion is a method of causing a computer, which is a node of a network in which first value exchange medium recorded in a first ledger in association with user identification information is circulate, to execute a step of issuing a first value exchange medium of a first predetermined quantity based on operation information of a node for acquiring a first economic value set not to receive a first value exchange medium as a consideration for transfer between a plurality of user identification information, and a step of write-off of a second predetermined quantity based on an act of extracting a second economic value generated from the network, wherein the first predetermined quantity is determined based on the second predetermined quantity.

【0016】

According to this aspect, the variation of the exchange value per unit of the first value exchange medium to be issued and write-off can be controlled based on the evaluation amount of the value provided and obtained free-of-charge and the consumed amount of the value obtained at a charge. This allows the exchange value per unit of the first value exchange medium to be varied arbitrarily.

【0017】

The method according to an embodiment of the present invention causes a computer, which is a node of a network in which first value exchange medium recorded in a first ledger in association with user identification information is circulate, to execute the steps of: acquiring a first economic value set not to receive a first value exchange medium as a consideration for transfer between a plurality of pieces of user identification information; transmitting operation information in the step of acquiring a first economic value to an information processing apparatus for managing a first ledger; and, in association with the step of acquiring a first economic value, accepting an act of extracting a second economic value generated from the network with consuming first value exchange medium from another information processing apparatus.

【0018】

According to this aspect, it becomes possible to quantify the size of the evaluation of the value provided and obtained free-of-charge, also becomes possible to make the consumption amount of the value obtained at a charge to the quantified evaluation based on the consumption amount. As a result, a first value exchange medium based on evaluations as a controllable economic value can be issued.

[Effect of the Invention]

【0019】

According to the present invention, it is possible to provide a value exchange medium capable of controlling the size (exchange value per unit) of a value (e.g., a economic value, a exchange value, purchasing power, etc.) contained per unit of a value exchange medium on which a value scale function is based.

[Brief description of the diagrams]

【0020】

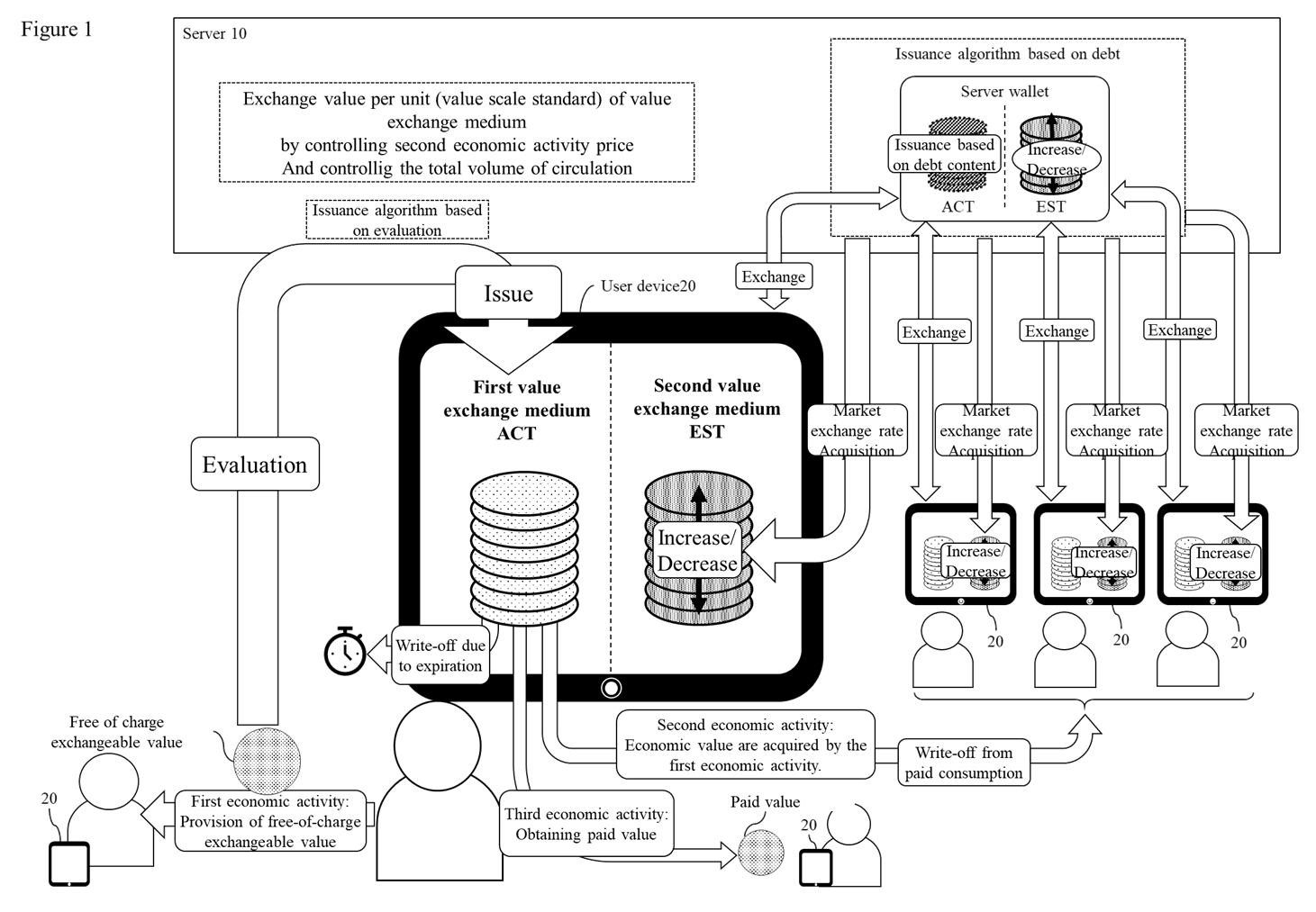

FIG.1. 1 is a diagram for explaining an outline of a value exchange medium circulation system 1 according to an embodiment of the present invention.

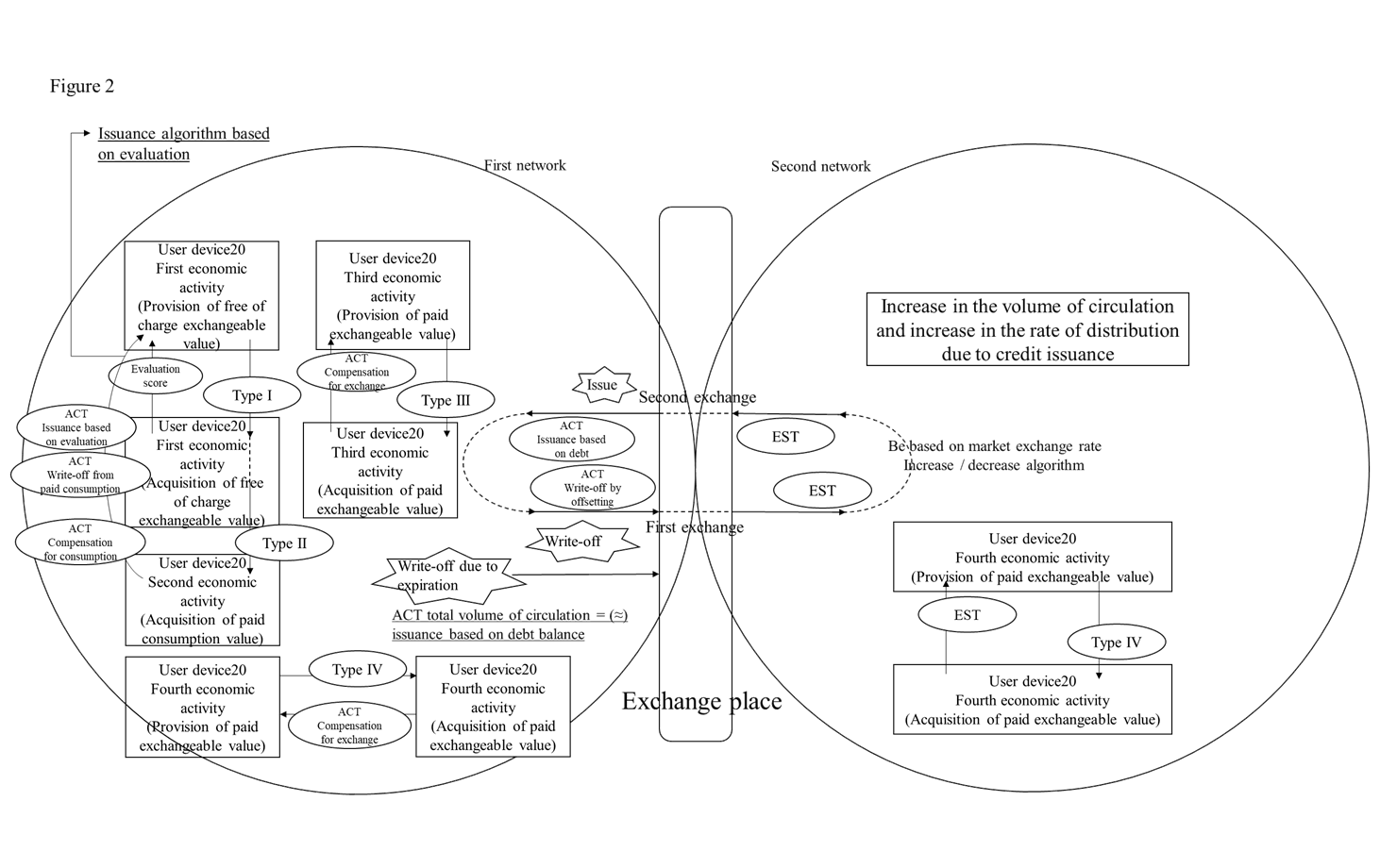

FIG. 2 is a conceptual diagram for explaining examples of mutual relationships among economic activities, value, and value exchange medium.

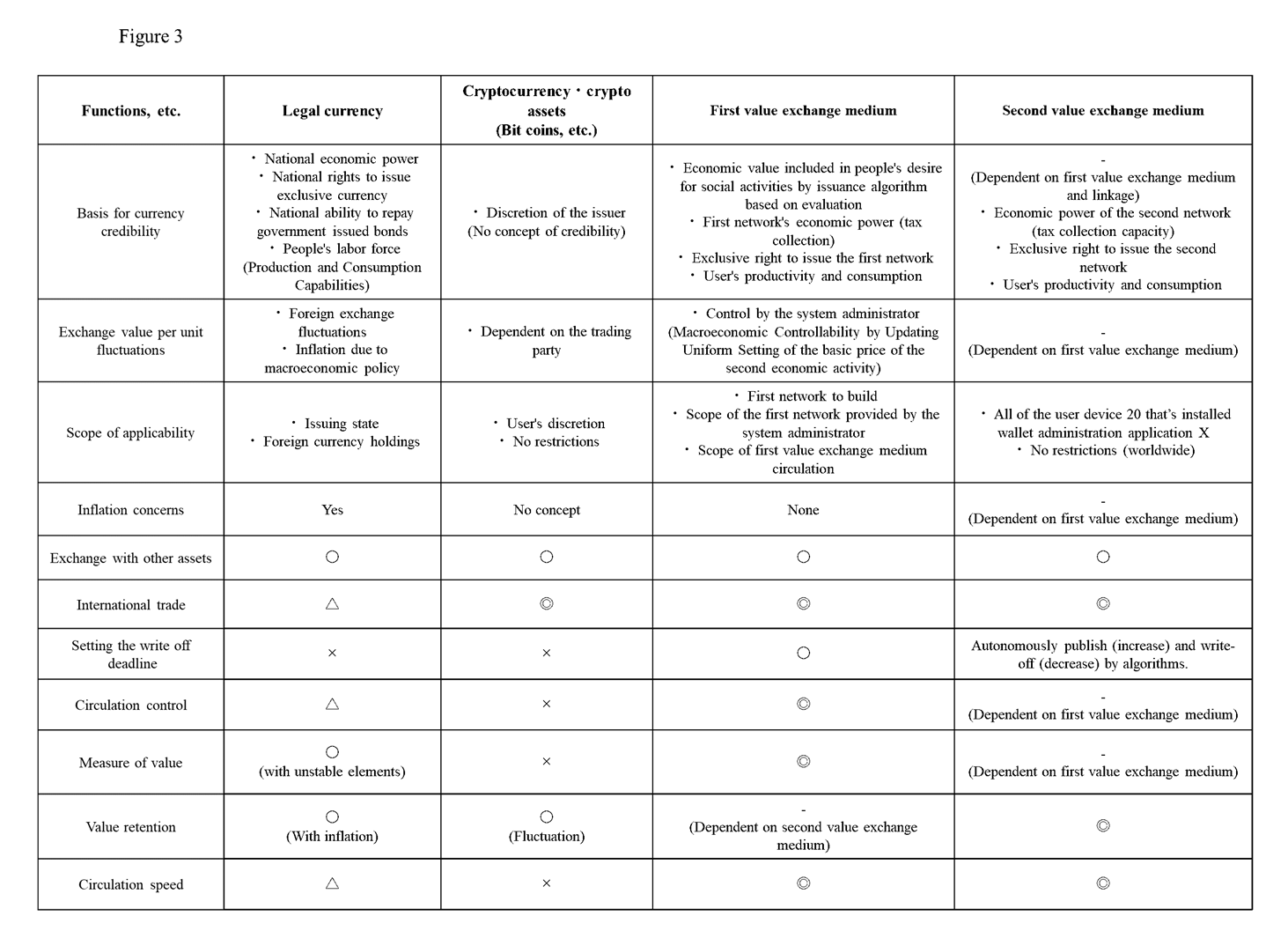

FIG. 3 is a diagram for explaining examples of the functions of the first value exchange medium and the second value exchange medium.

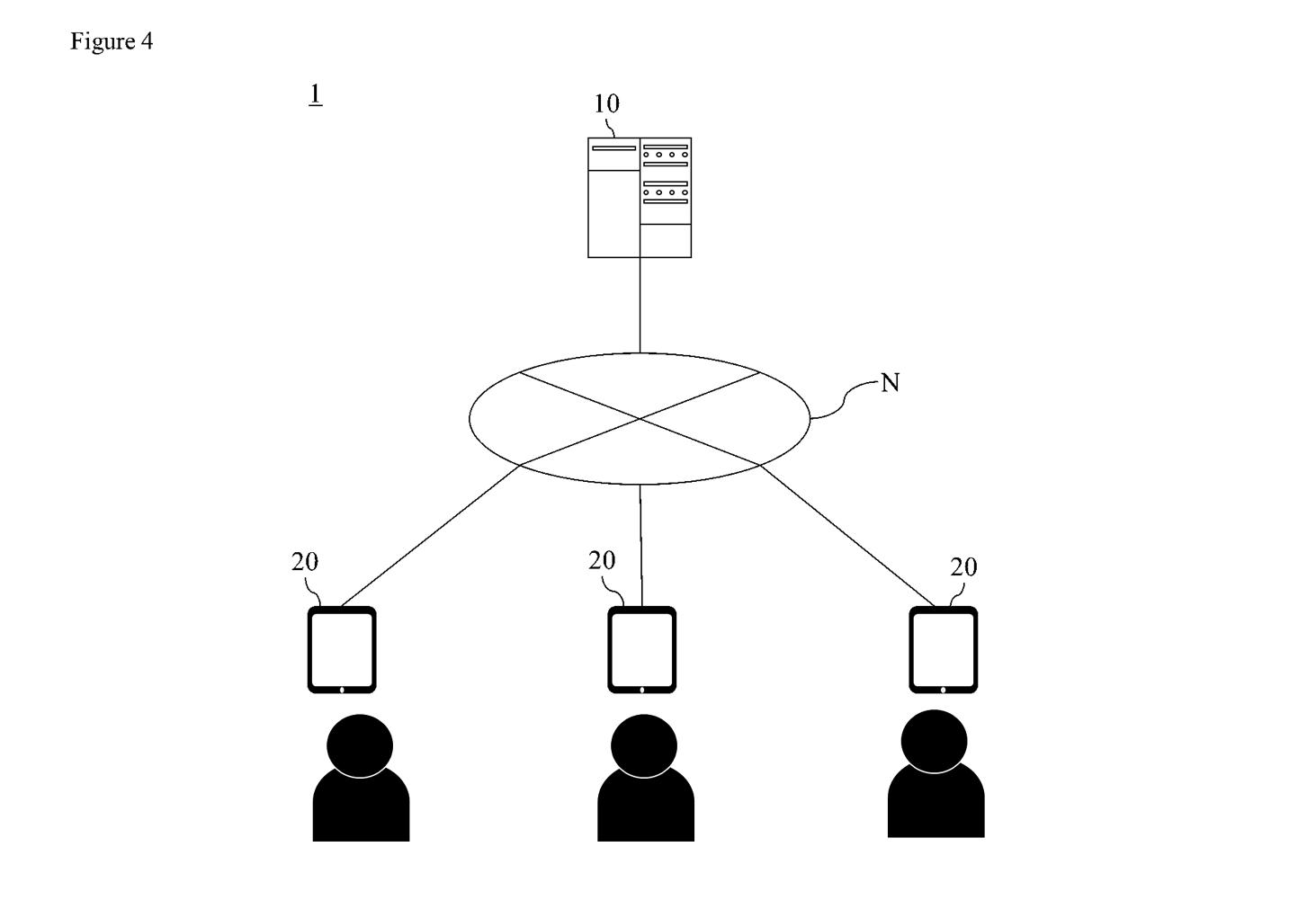

FIG. 4 shows an exemplary configuration of the value exchange medium circulation system 1.

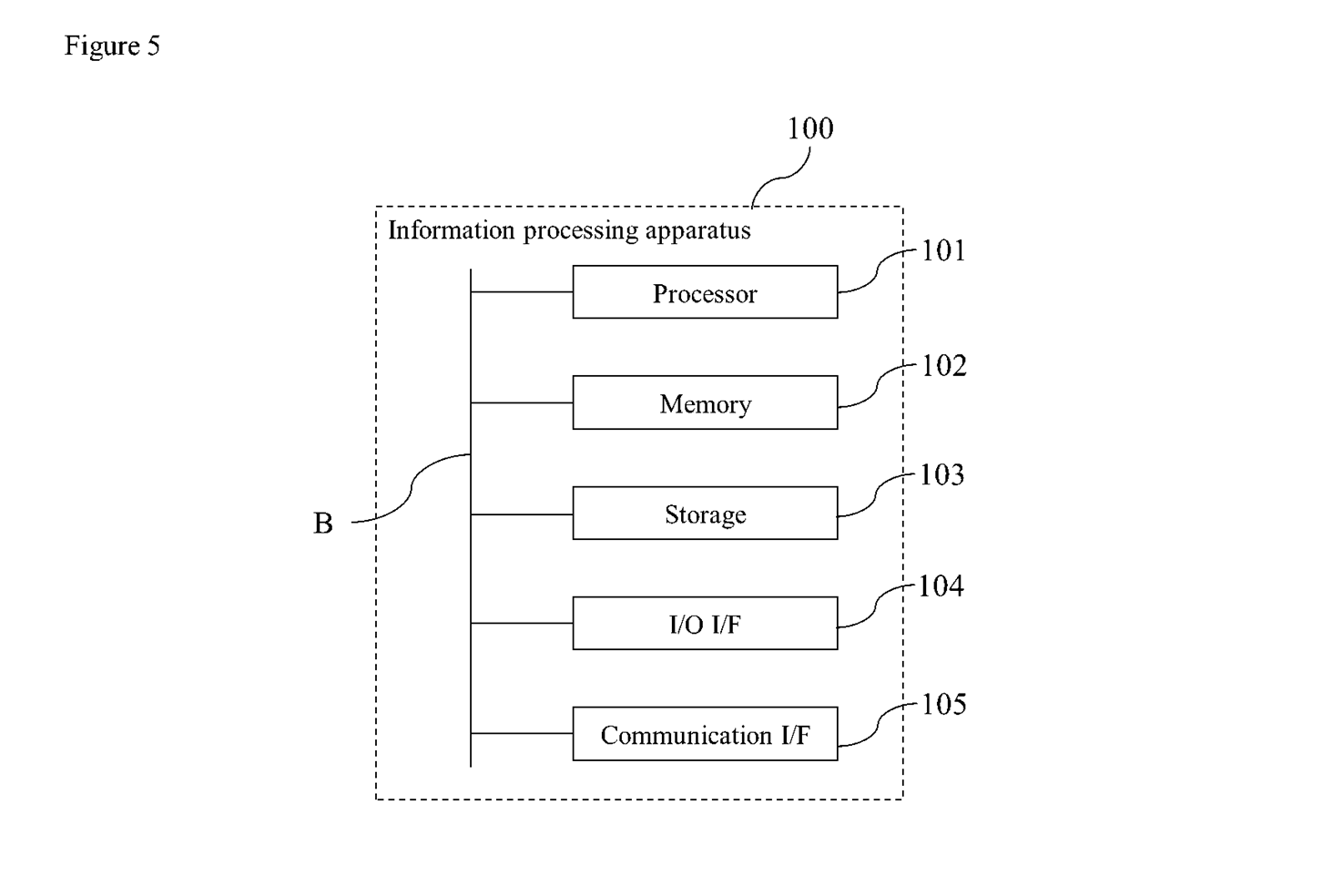

FIG. 5 is a diagram showing an exemplary hardware configuration of the servers 10 and the user device 20.

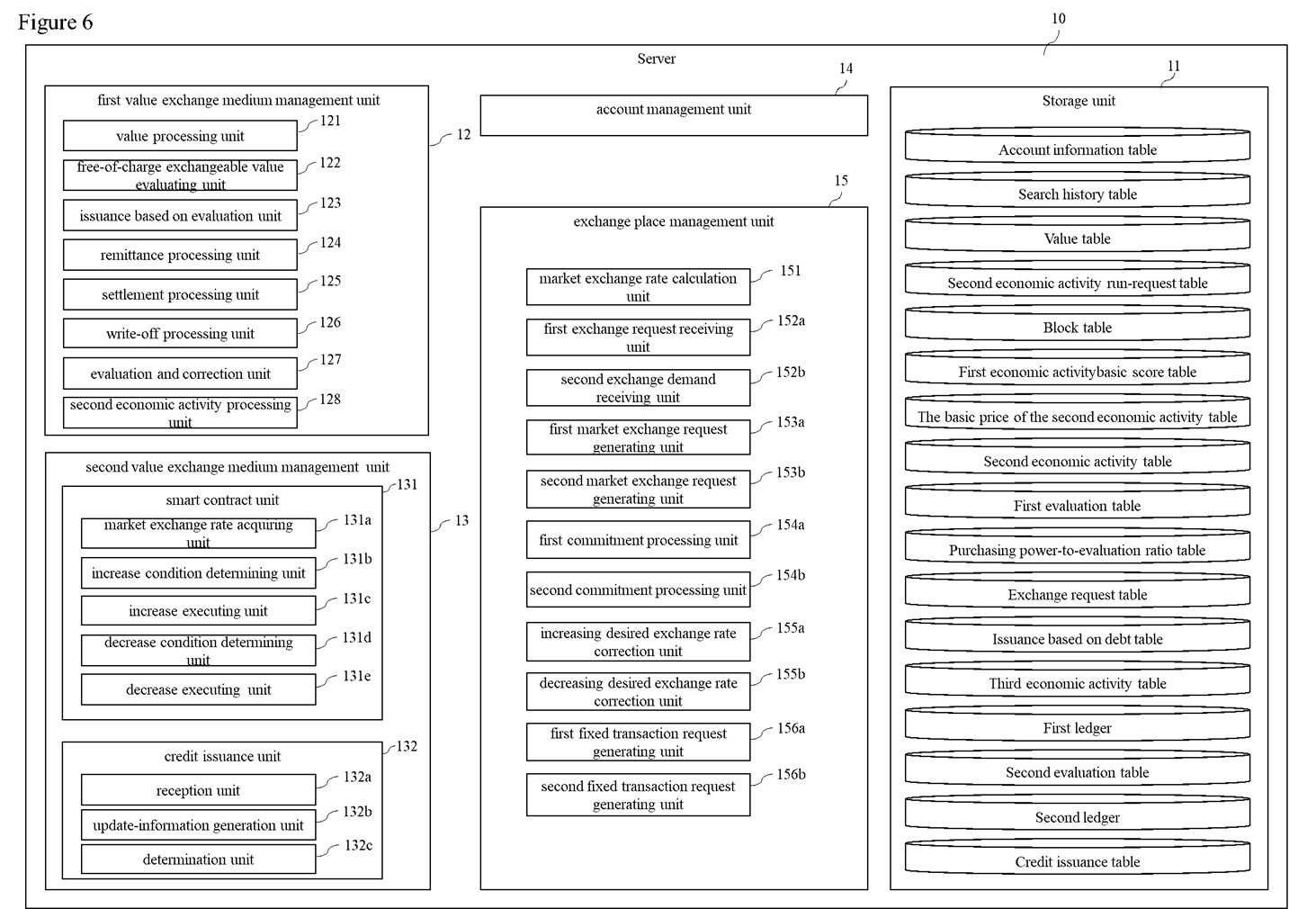

FIG. 6 is a block diagram showing an example of the functional configuration of the server 10.

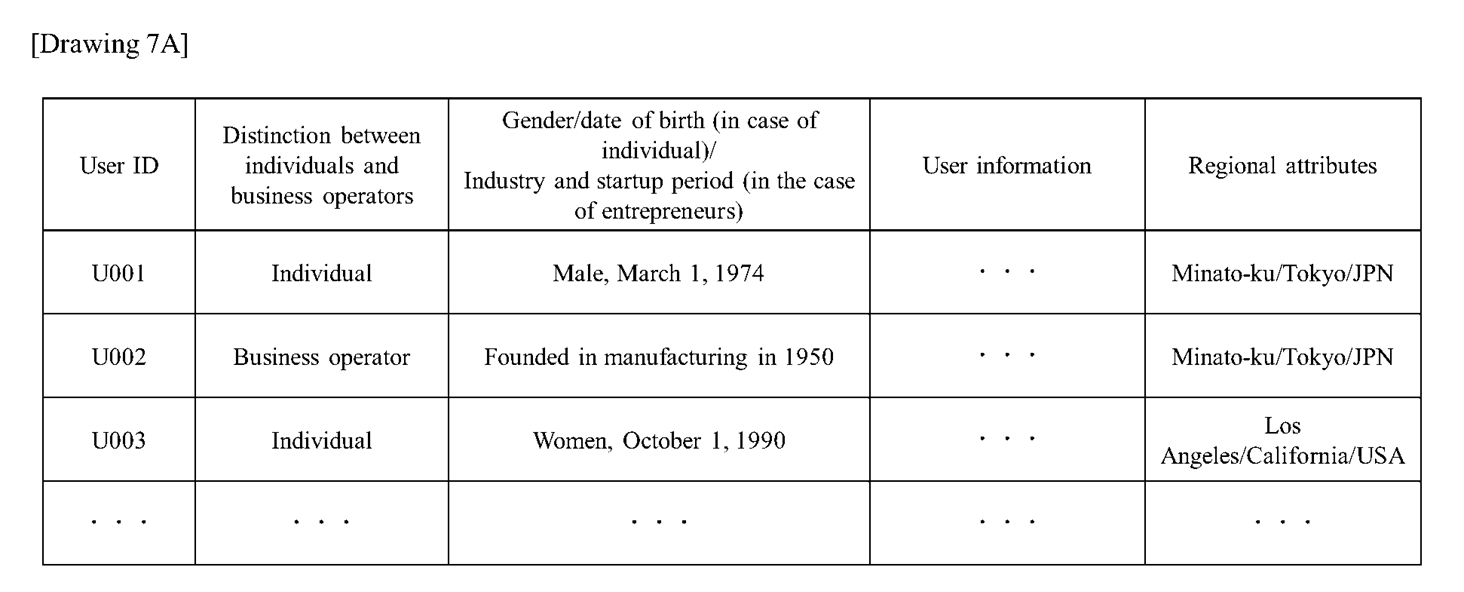

FIG. 7A shows an exemplary account-information table.

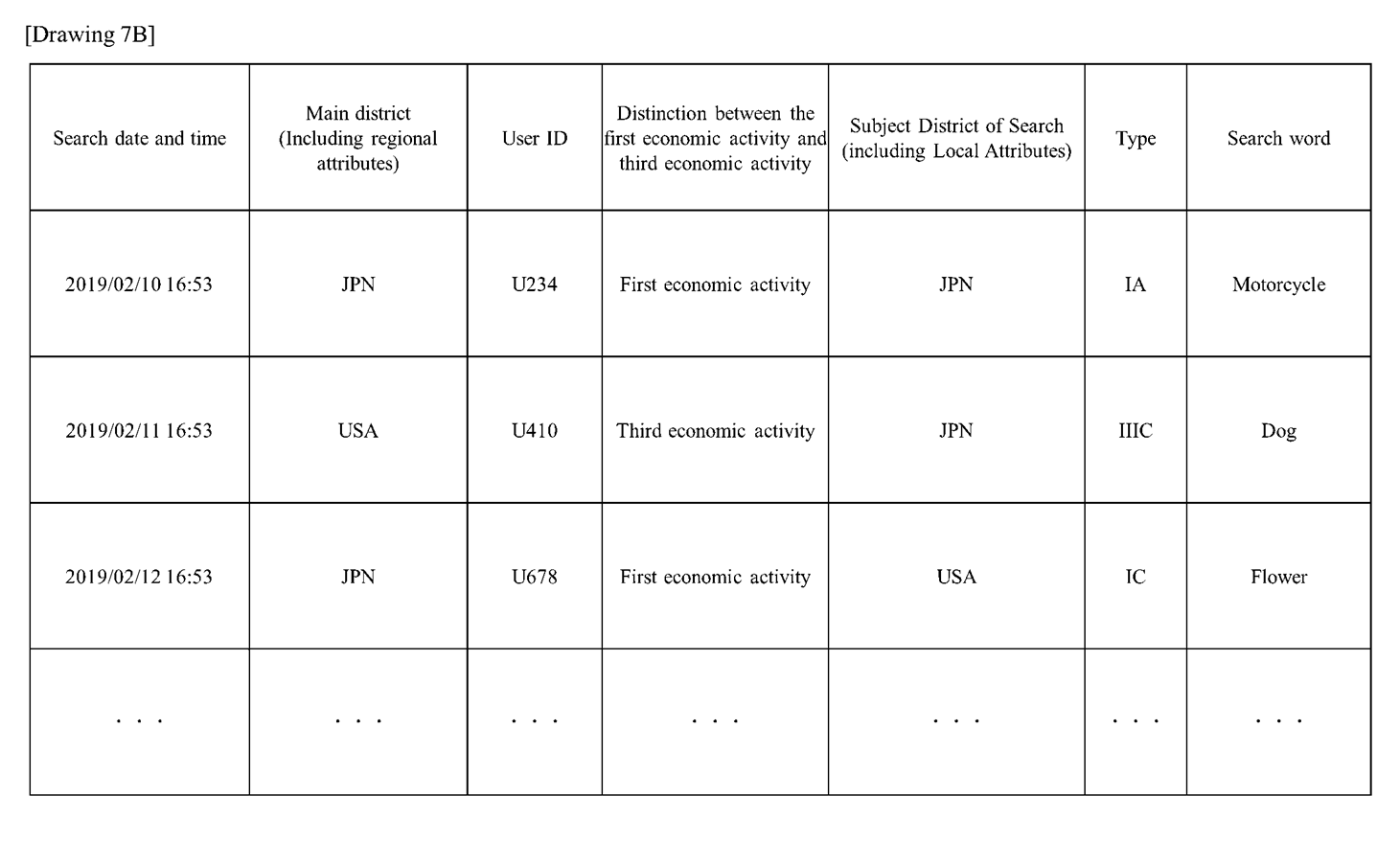

FIG. 7B shows an exemplary search history table.

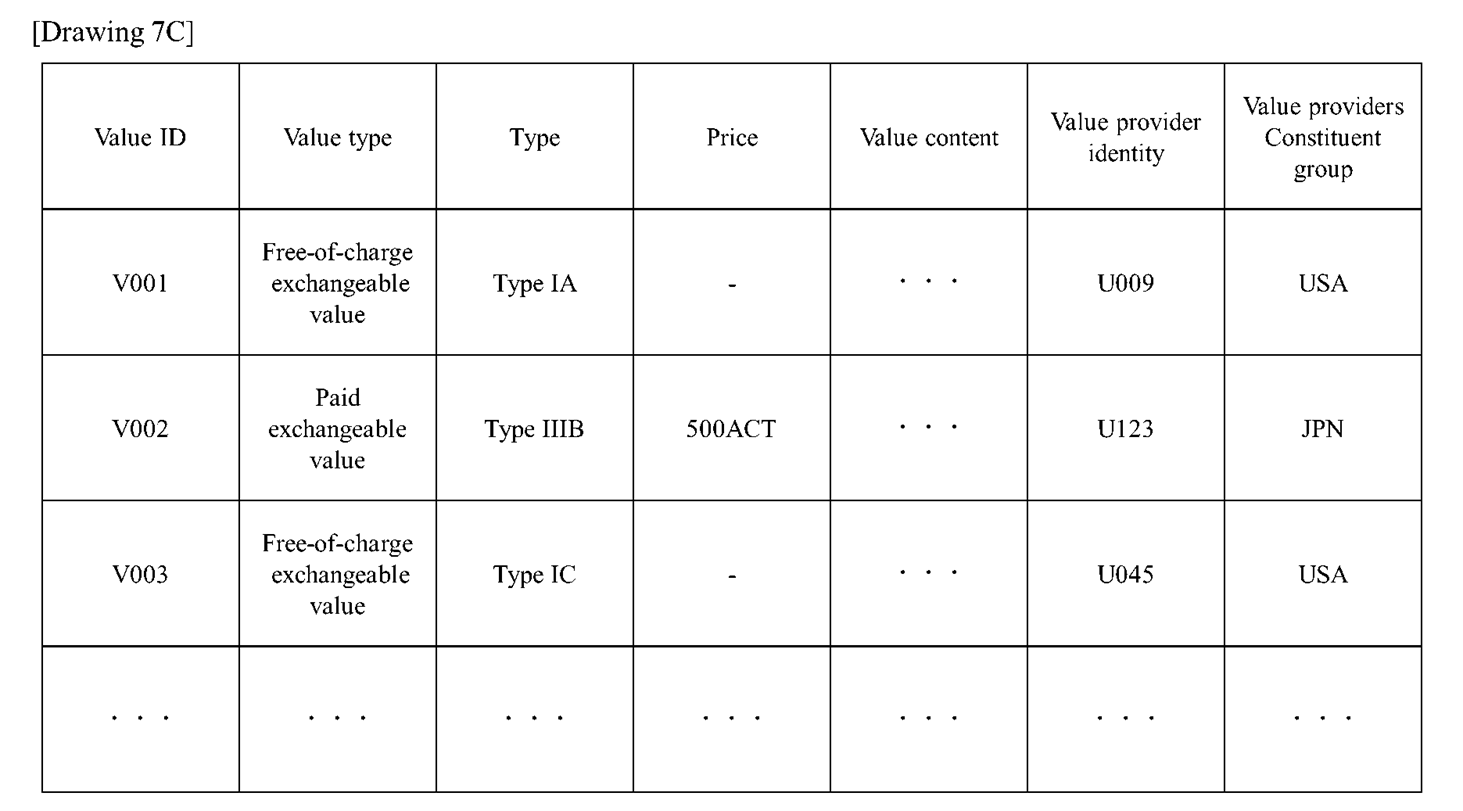

FIG. 7C shows an exemplary value table.

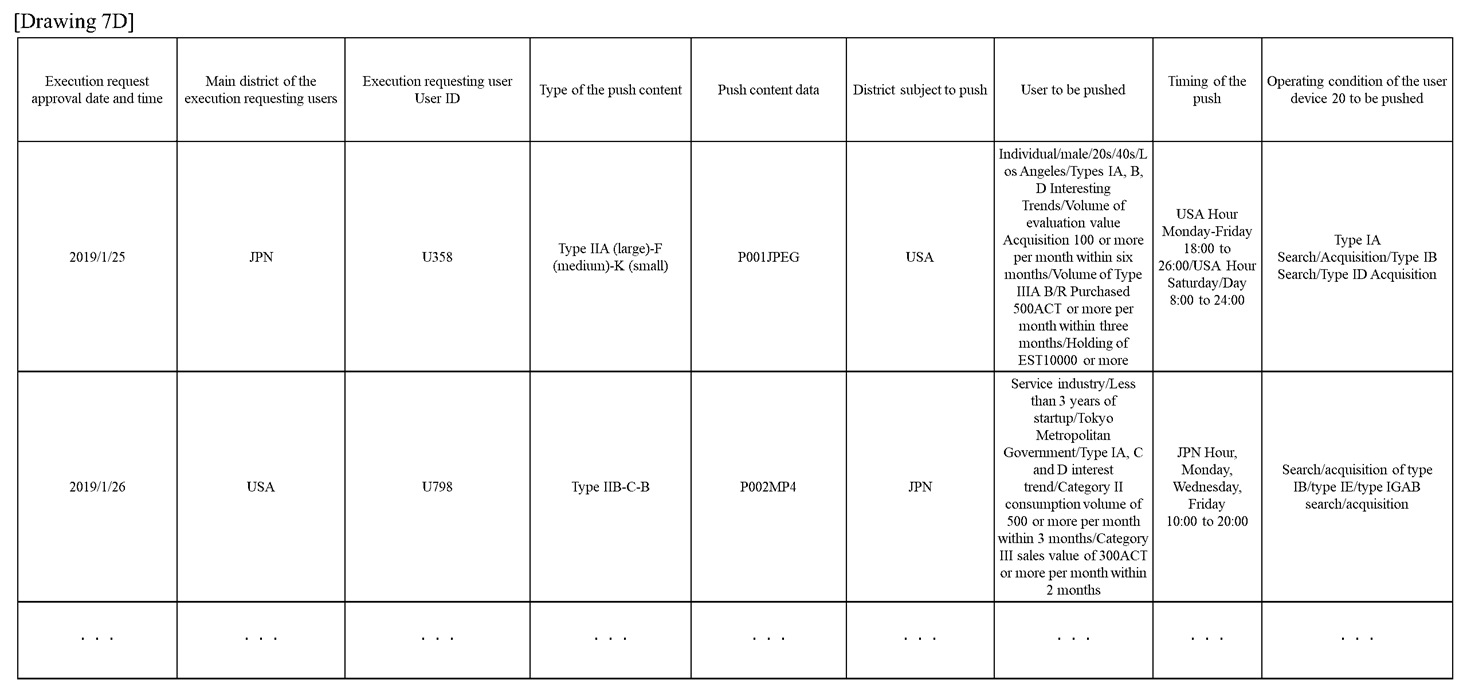

FIG. 7D shows an exemplary second economic activity run-request table.

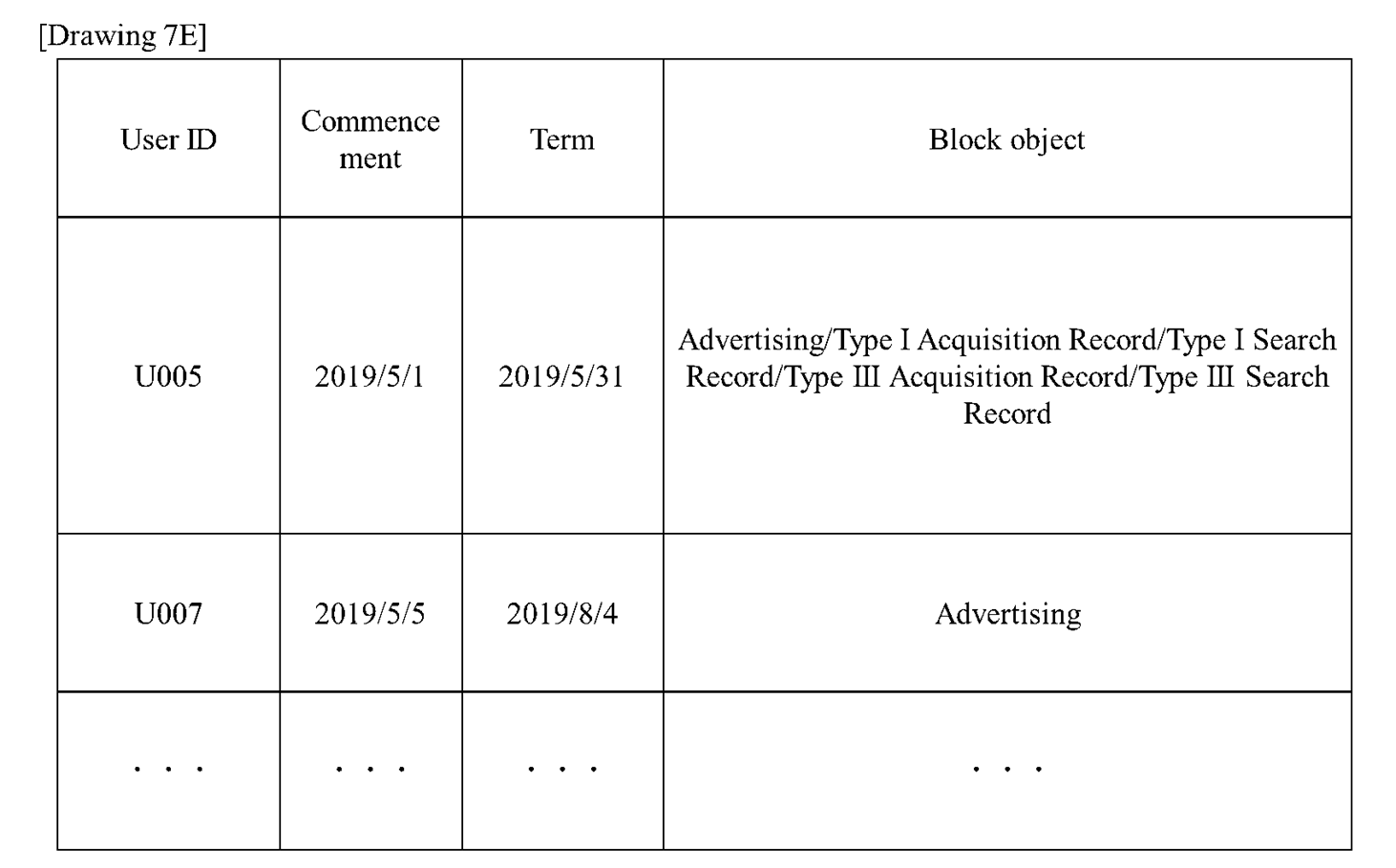

FIG. 7E is a diagram illustrating an exemplary block table.

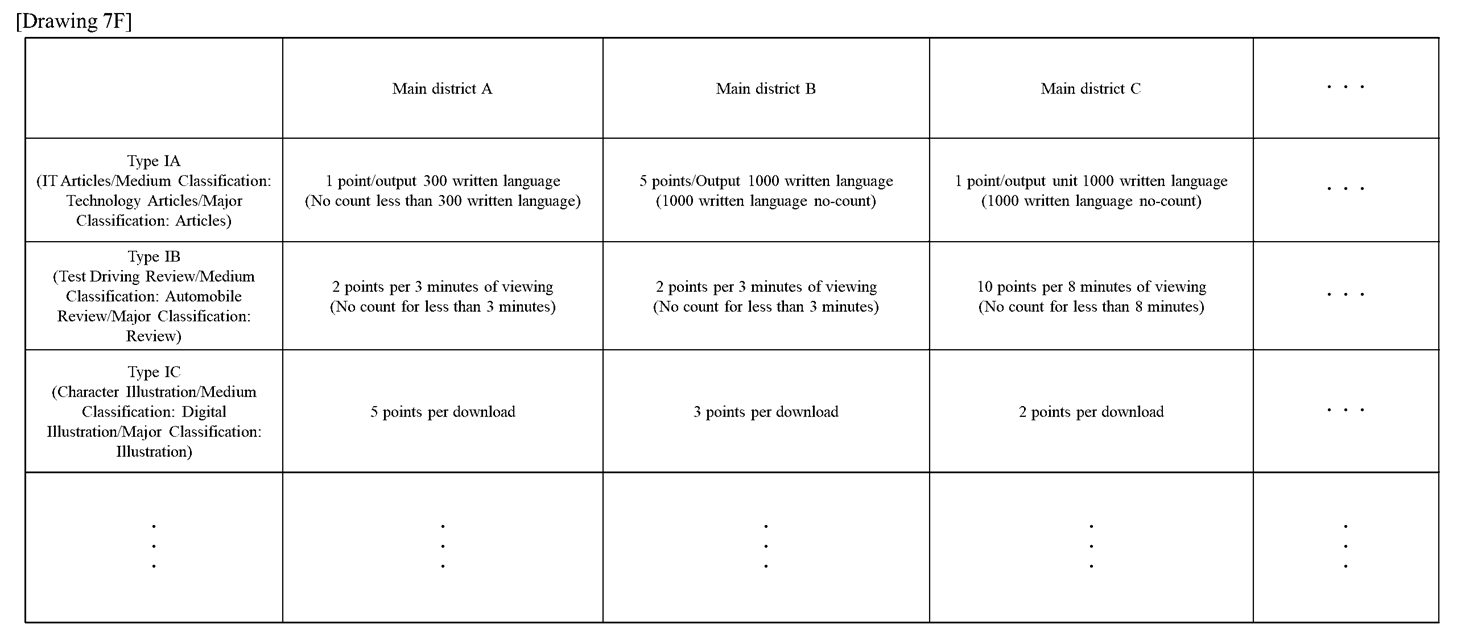

FIG. 7F shows an exemplary basement number of first economic activity table.

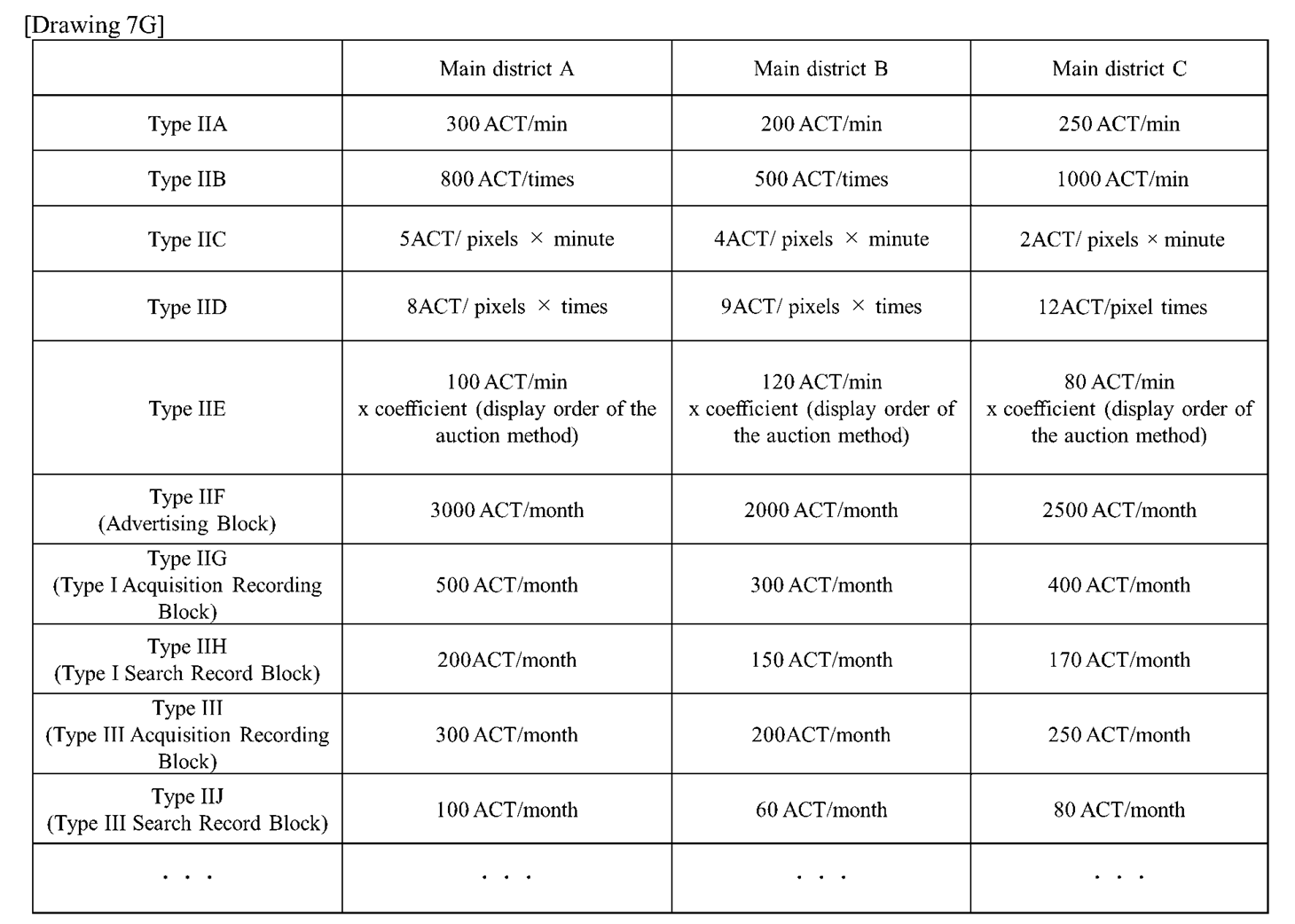

FIG. 7G shows an exemplary basement price of the second economic activity table.

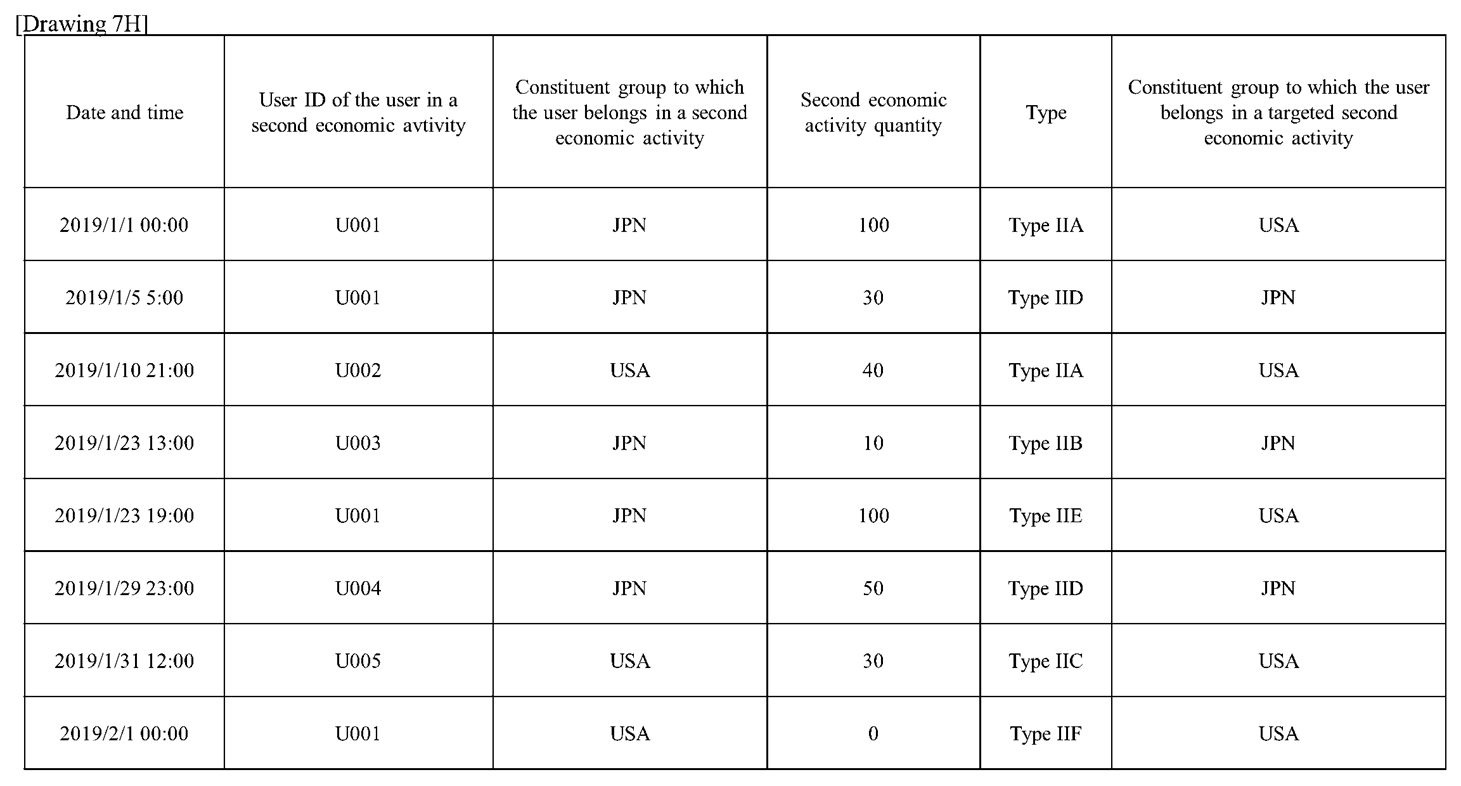

FIG. 7H shows an exemplary second economic activity table.

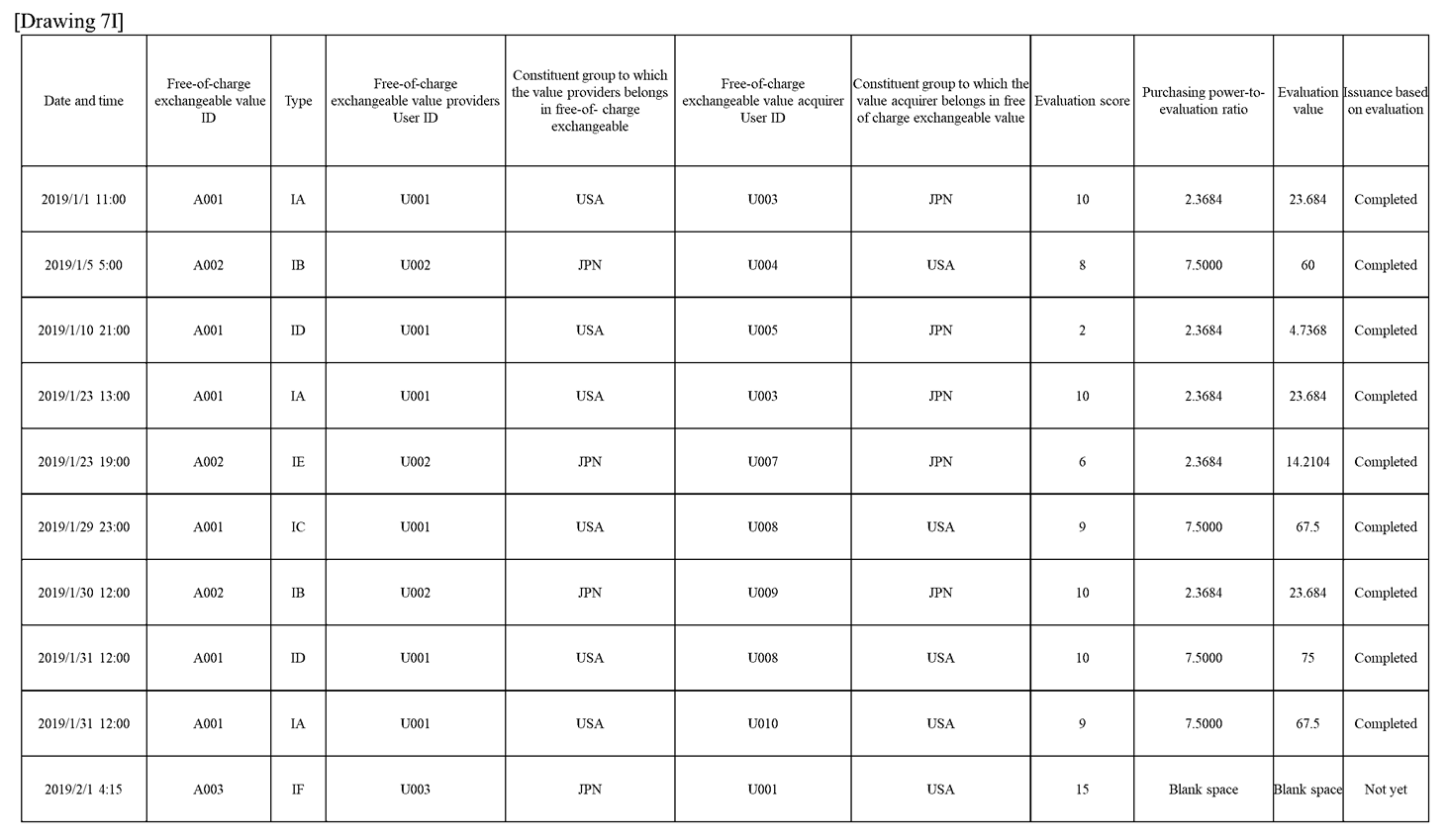

FIG. 7I shows an exemplary first evaluation table.

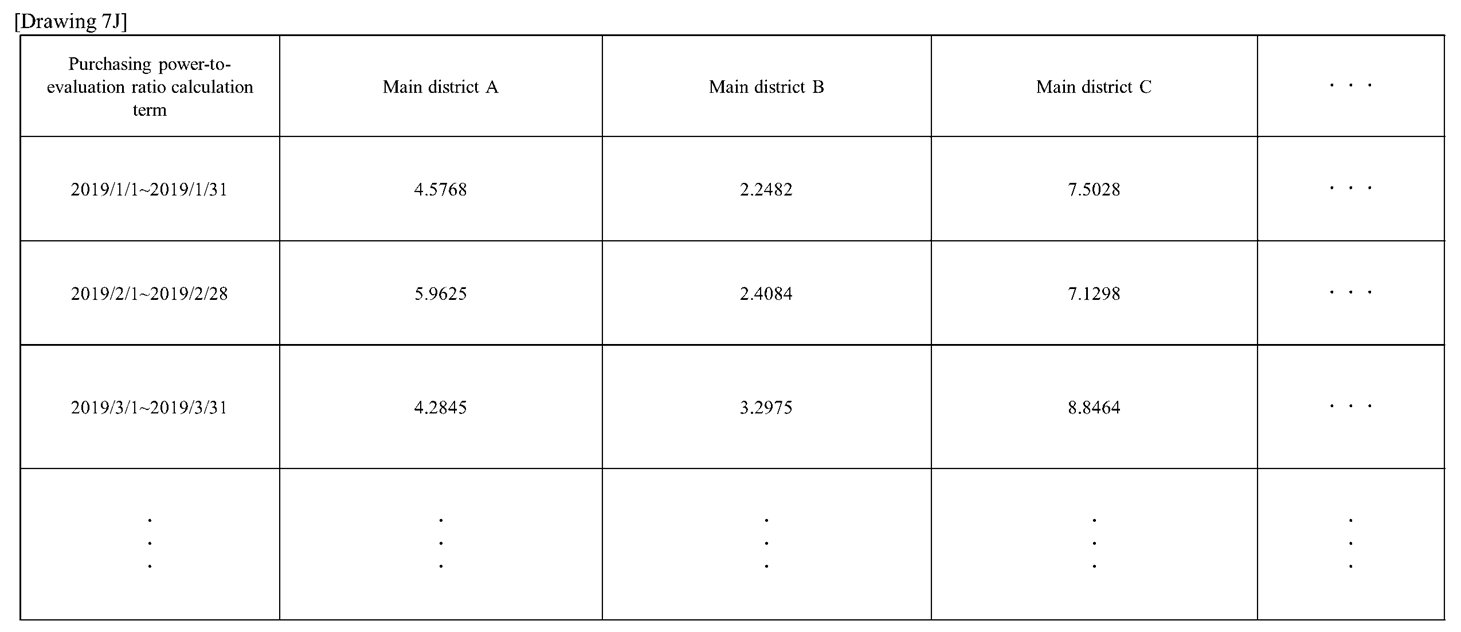

FIG. 7J shows an exemplary purchasing power-to-evaluation ratio table.

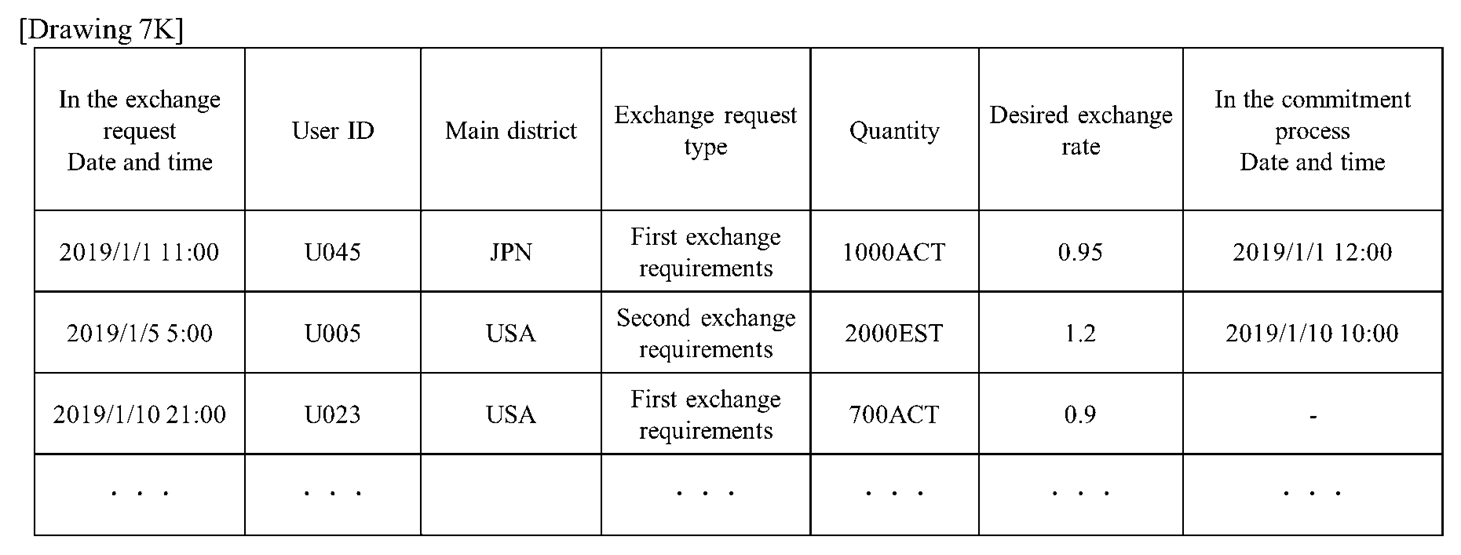

FIG. 7K shows an exemplary exchange request table.

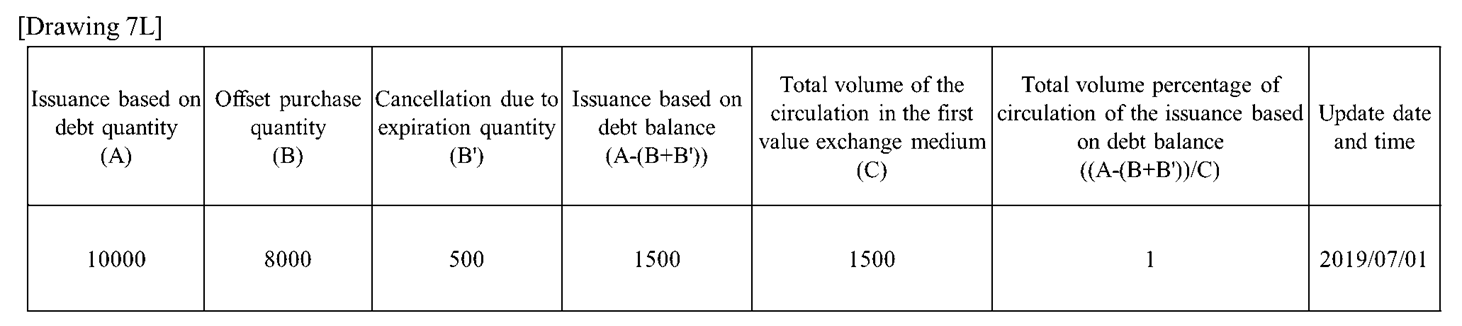

FIG. 7L shows an exemplary issuance based on debt table.

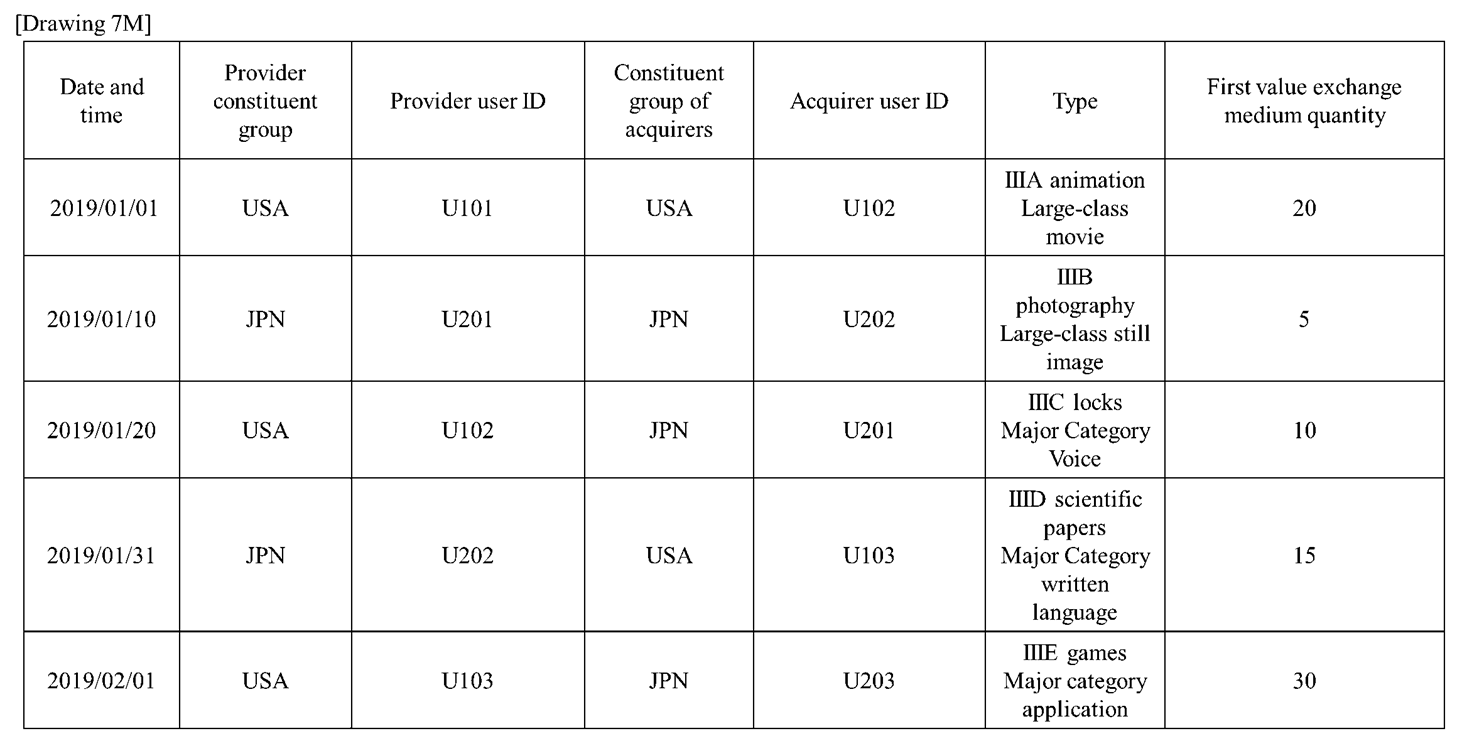

FIG. 7M shows an exemplary third economic activity table.

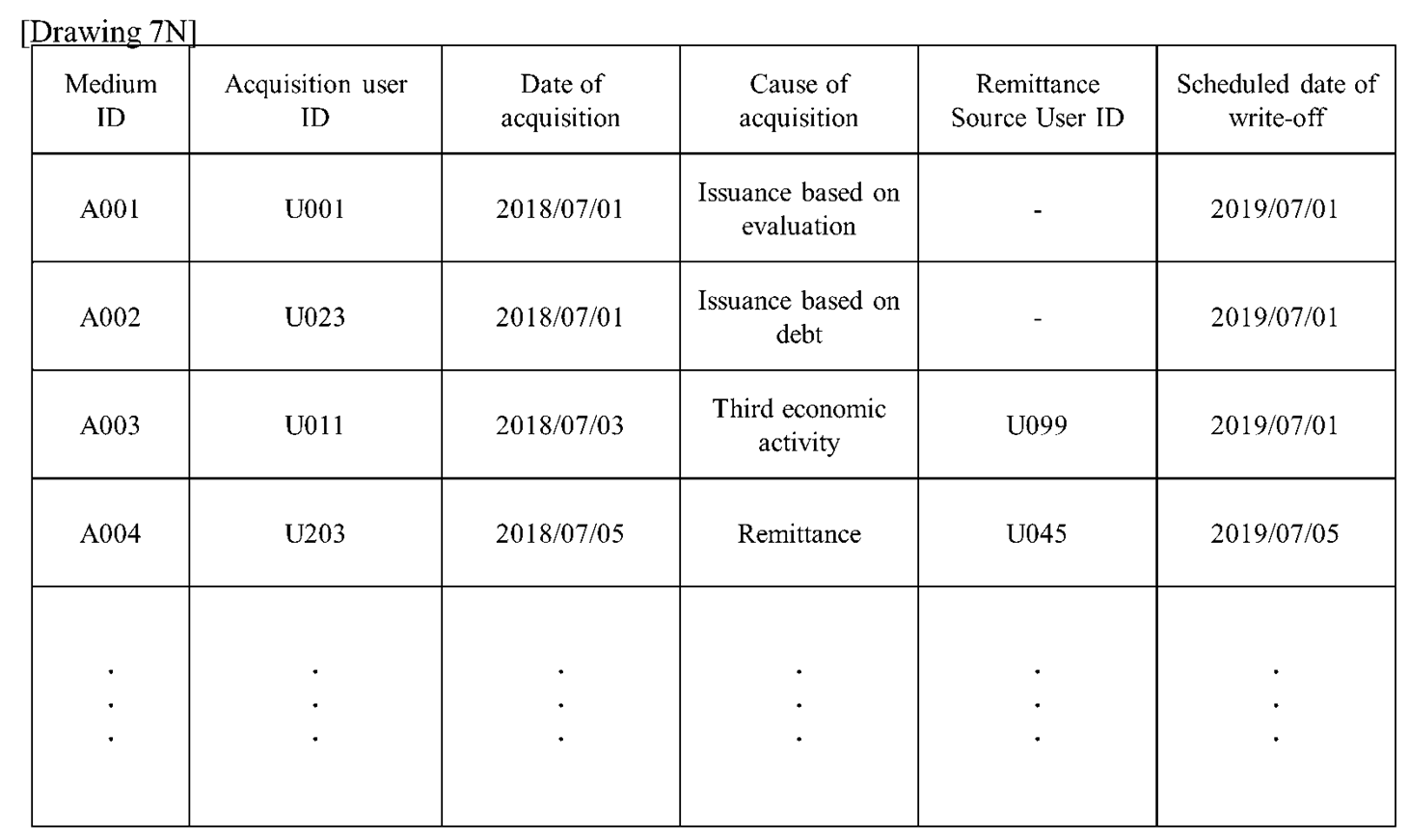

FIG. 7N shows an exemplary first ledger.

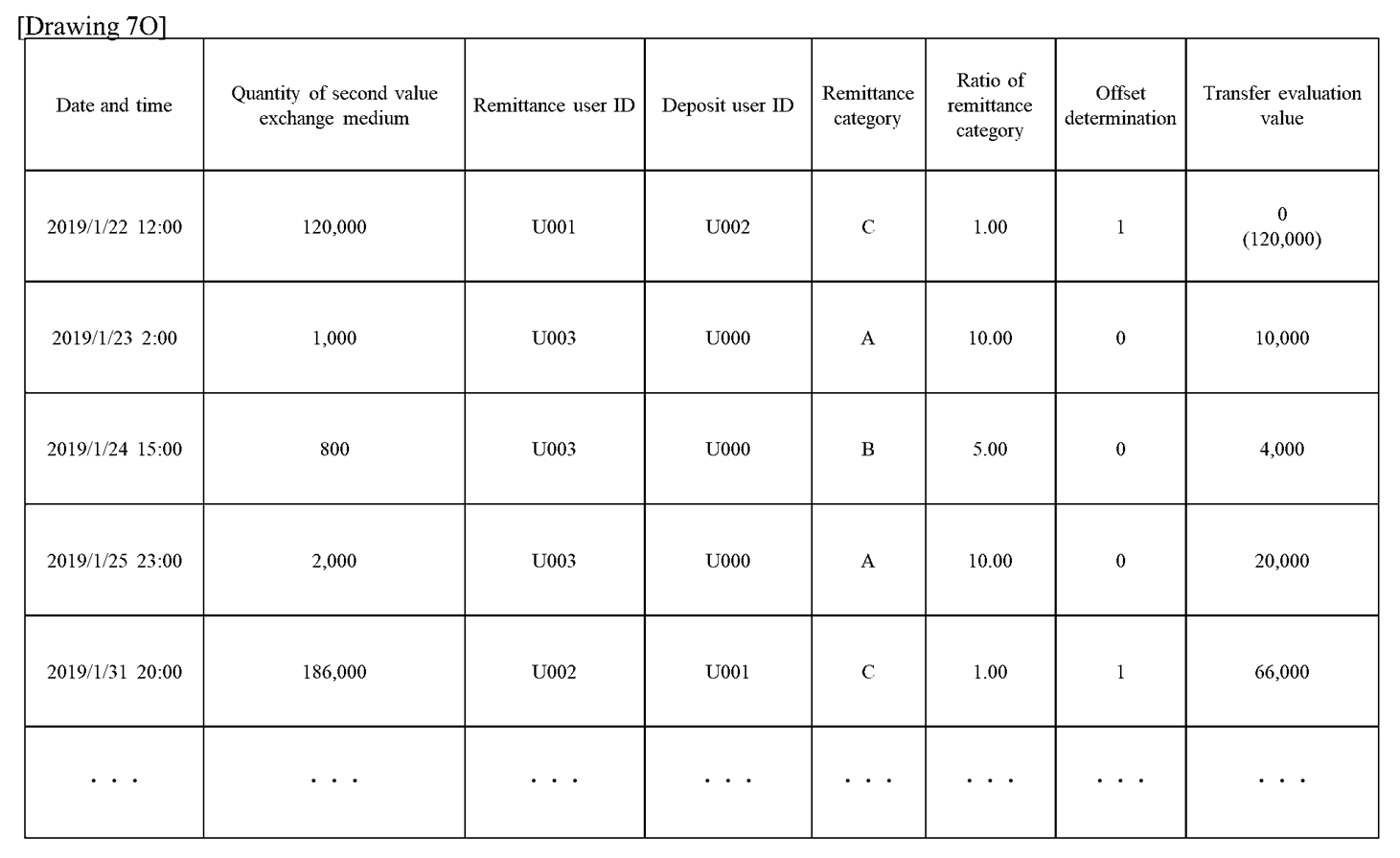

FIG. 7O shows an exemplary second evaluation table.

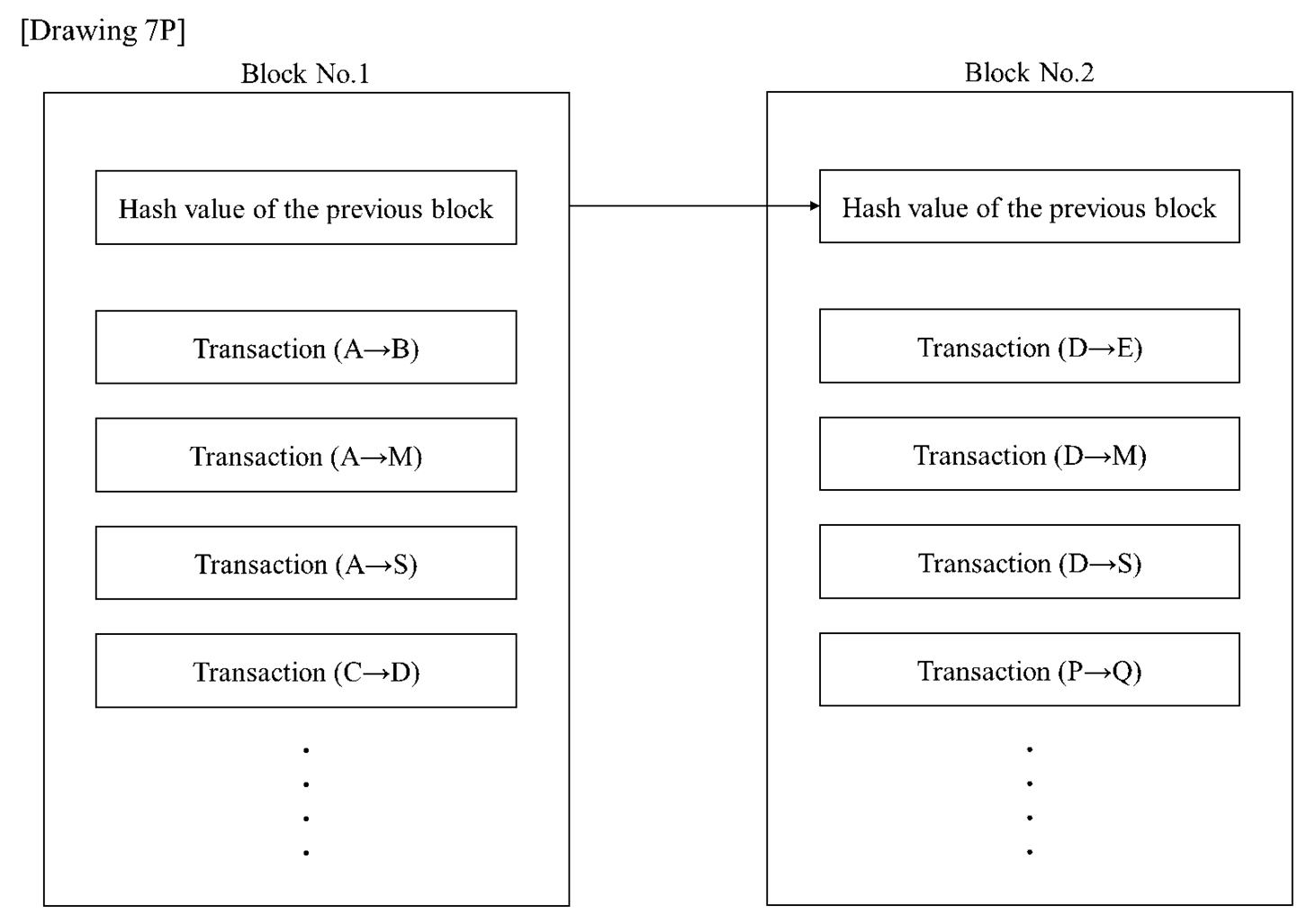

FIG. 7P shows an exemplary second ledger.

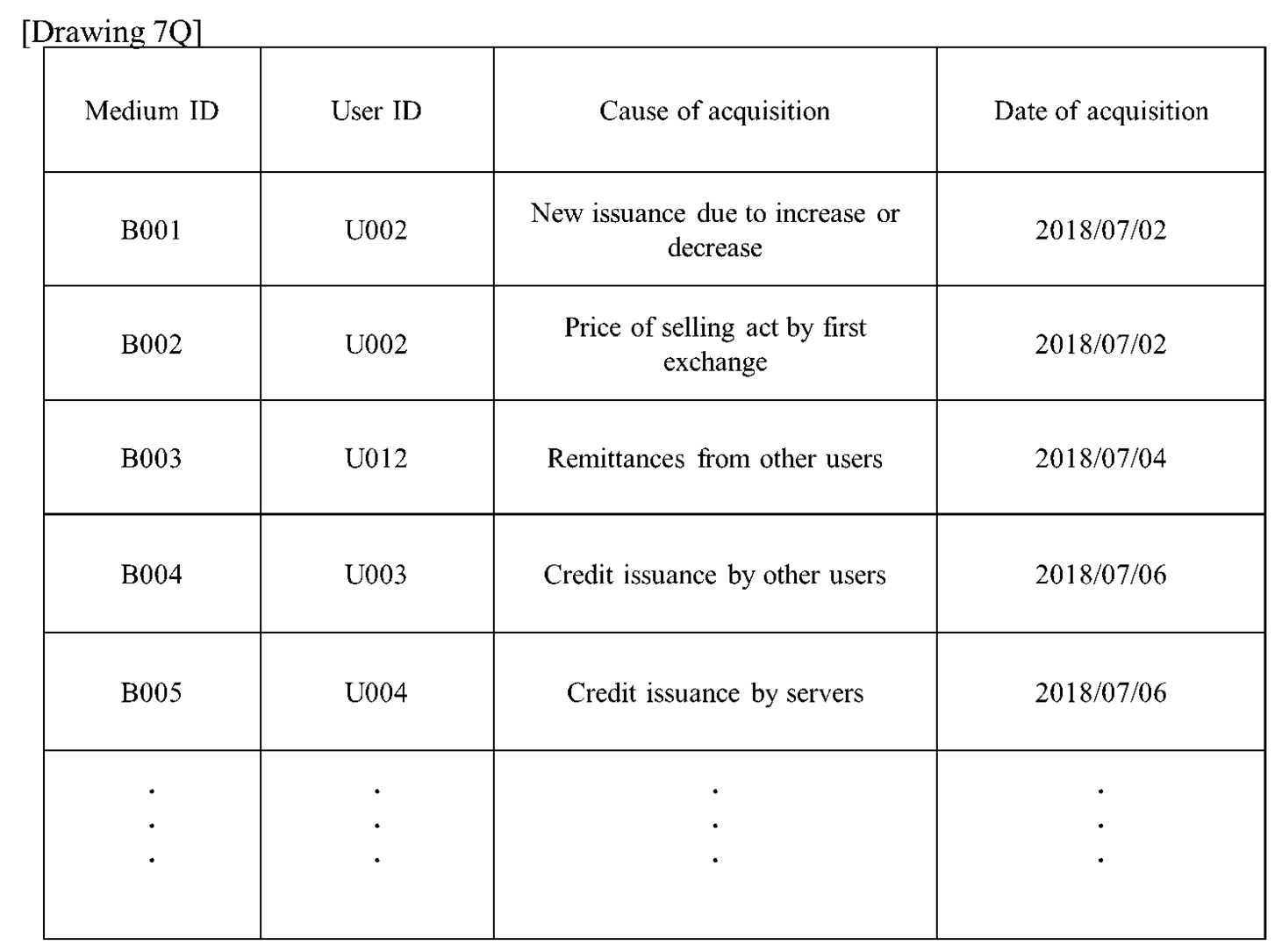

FIG. 7Q shows another exemplary second ledger.

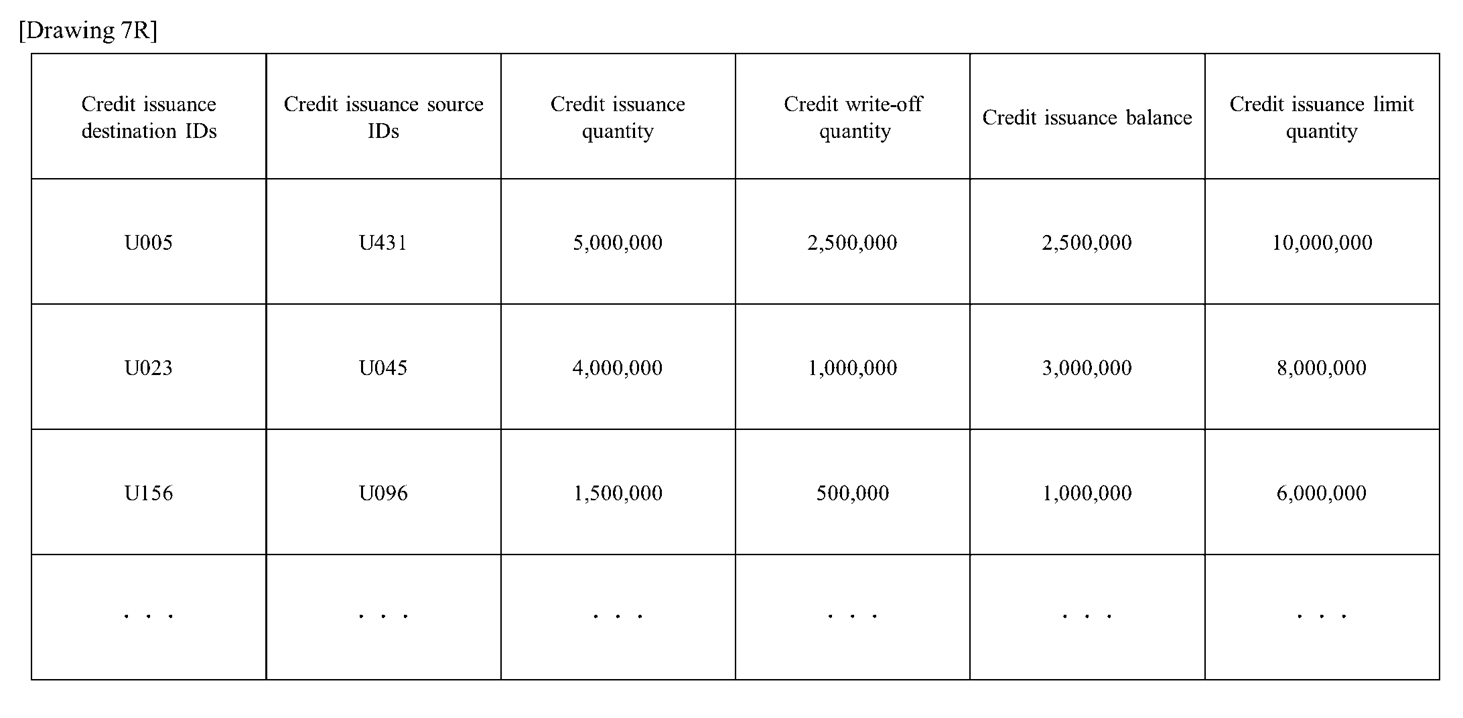

FIG. 7R shows an exemplary credit issuance table.

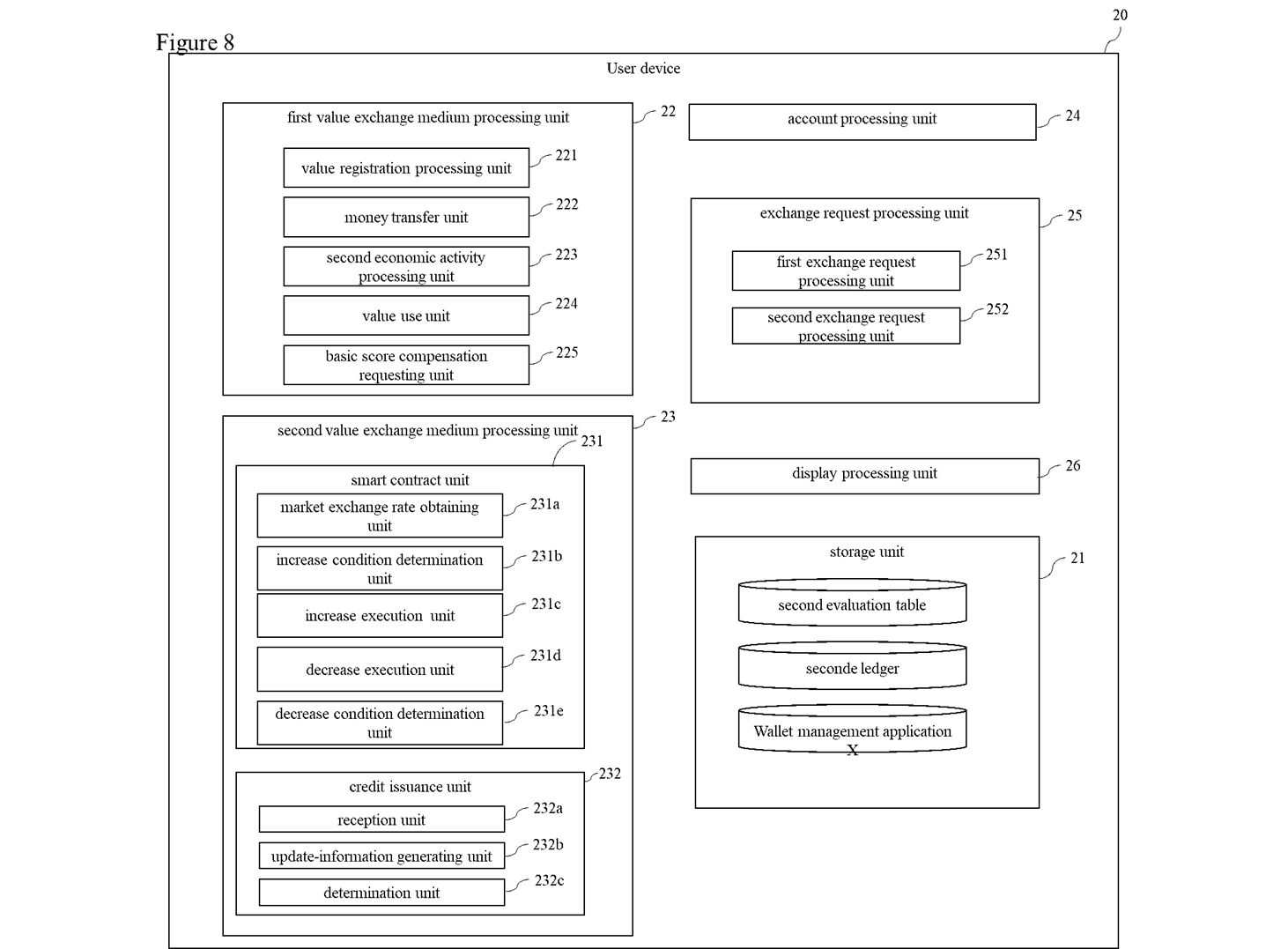

FIG. 8 is a block diagram showing an exemplary functional configuration of the user device 20.

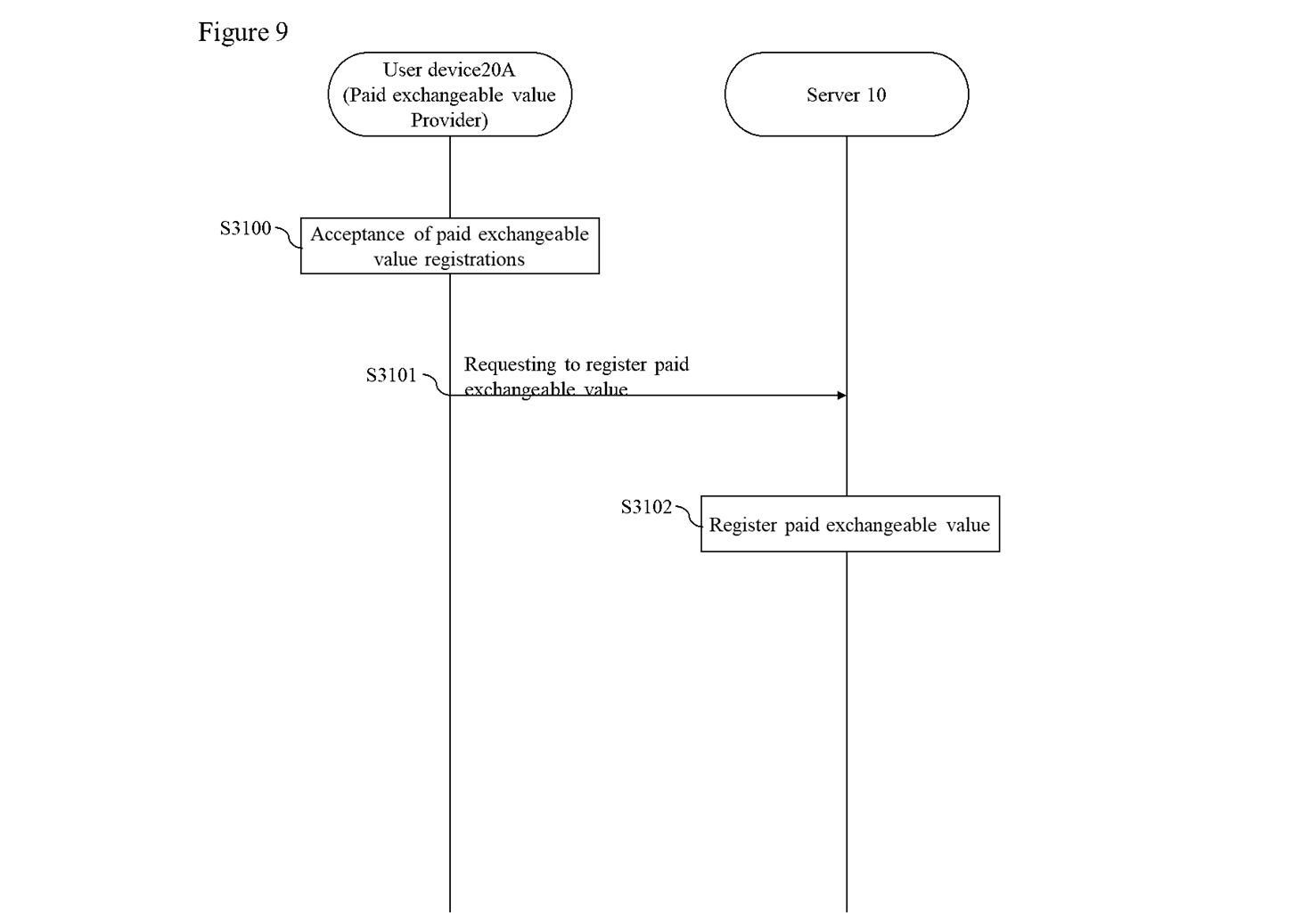

FIG. 9 is a diagram illustrating exemplary operation sequences of the paid exchangeable value registering process.

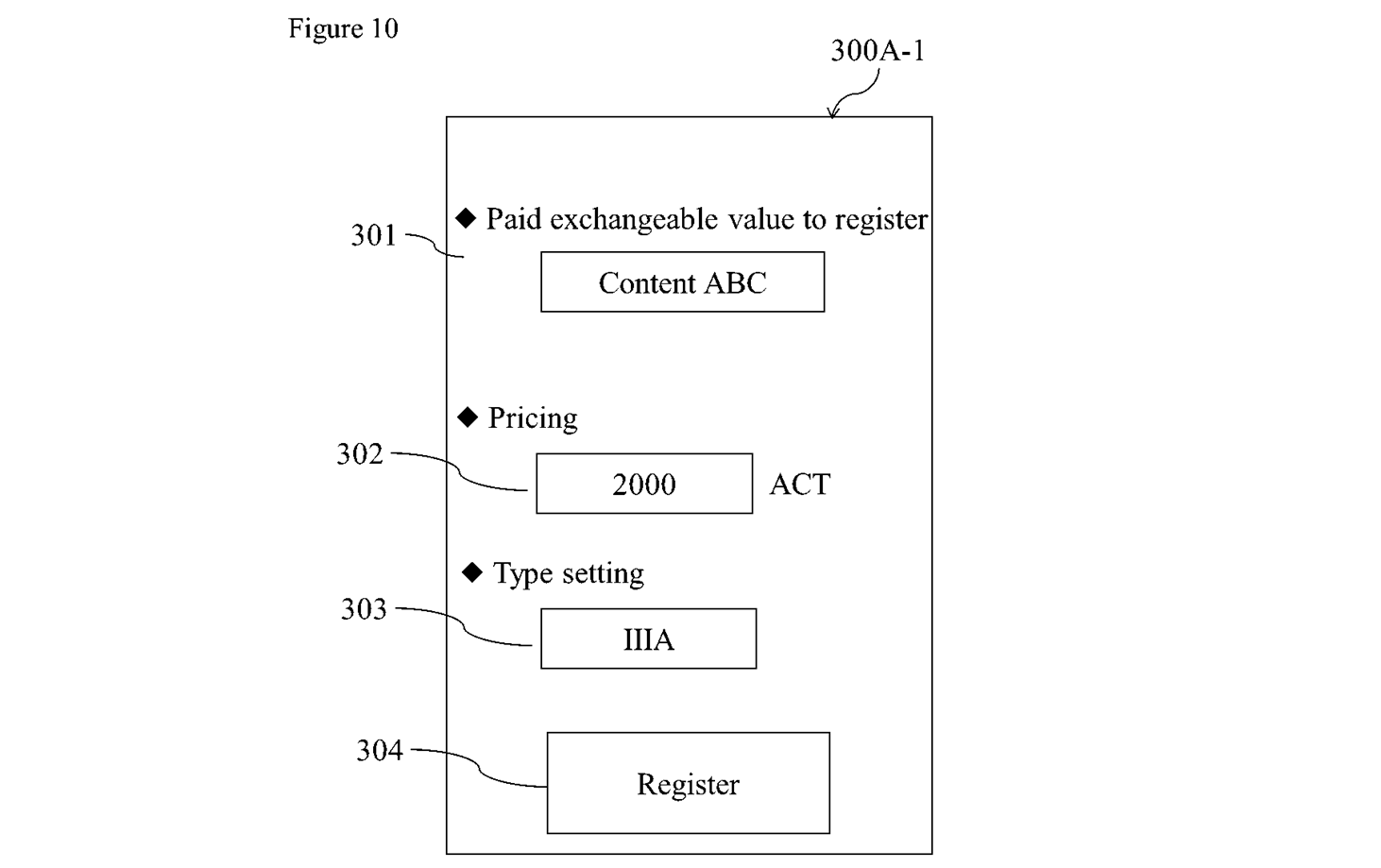

FIG. 10 is a diagram showing an exemplary paid exchangeable value input screen 300 A-1.

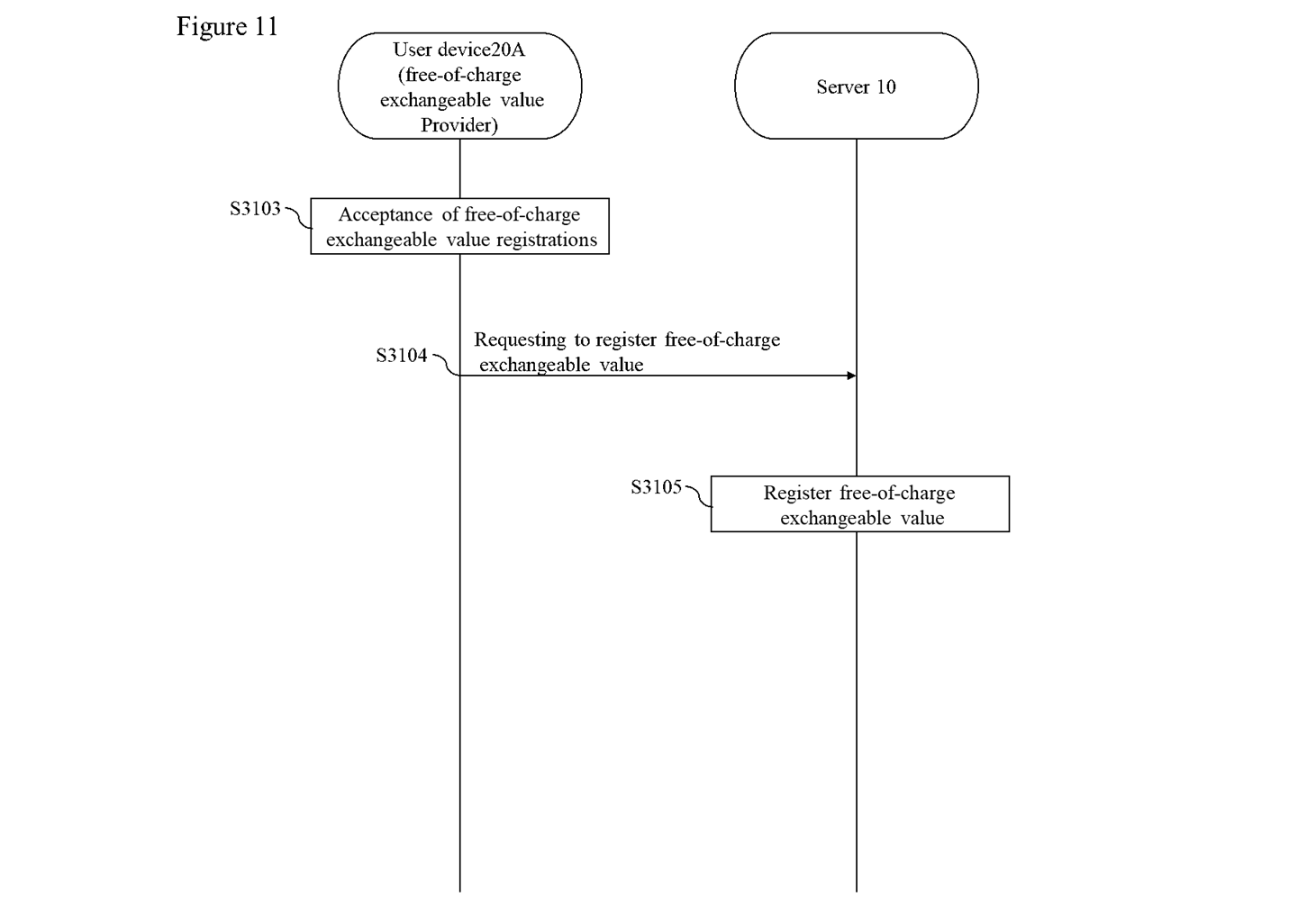

FIG. 11 is a shows exemplary operation sequences of the free-of-charge exchangeable value registering process.

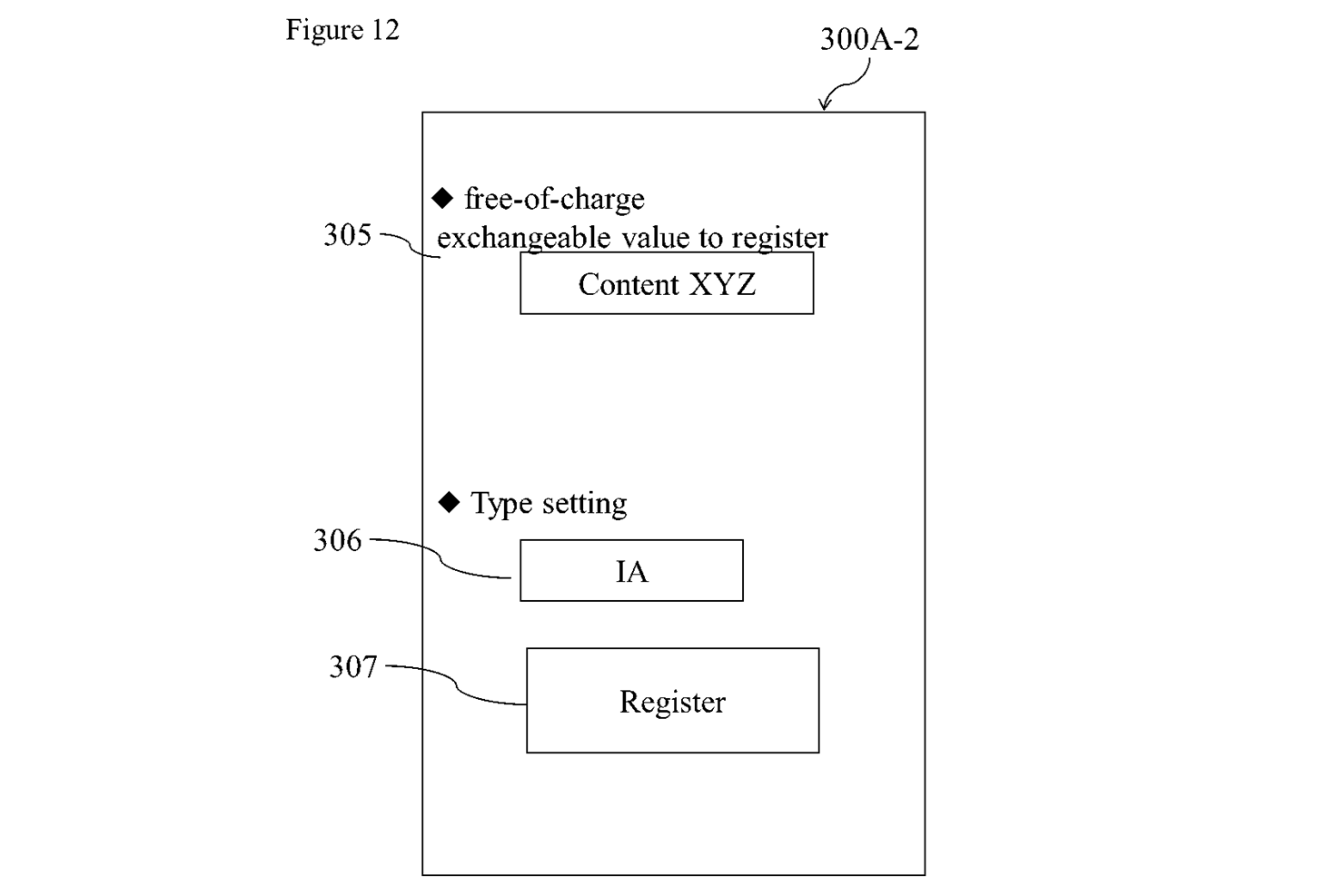

FIG. 12 shows an exemplary free-of-charge exchangeable value input screen 300 A-2.

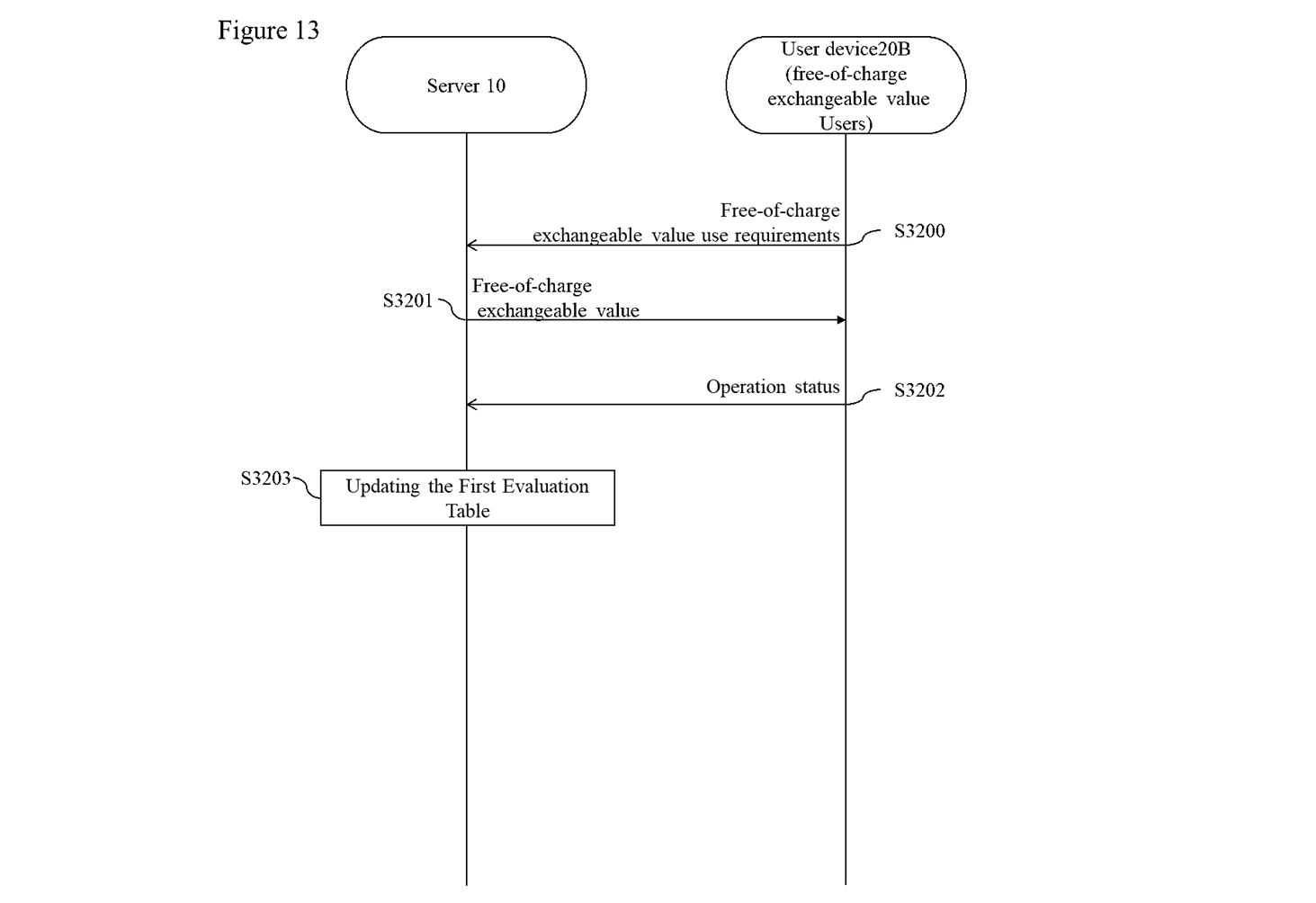

FIG. 13 is a diagram illustrating exemplary operation sequences of the free-of-charge exchangeable value providing and acquiring process.

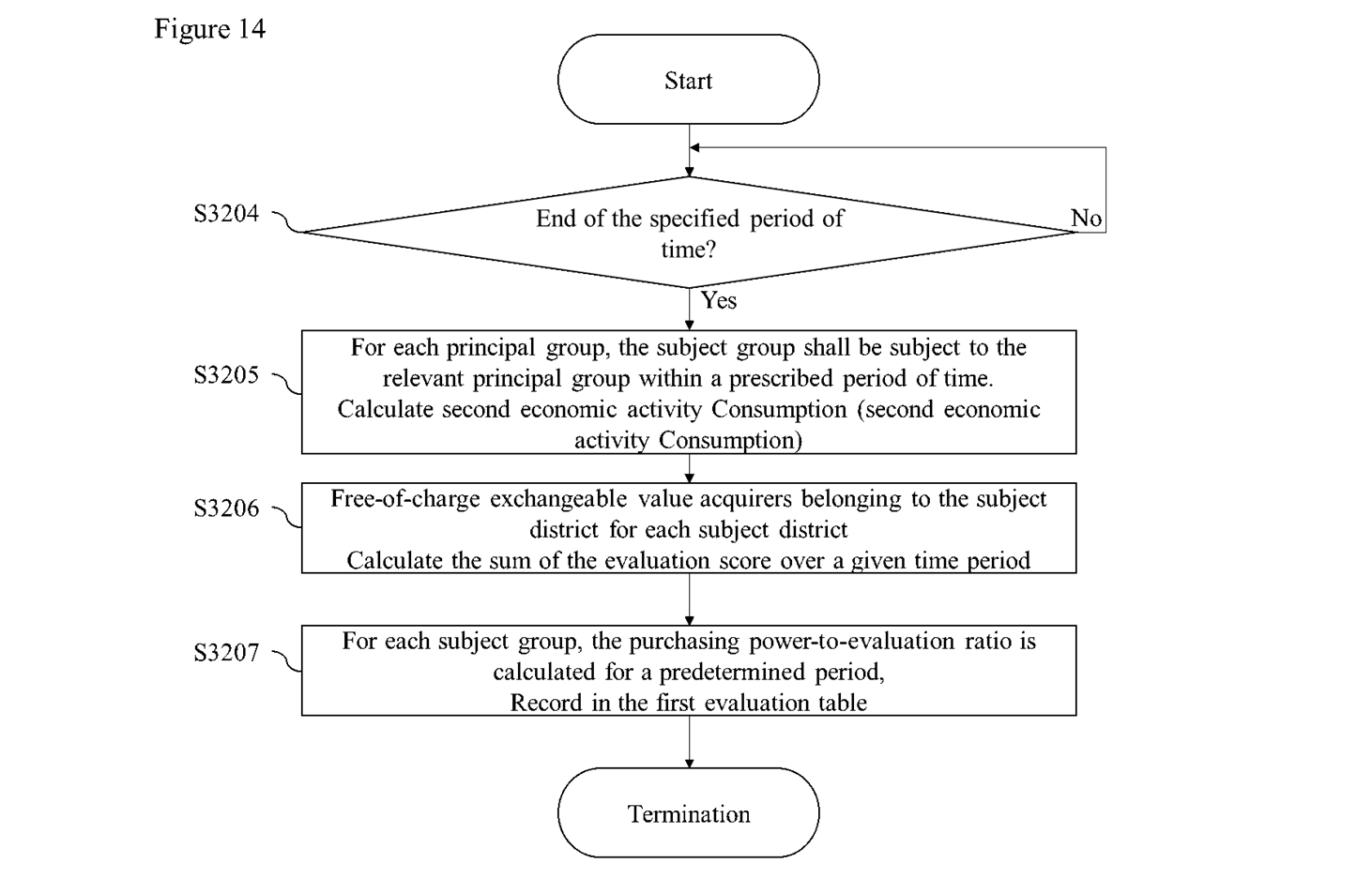

FIG. 14 is a diagram showing an exemplary operation flow of the purchasing power-to-evaluation ratio calculation process.

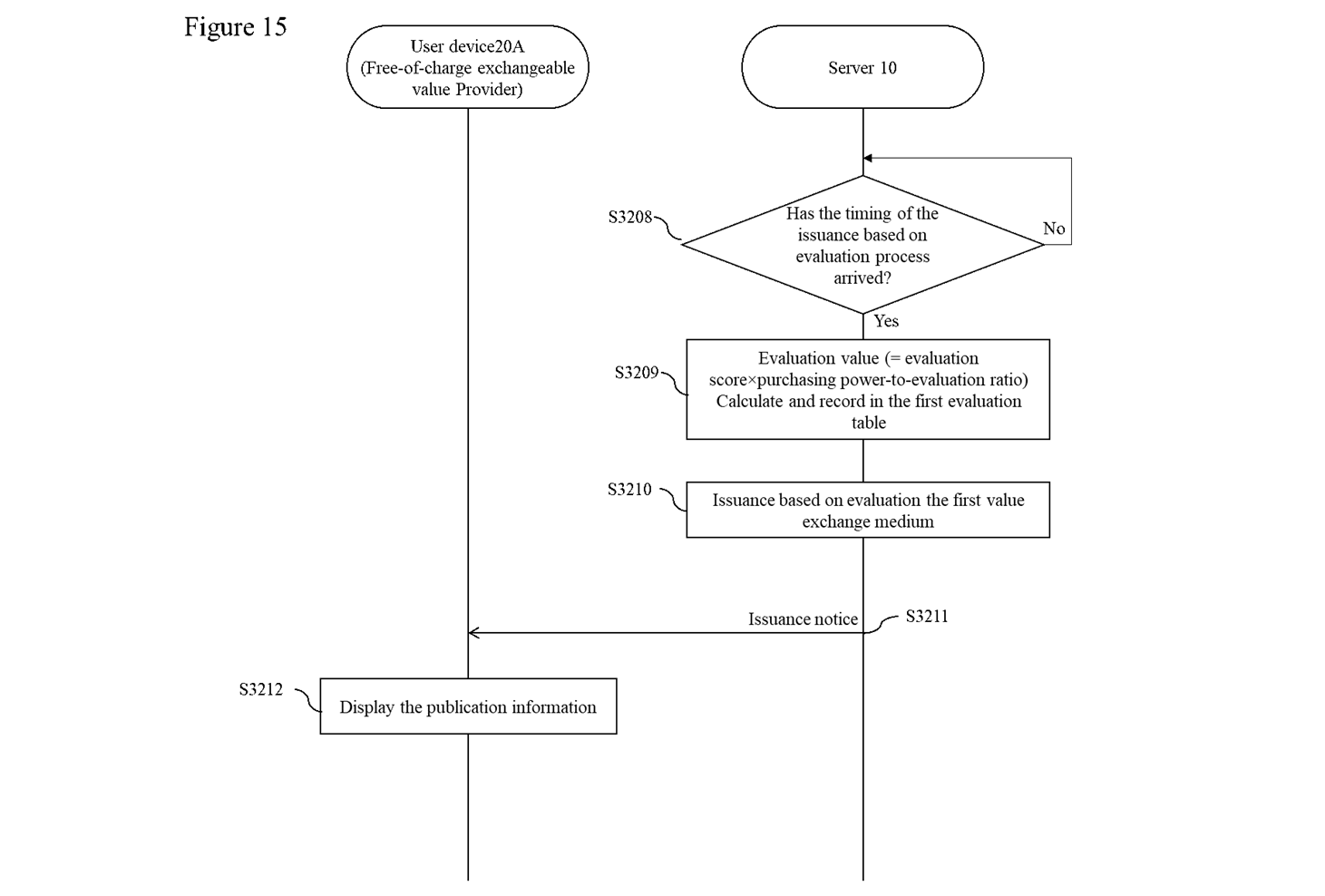

FIG. 15 is a diagram illustrating exemplary operation sequences of the issuance based on evaluation process.

FIG. 16 is a diagram showing an example of an issuance information screen 300B for displaying issue information.

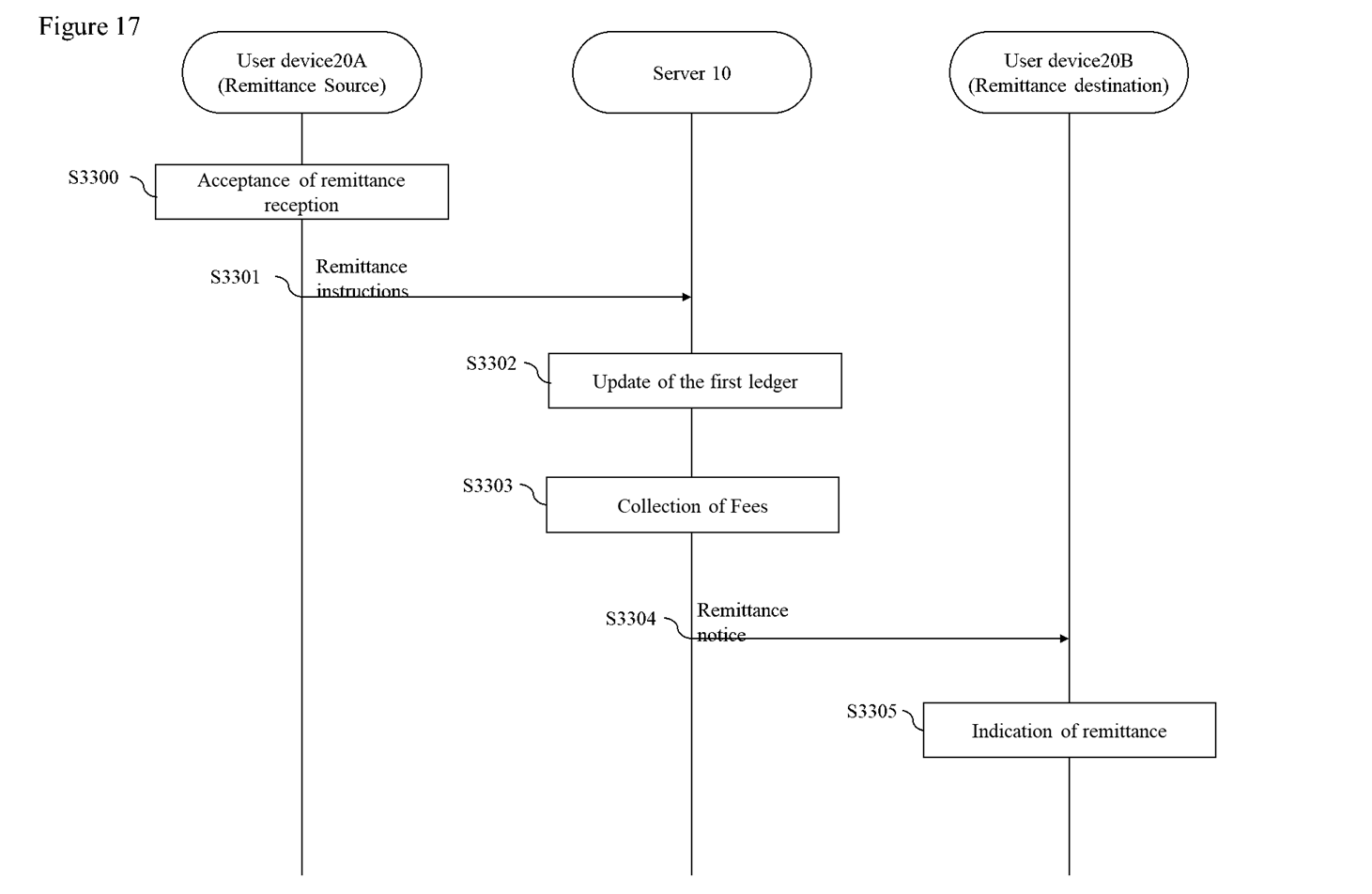

FIG. 17 is a diagram showing an exemplary operation sequence of the first value exchange medium remittance process.

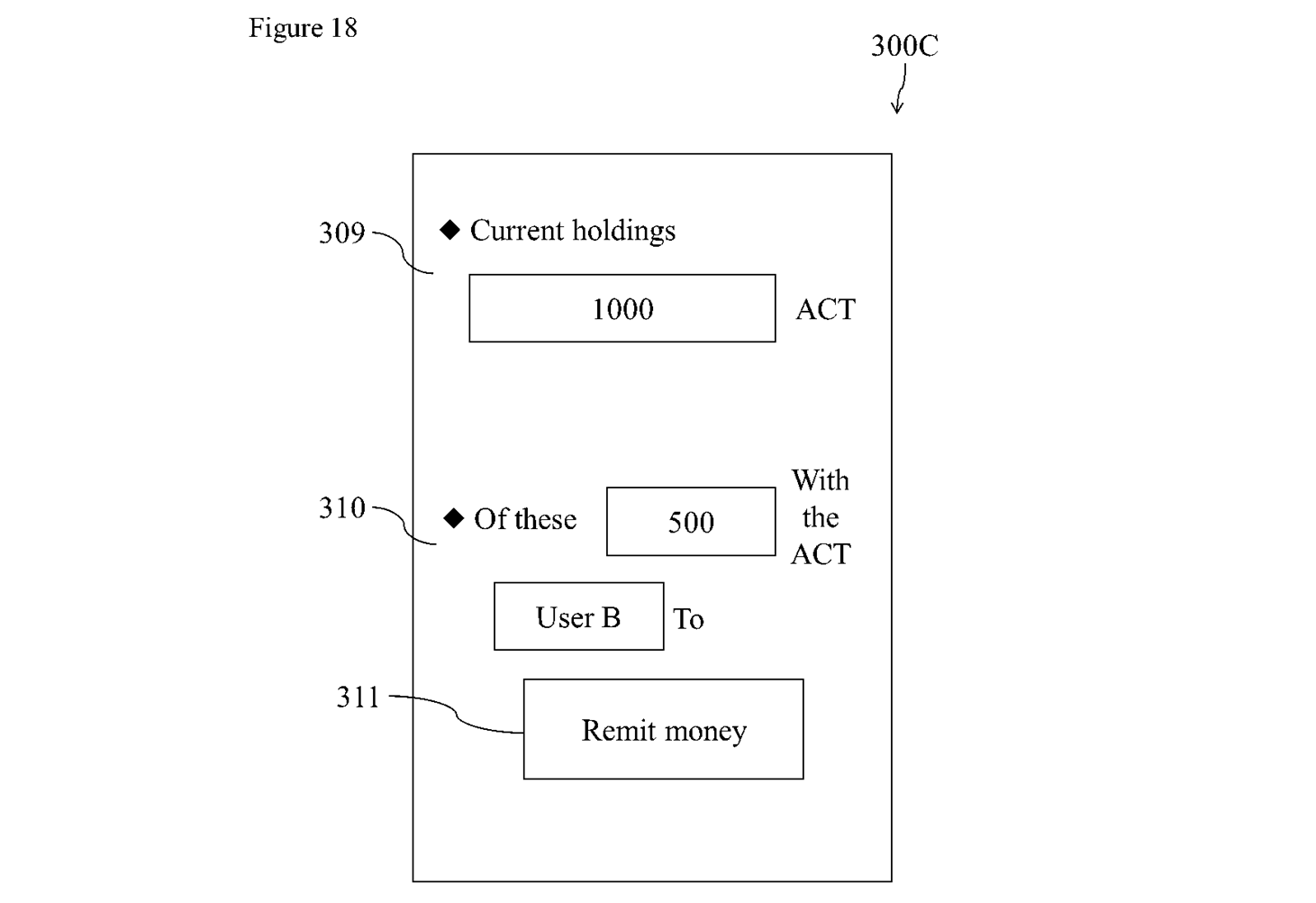

FIG. 18 is a diagram showing an example of the remittance instruction input screen 300C.

FIG. 19 is a diagram showing an example of the remittance notification screen 300D.

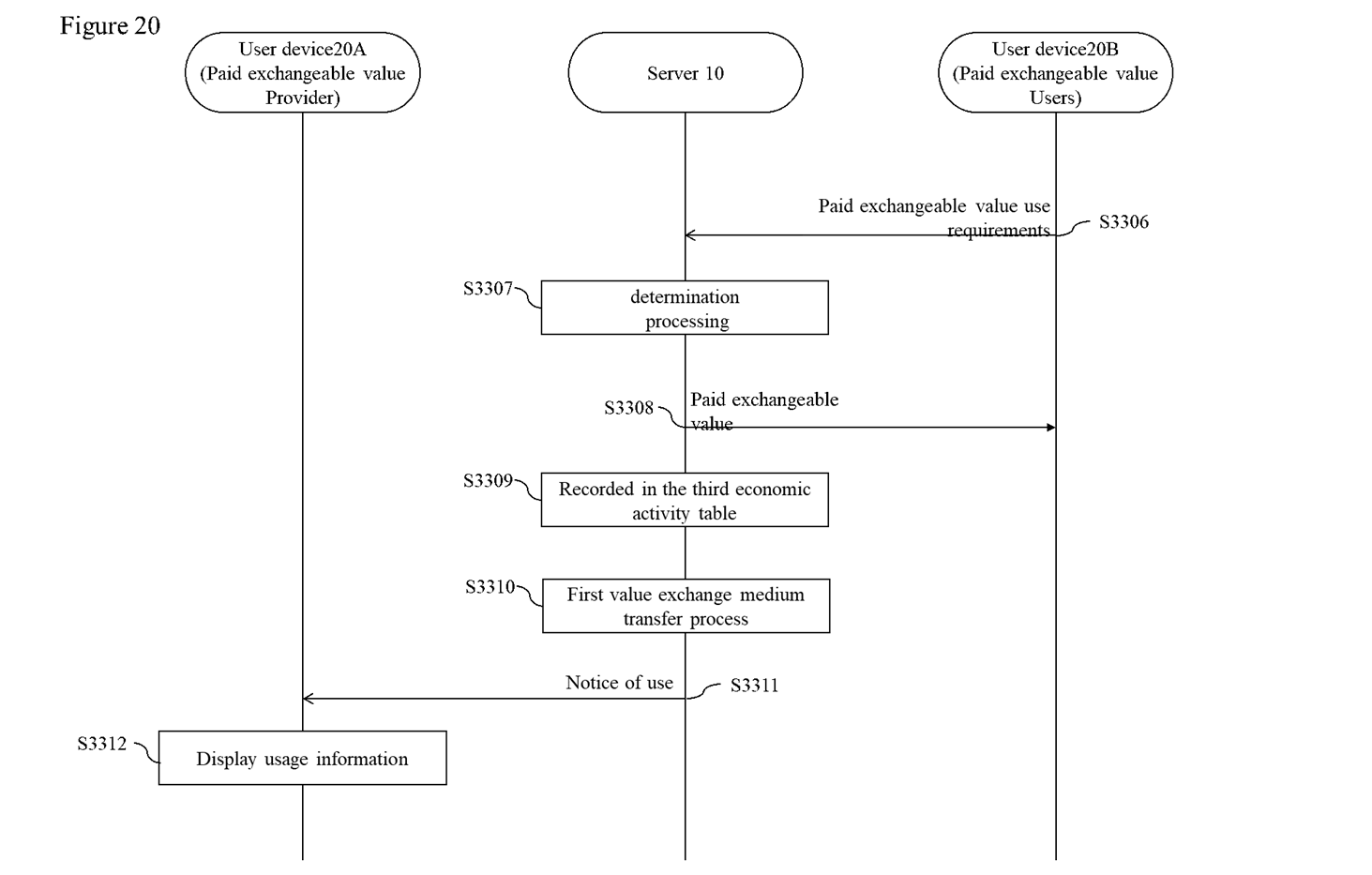

FIG. 20 is a diagram showing an exemplary operation sequence of the settlement (third economic activity) process in accordance with the use of the paid exchangeable value.

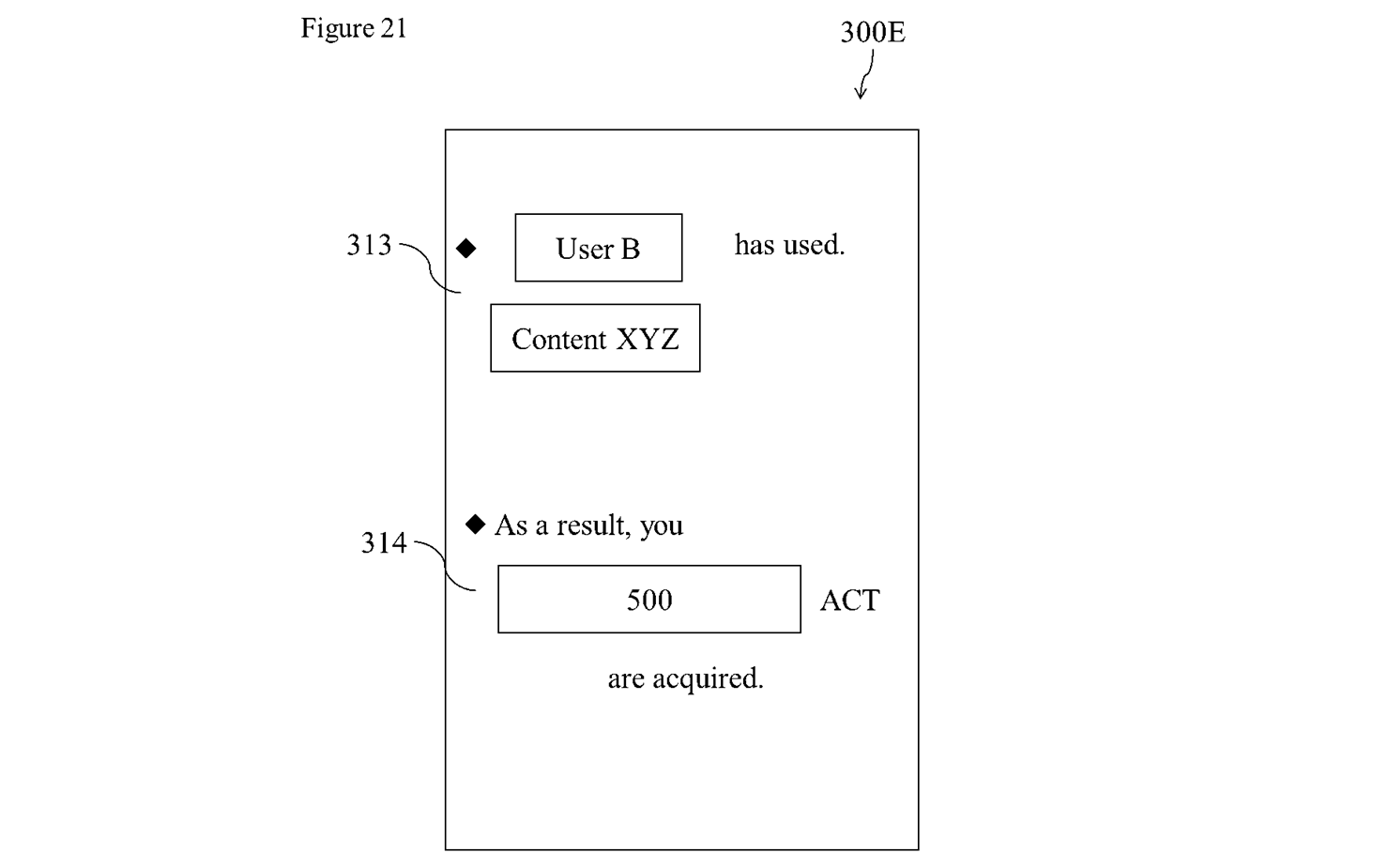

FIG. 21 is a diagram showing an example of the usage information display screen 300E.

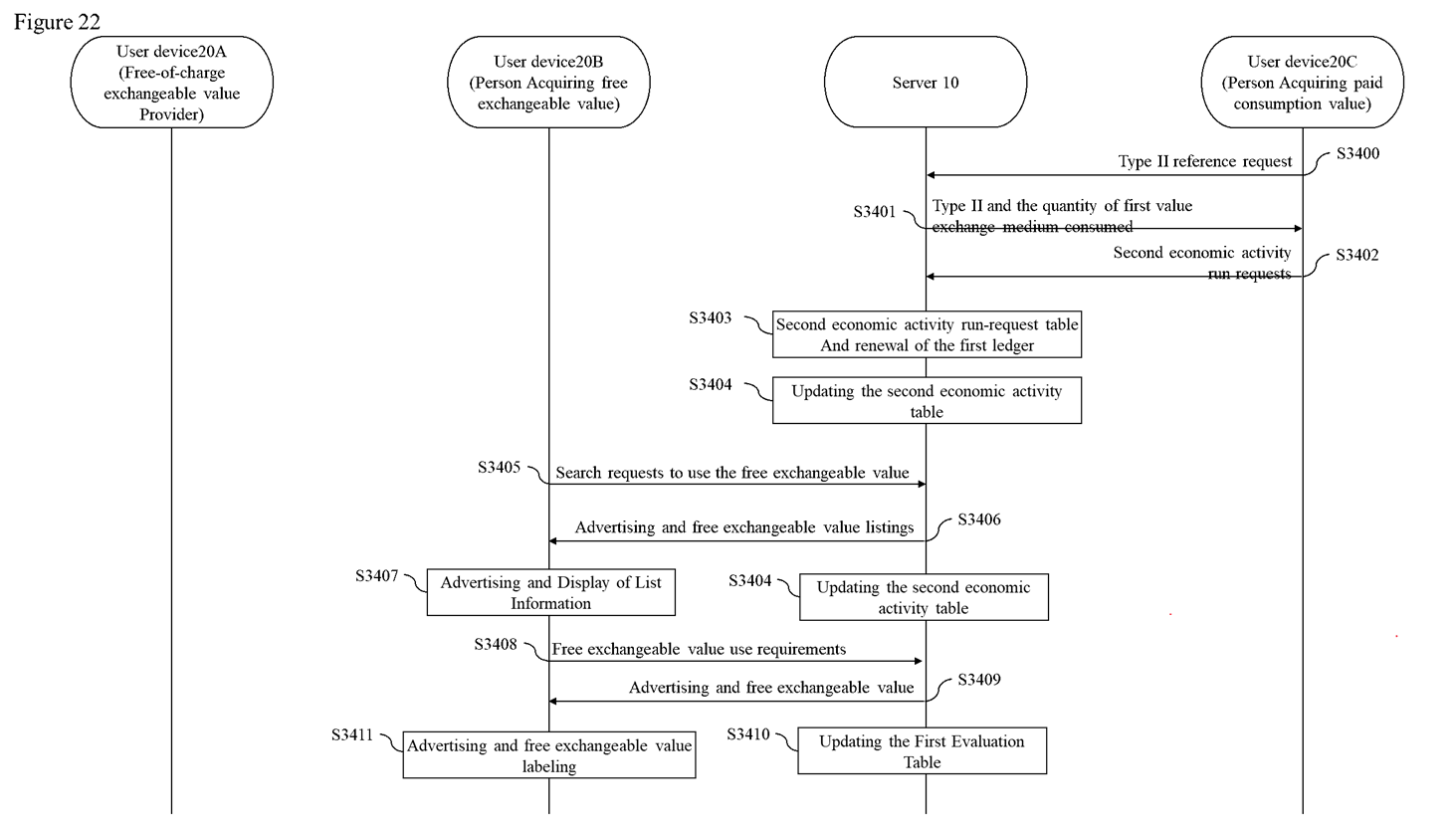

FIG. 22 is a diagram for explaining an exemplary process when second economic activity is performed in the value exchange medium circulation system 1.

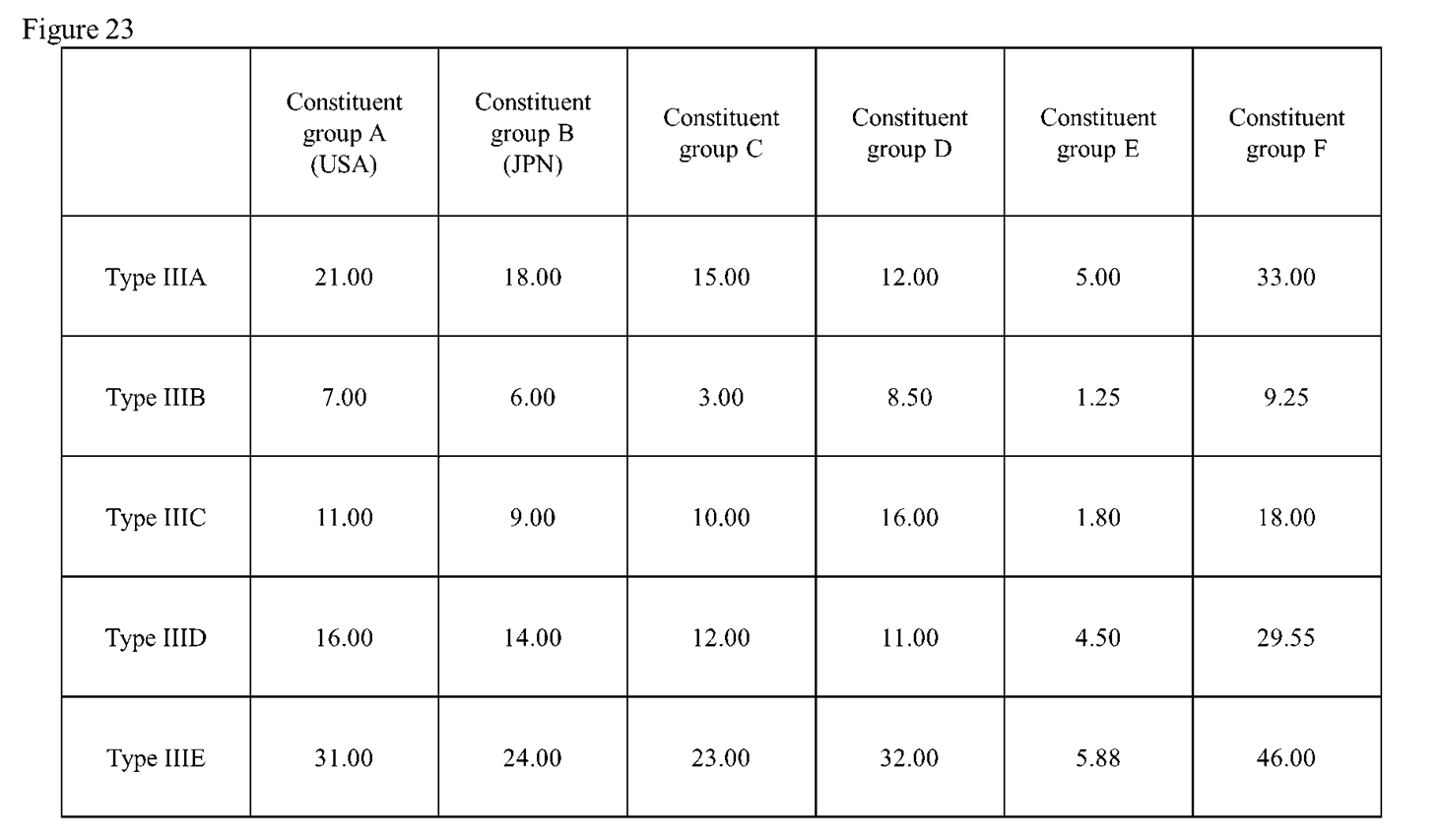

FIG. 23 is a diagram showing an exemplary third economic activity purchasing power reference table.

FIG. 24 is a schematic diagram illustrating exemplary operation sequences related to the credit issuance process.

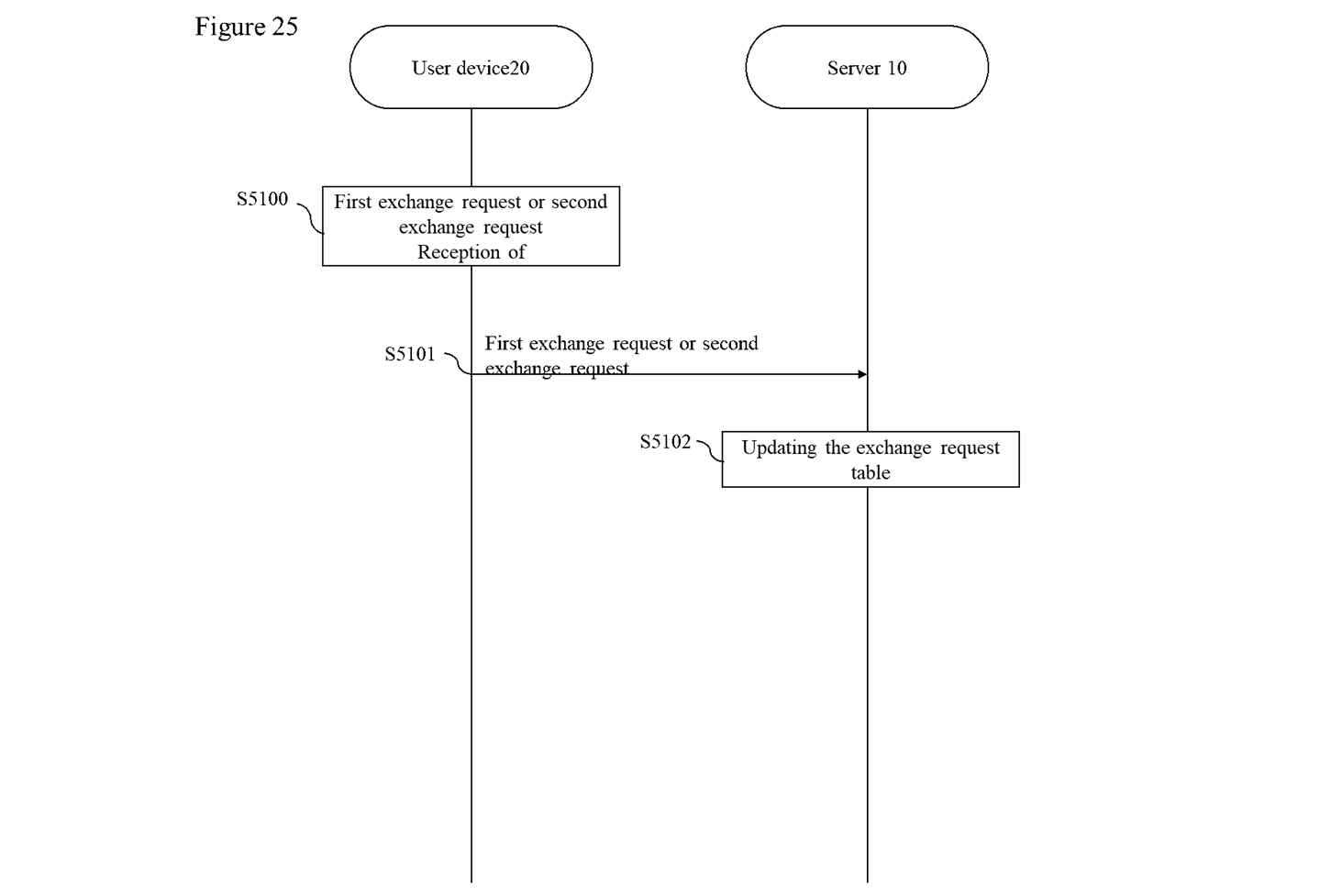

FIG. 25 is a diagram illustrating exemplary operation sequences related to the process of transmitting and registering exchange request.

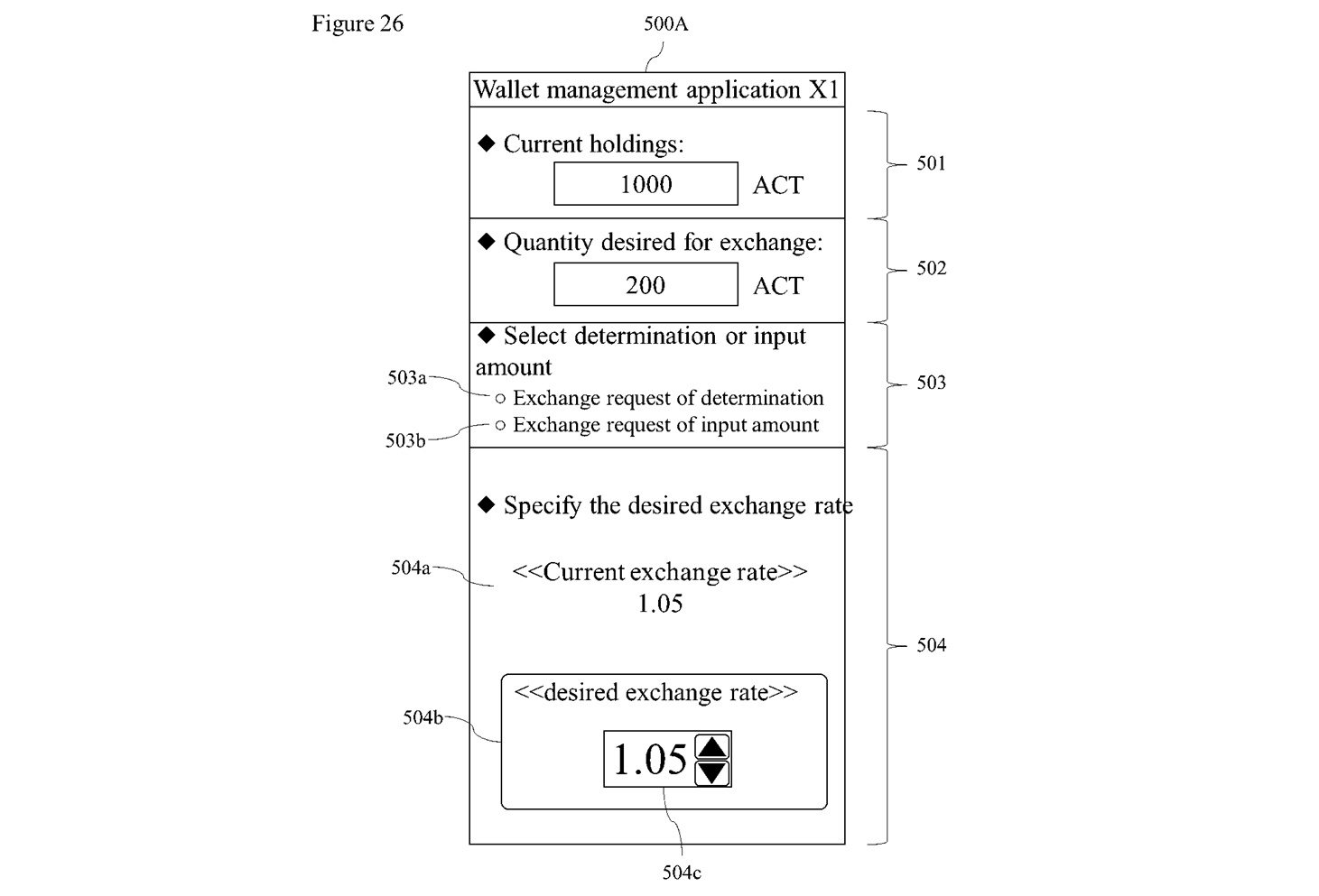

FIG. 26 is a diagram showing an exemplary first exchange request input screen 500A displayed in the wallet managing application X1.

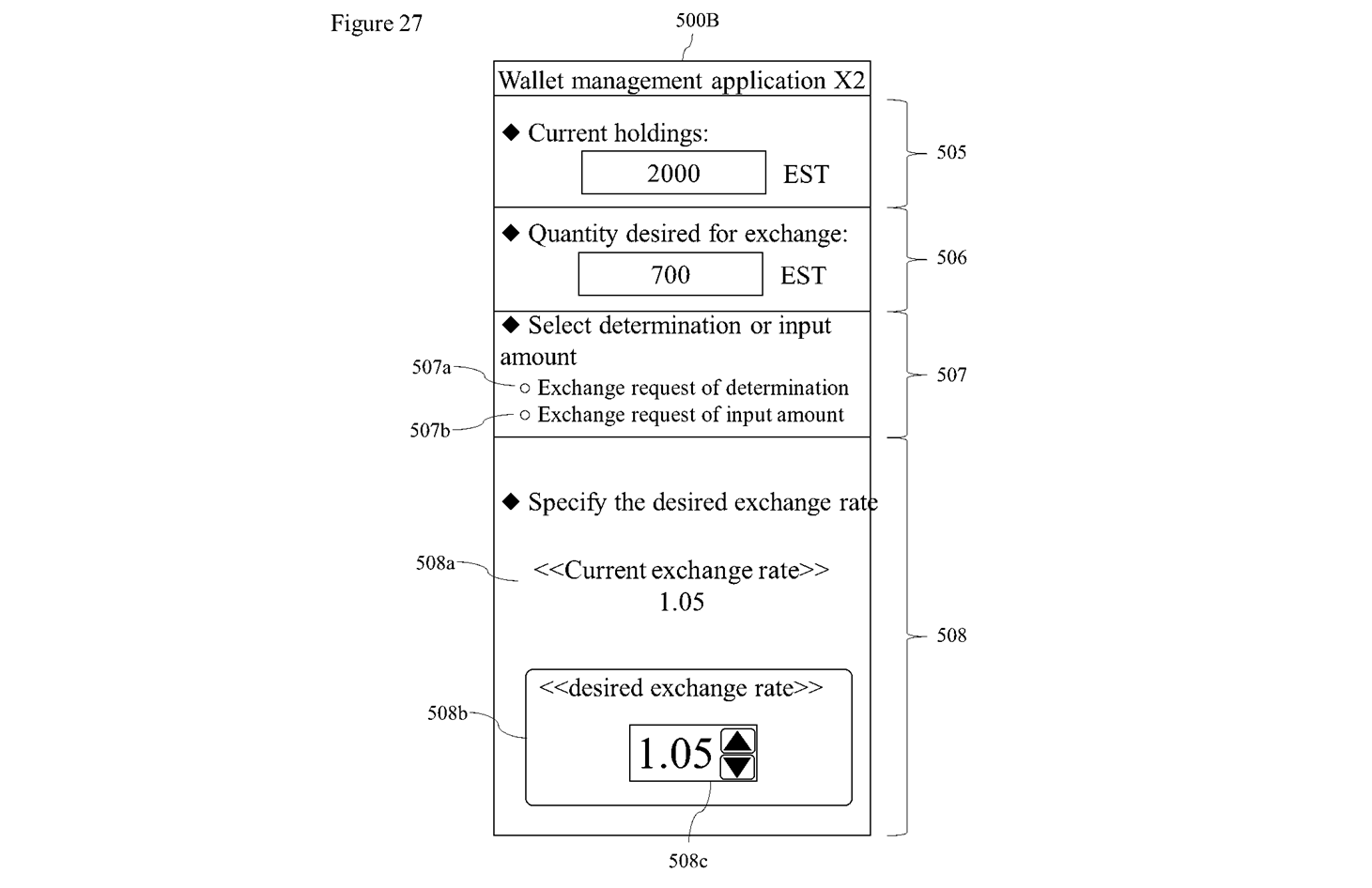

FIG. 27 is a diagram showing an exemplary input screen 500B of the second exchange request displayed in the wallet managing application X2.

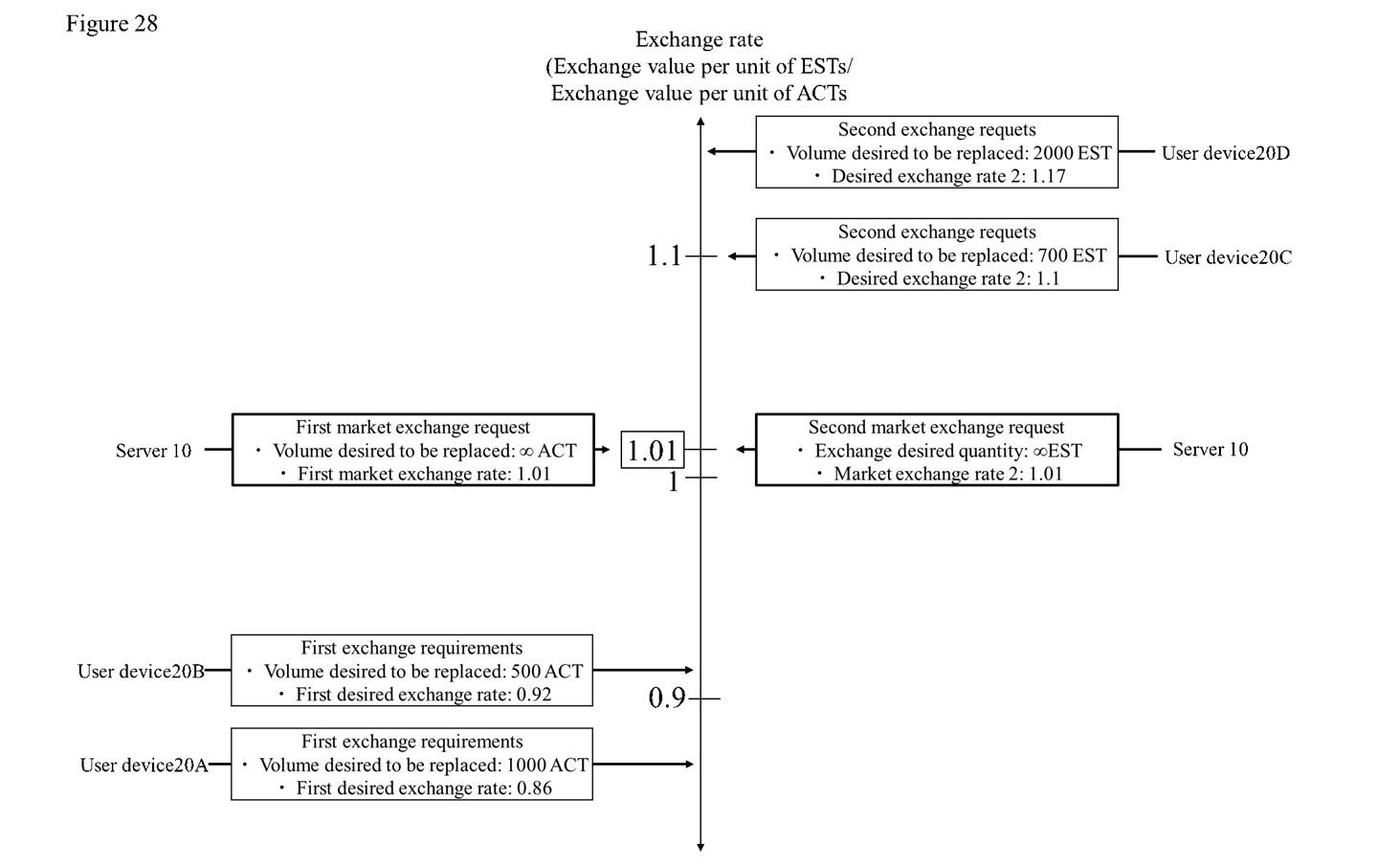

FIG. 28 is a diagram for explaining the exchange request.

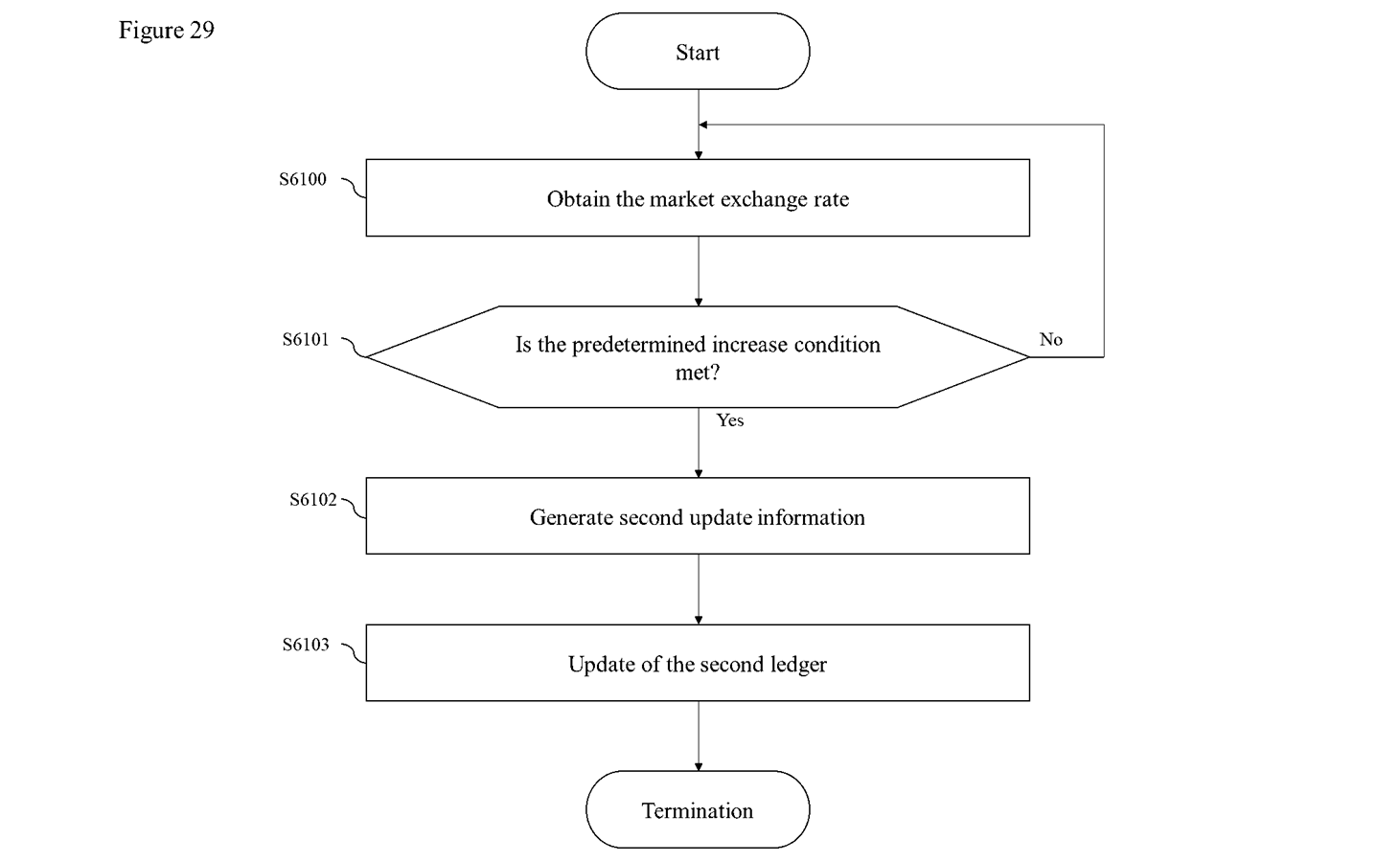

FIG. 29 is a diagram showing an exemplary operation flow of the second value exchange medium increasing process.

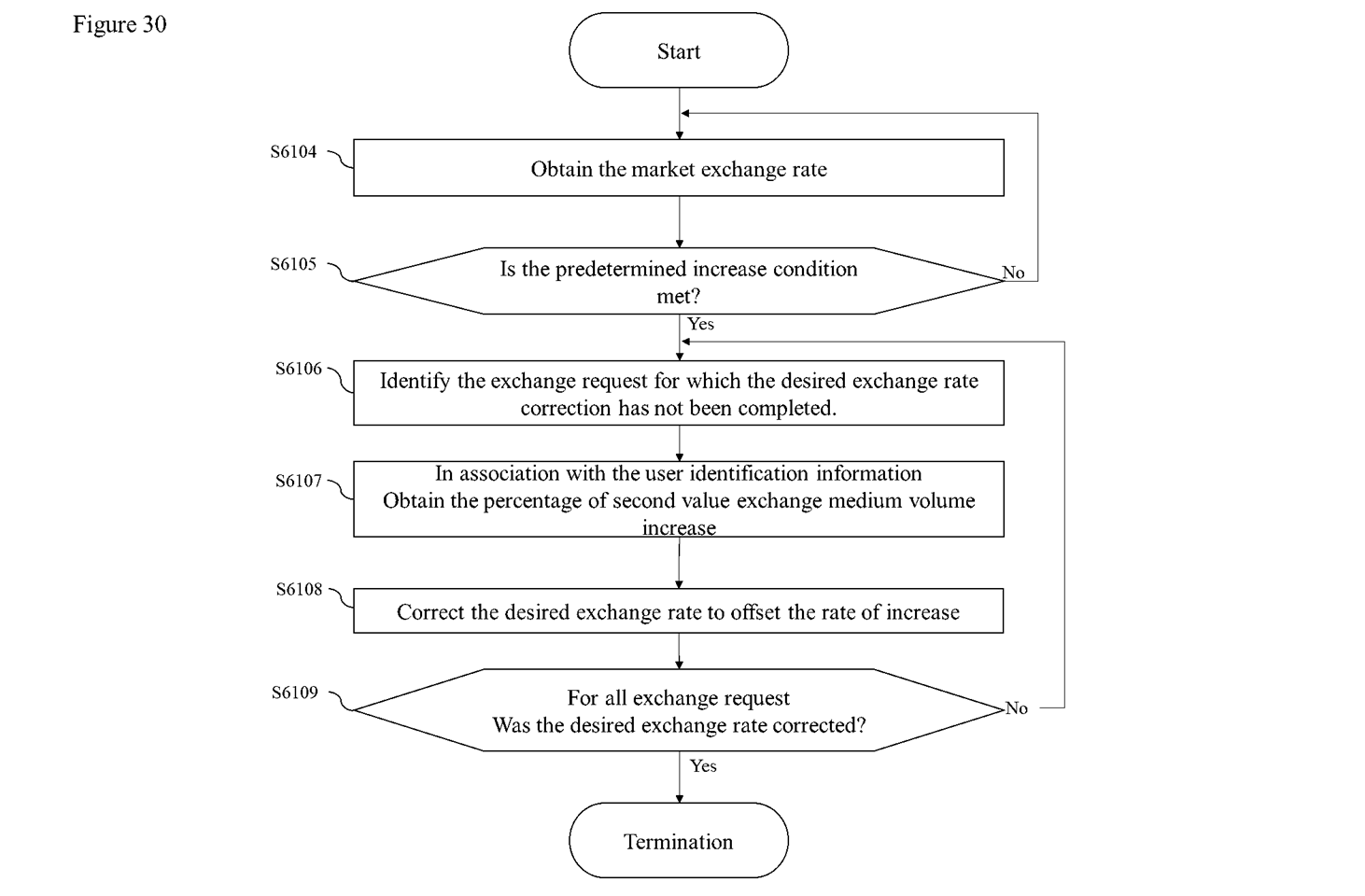

FIG. 30 is a diagram showing an exemplary operation flow of the desired exchange rate correction processing at the time of the increasing processing.

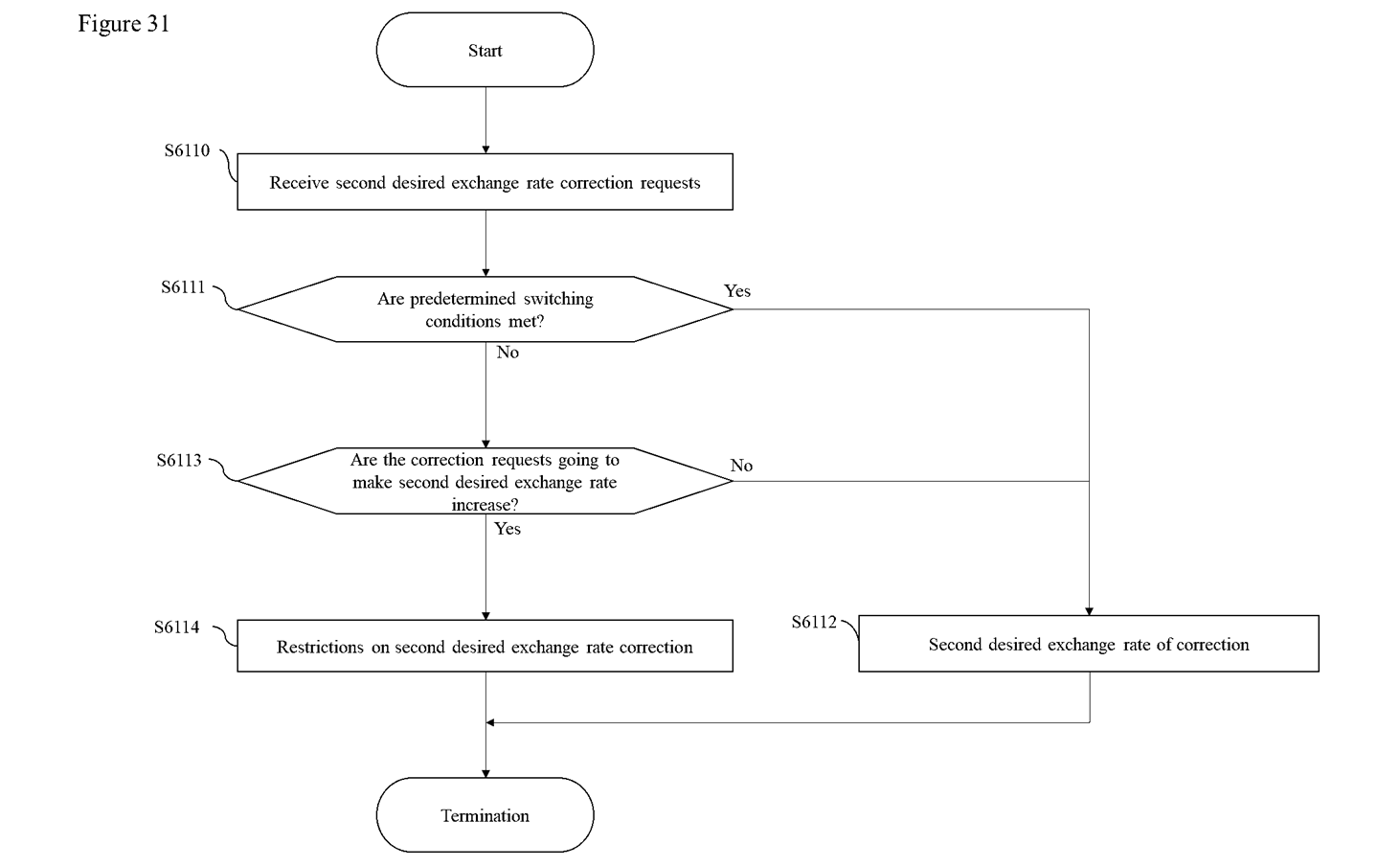

FIG. 31 is a diagram showing an exemplary operation flow of the process of restricting the modification of the second desired exchange rate.

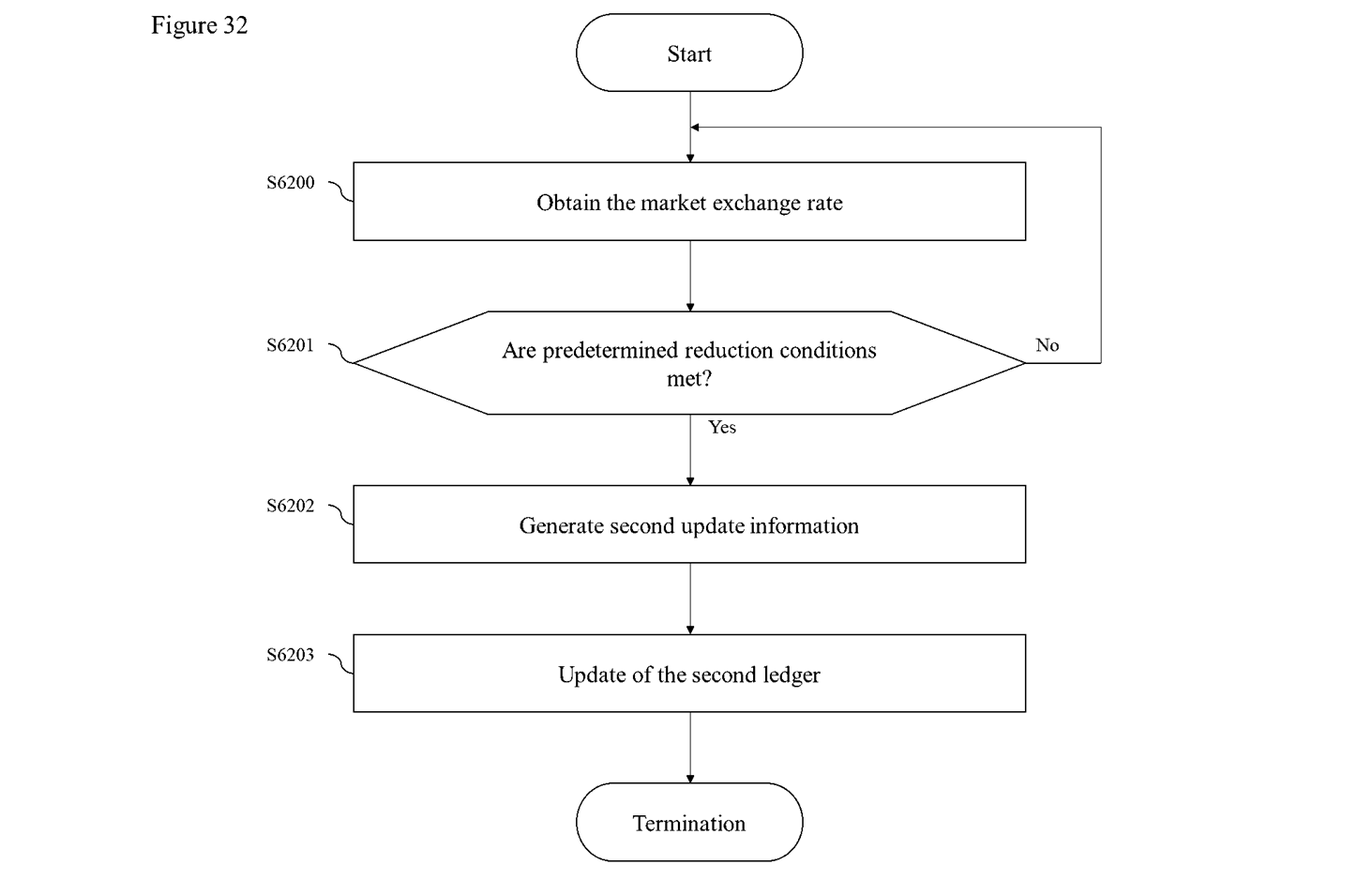

FIG. 32 is a diagram showing an exemplary operation flow of the second value exchange medium reduction process.

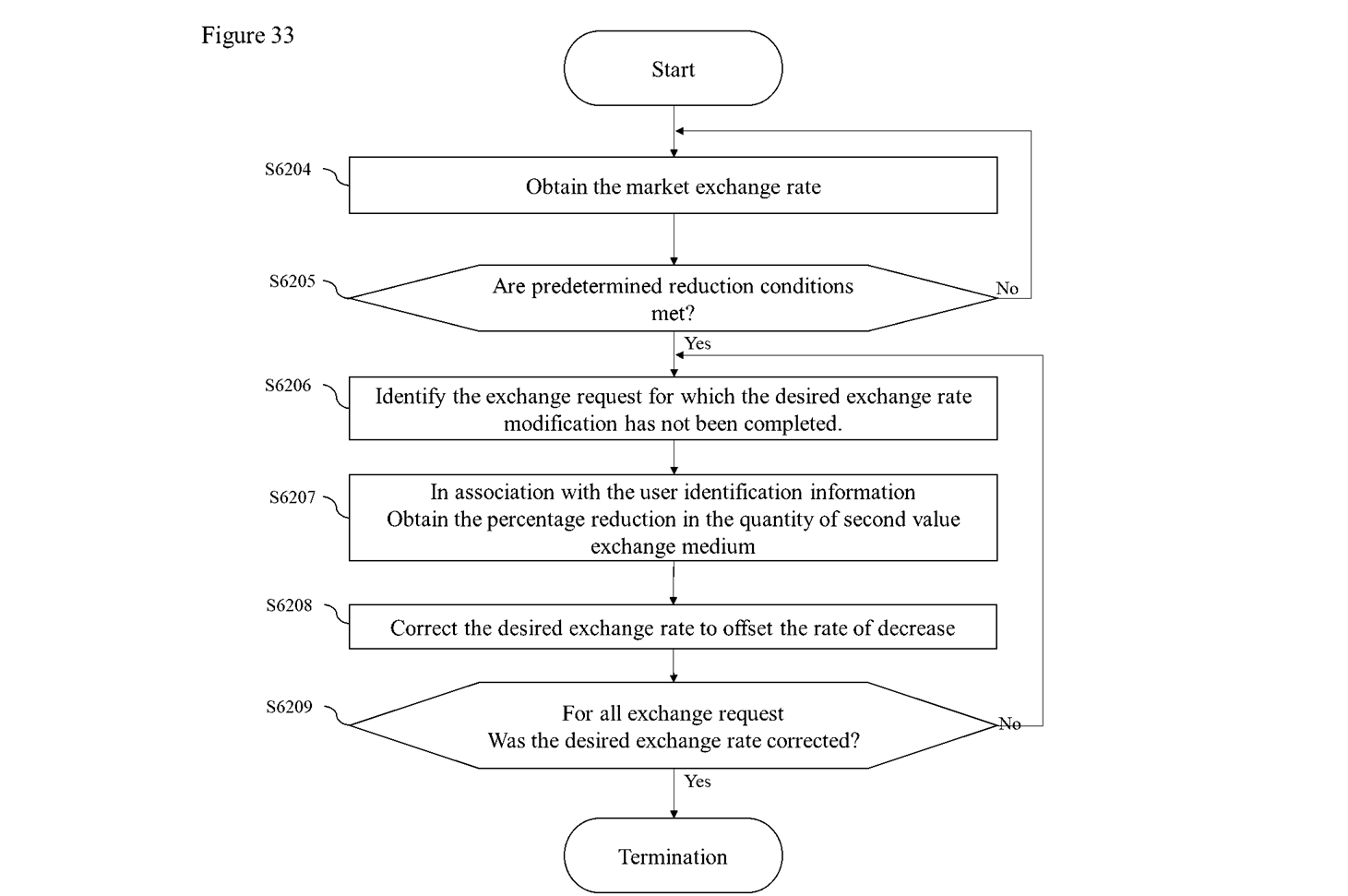

FIG. 33 is a diagram showing an exemplary operation flow of the desired exchange rate correction processing at the time of the reduction processing.

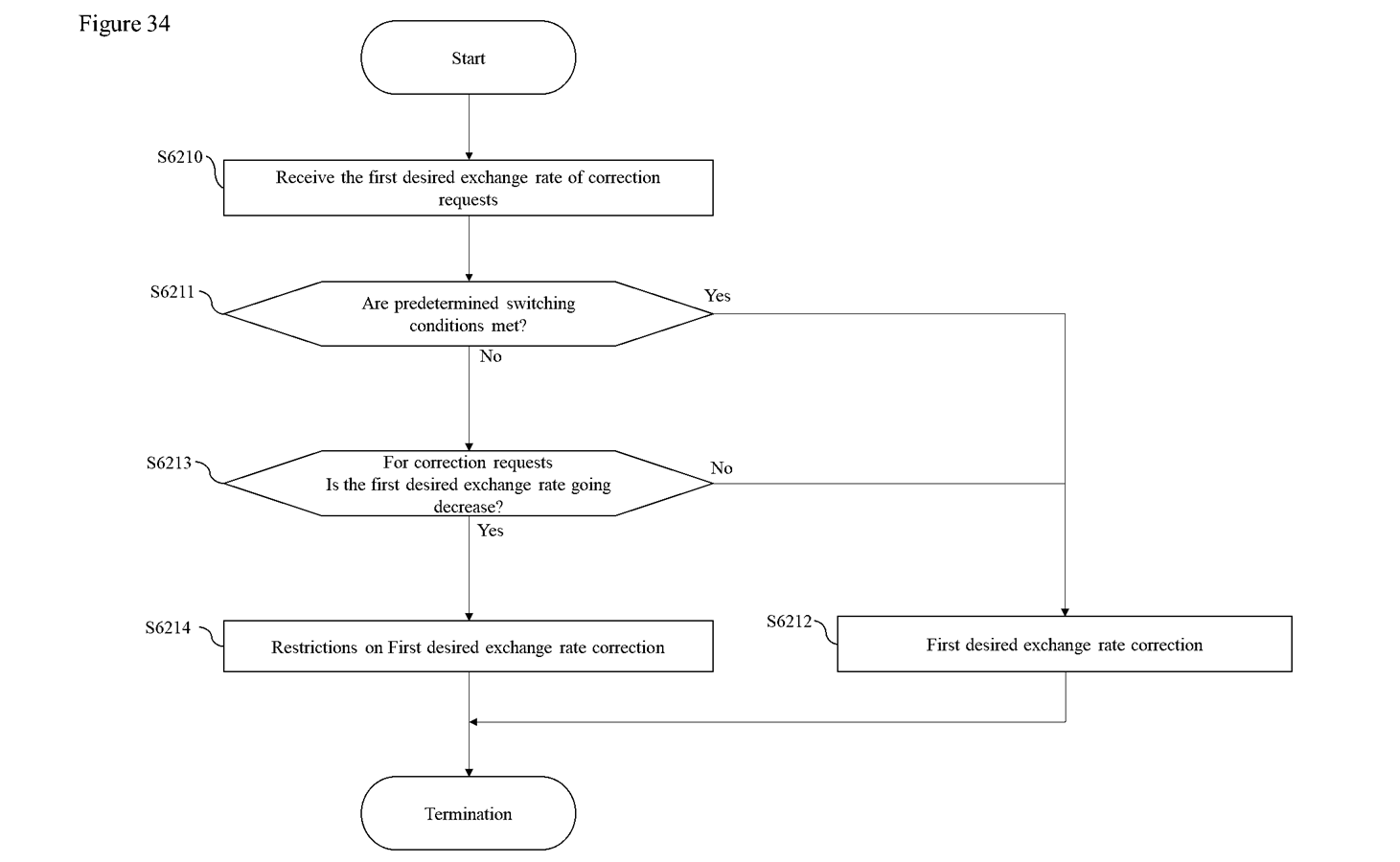

FIG. 34 is a diagram showing an exemplary operation flow of the process of restricting the modification of the first desired exchange rate.

[DETAILED DESCRIPTION OF THE INVENTION]

【0021】

Preferred embodiments of the present invention is described with reference to the accompanying diagrams. (In the diagrams, the same reference numerals denote the same or similar components.

【0022】

In the present embodiment, the "size of value (e.g., economic value, exchange value, purchasing power, etc.) included per unit of value exchange medium" may be referred to as "exchange value per unit". The "size of value (e.g., economic value, exchange value, purchasing power, etc.) included per unit of value exchange medium", that is, "exchange value per unit" may be referred to as "value scale standard", "unit economic value", "purchasing power per unit", "value of money", "standard measures of price", "credit computation unit", or "weights and measures of value", etc.

【0023】

(1) SUMMARY

(1-1) Configuration

FIG. 1 is a diagram for explaining an outline of a value exchange medium circulation system 1 according to an embodiment of the present invention.

【0024】

The value exchange medium circulation system 1 includes, for example, servers 10 and a user device 20, which are connected via communication networks N such as the Internet so as to be able to transmit and receive information to and from each other. The server 10 is, for example, a system administrator, and the user device 20 is, for example, an information processing device used by a user. The value exchange medium circulation system 1 may constitute, for example, a network having nodes such as the server 10 and the user device 20, and the network may have a side as a server-client model and a side as a block chain network. In the present embodiment, the value exchange medium circulation system 1 may be referred to as a "first network" from the standpoint of, for example, a first value exchange medium as a circulate network. In the present embodiment, the value exchange medium circulation system 1 may be referred to as a "second network" from the standpoint of, for example, a second value exchange medium as a circulate network.

【0025】

The value exchange medium circulation system 1 quantifies the "value" provided to others as a source of the desire for human social activities (the force included in the function constituting a part of the community) as a relative assessment from the viewpoint of economic value, and generates a "value scale function in which temporal and spatial variations are suppressed" and a "value exchange medium" having a "value storage function" which are not influenced by the era or the state in a controllable manner by the exchange value per unit, and distributes them between the nodes. In value exchange medium circulation system 1, two types of value exchange medium, a first value exchange medium and a second value exchange medium, may be distributed between the servers 10 and the user device 20.

【0026】

The user can manage each of the first value exchange medium and the second value exchange medium associated with the user ID via, for example, a wallet management application X, which is an application software installed in the user device 20 and will be described later.

【0027】

In the present embodiment, the name or unit of the first value exchange medium may be referred to as "ACT" and the name or unit of the second value exchange medium may be referred to as "EST". In the present embodiment, replacing first value exchange medium with second value exchange medium is sometimes referred to as "first exchange", and replacing second value exchange medium with first value exchange medium is sometimes referred to as "second exchange". In the present embodiment, the first exchange request transmitted by the user device 20 to the server 10 may be referred to as a "first exchange request", and the second exchange request transmitted by the user device 20 to the server 10 may be referred to as a "second exchange request".

【0028】

In the present embodiment, unless otherwise specified, "exchange rate", "desired exchange rate", "first desired exchange rate", "second desired exchange rate", "market exchange rate", "first market exchange rate", "second market exchange rate", "target exchange rate", "first target exchange rate", and "second target exchange rate" are expressed as the ratio of the first value exchange medium exchange quantity to the second value exchange medium exchange quantity, "first value exchange medium exchange quantity/second value exchange medium exchange quantity" (i.e., the ratio of the second value exchange medium unit exchange value to the first value exchange medium unit exchange value, "second value exchange medium unit exchange value/first value exchange medium unit exchange value"). However, this does not mean that expressing the "exchange rate", "desired exchange rate", "first desired exchange rate", "second desired exchange rate", "exchange rate", "first exchange rate", "second exchange rate", "target exchange rate", "first target exchange rate", and "second target exchange rate" as the ratio of the second value exchange medium exchange quantity to the first value exchange medium exchange quantity, "exchange quantity of second value exchange medium/exchange quantity of first value exchange medium" (i.e., the ratio of the first value exchange medium unit exchange value to the second value exchange medium unit exchange value, "unit exchange value of first value exchange medium/unit exchange value of second value exchange medium") is excluded from the present embodiment.

【0029】

(1-2)first value exchange medium

In value exchange medium circulation system 1, first value exchange medium may be circulated. The first value exchange medium may be newly issued (hereinafter sometimes referred to as "issuance based on evaluation") based on, for example, evaluations of value transferred between a plurality of user device(s) 20 free-of-charge by a predetermined issuance algorithm based on evaluation (to be described later) of the servers 10. The first value exchange medium may be write-off from paid consumption by the server 10 based on, for example, the first value exchange medium consumed by the user device 20 and the server 10 by acquiring a value in a second economic activity described later, which is performed between the server 10 and the server 10. The first value exchange medium may be newly issued (hereinafter sometimes referred to as "issuance based on debt") based on, for example, a second exchange between the user device 20 and the servers 10. In other words, the issuance based on debt can be said to be an act in which the server 10 deposits a second value exchange medium from the user device 20, and the server 10 newly issues a first value exchange medium as a substantial deposit certificate. In other words, the issuance based on debt can be said to have a "debt" in which the size of the economic value is represented by the number of first value exchange medium to the issuing destination (user device 20) (obligation to provide second value exchange medium to the user by exchange as described later) as the issuing source (server 10); and a "claim" in which the size of the economic value is represented by the number of first value exchange medium to the issuing source (right to acquire second value exchange medium from the server by exchange as described later) as the issuing destination. The first value exchange medium may be write-off by offsetting based on issuance on debt offsetting purchases by the server 10, e.g., by a first exchange made between the user device 20 and the server 10. The first value exchange medium may be write-off (write-off due to expiration), for example, when a predetermined time has elapsed since it was acquired. For example, the first value exchange medium may be recorded in the first ledger stored in the servers 10 by associating the issuance quantity with the user ID. In the present embodiment, the mode in which the first ledger is configured is not particularly limited. The first ledger may be, for example, a centralized ledger managed by the servers 10, any user device 20, or the like. The first ledger may be, for example, a distributed ledger configured by a block chain etc stored in each of the servers 10 and the user device 20. In the present embodiment, the "update of the first ledger" may include any process for update that can be defined according to the aspect of the configuration of the first ledger, and may include a process of directly updating the first ledger, as well as a process of transmitting a request for update to an information processing device having an first ledger update right.

【0030】

(1-2-1) value and Economic Activities

(1-2-1-1)value

The "value" in the present embodiment may include any information expressed in a form that can be transmitted and received between a plurality of information processing apparatuses in relation to any action (social activity) performed by a human in the course of a social lifestyle. In other words, "value" may include, for example, benefits exchanged between users (individuals, corporations, etc.) in human social activities. The "value" may also include, for example, information about goods (goods), services (services), or contractual actions (including actions that cause (psychological) claims on one side and (psychological) debt on the other side) that are exchanged between users (individuals, corporations, etc.), and information that has not necessarily been evaluated or quantified in conventional societies. The value may include, for example, contents such as written language data, moving image data, image data, audio data, design drawing data, work data, useful information data, etc.

【0031】

In this embodiment, the value may include "paid exchangeable value" and "free-of-charge exchangeable value" and "paid exchangeable value" may include "paid consumption value". In the present embodiment, "paid for" means that a first value exchange medium or second value exchange medium is required as a consideration in the economic activity performed by the user device 20. In the present embodiment, "free-of-charge" means that no first value exchange medium or second value exchange medium is required in consideration of the economic activity performed by the user device 20. In the value exchange medium circulation system 1 according to the present embodiment, the user device 20 can execute "first economic activity", "second economic activity", "third economic activity", and "fourth economic activity" which will be described later. Hereinafter, "paid exchangeable value" (including "paid consumption value") and "free-of-charge exchangeable value" will be described together with "first economic activity", "second economic activity", "third economic activity" and "fourth economic activity".

【0032】

In the present embodiment, the "type I" may be a type to which the "free-of-charge exchangeable value" that is not compensation for exchange to first value exchange medium in the first economic activity, can be managed by the servers 10, or is managed, belongs. In the present embodiment, the "type II" may be a type to which the "paid consumption value" managed by the server 10 or managed by the server 10, which has the first value exchange medium as a compensation for consumption in the second economic activity, belongs. In the present embodiment, the "type III" may be a type to which the "paid exchangeable value" that can be managed by the server 10 or is managed by the server 10 for the compensation for exchange of first value exchange medium in the third economic activity belongs. In the present embodiment, the "type IV" may be a type to which "any paid exchangeable value" that cannot be managed or is not managed by the servers 10, which has a first value exchange medium or second value exchange medium as a compensation for exchange in the fourth economic activity, belongs.

【0033】

(1-2-1-2)paid exchangeable value

In the present embodiment, the "paid exchangeable value" (including "paid consumption value") may include, for example, a value that is provided and obtained in consideration of first value exchange medium in second economic activity and third economic activity, which is a value set to accept provision of a predetermined quantity (which may include 0 (zero)) of first value exchange medium as consideration for provision of value.

【0034】

<Second Economic Activities>

In the present embodiment, an act of obtaining (using) a first value exchange medium in a compensation for consumption manner a economic value (paid consumption value) that can be extracted from value that may occur in networks via the servers 10 between the user device 20 that perform differing economic activities is referred to as "second economic activity". More specifically, the "second economic activity" refers to an act of acquiring the "value" that may occur in the network (first network) by the first economic activity while consuming a predetermined quantity of first value exchange medium as a consideration. When the user device 20 executes the second economic activity, it can be considered that the value is exchanged between the user device 20 that executes the second economic activity and the user device 20 that acquires the free-of-charge exchangeable value described later in the first economic activity. The type II to which the paid consumption value accompanied by the compensation for consumption acquired by the user using the user device 20 in the second economic activity belongs may be further subdivided into, for example, types IIA, IIB, IIC, IIAA, IIAAA,..

【0035】

(push type)

The second economic activity may include, for example, an act of obtaining a paid consumption value as a push-type second economic activity. Here, the "push-type second economic activity" can be said to be a second economic activity as an "action for arbitrarily (intentionally) exerting an influence" by a user who attempts to acquire paid consumption value (attempts to extract economic value from the first network) that consumes first value exchange medium as a consideration and can cause economic value to a target user (group) of a second economic activity that acquires free-of-charge exchangeable value in the first economic activity. The target paid consumption value of the push-type second economic activity may include, for example, "small classification: reproduction frequency specification/frequency accounting type moving picture commercial/medium classification: terminal display interrupt insertion type advertisement/large classification: targeting advertisement", "small classification: display time/region/user attributes (characteristics) specification insertion type advertisement/medium classification: terminal display interrupt insertion type advertisement/large classification: targeting advertisement", "small classification: main part display/pre-reproduction insertion type advertisement/medium classification: free-of-charge exchangeable value synthetic advertisement/large classification: targeting advertisement", etc and value (economic value). More specifically, the push-type second economic activity includes, for example, transmission of information for increasing the willingness to purchase, transmission of information for impressive manipulation, transmission of information for influencing behavior, etc can be said to be an action such as displaying (forcibly displaying) information transmitted by the user device 20 (which will be described later, the content of the execution request relating to the acquisition action of the paid consumption value belonging to the type II, which is registered in the second economic activity execution request table stored in the storage unit 11), on the user device 20 operated by the target user who acquires the free-of-charge exchangeable value etc in the first economic activity, via the server 10. This may enable a consumer user who intends to acquire paid consumption value belonging to the type II related to the push type second economic activity to acquire economic value obtained from actions for a user who acquires free-of-charge exchangeable value belonging to the type I in the first economic activity. In other words, as described above in connection with acquiring free-of-charge exchangeable value, a user who receives an "arbitrarily influencing action" from another consumer user may be understood to have accepted (accepted) an "arbitrarily influencing action" from another consumer user, thereby repaying (settlement debt or debt a consumer user who acquires a paid consumption value) the (ideal) debt that occurs to the user who provided the free-of-charge exchangeable value by acquiring the free-of-charge exchangeable value. In this way, the (ideal) debt generated by the user who provided the free-of-charge exchangeable value may be offset by the debt generated by the second economic activity by the consumer user acquiring the paid consumption value, and the first value exchange medium consumed may have a basis for issuance based on evaluation to the (ideal) creditor free-of-charge exchangeable value provider user. That is, in the value exchange medium circulation system 1, as will be described later, a settlement, which is a settlement act between a debt and a debt that occurs between a plurality of users who perform first economic activity and second economic activity, can be autonomously processed by using a issuance algorithm based on evaluation.

【0036】

(pull type)

The second economic activity may include, for example, the act of obtaining a paid consumption value as a pull-type second economic activity. Here, the "pull-type second economic activity" can be said to be a second economic activity as an action of "an action of arbitrarily (intentionally) extracting information" by a user who intends to acquire paid consumption value (attempt to extract economic value from the first network) that consumes first value exchange medium as a consideration for a target user (group) of a second economic activity for which free-of-charge exchangeable value is acquired etc in a first economic activity and that can cause economic value. The paid consumption value which is the object of the second economic activity of the pull type may include, for example, "small classification: interest change prediction/middle classification: interest trend correlation analysis/large classification: interest statistics", "small classification: political party support change prediction/middle classification: awareness trend correlation analysis/large classification: awareness statistics", "small classification: consumption change prediction/medium classification: consumption trend correlation analysis/large classification: consumption statistics", "small classification: exchange fluctuation prediction/medium classification: currency and economic correlation analysis/large classification: economic statistics" (for example, value stored in the storage unit 11 of the server 10 and obtained by verifying the correlation data stored in the storage unit 11 of the server 10 by including, outside the value exchange medium circulation system 1, the exchange function of the second value exchange medium and the foreign legal currency of each country in the exchange transaction configuration by the user terminal 20, etc.). More specifically, the pull-type second economic activity includes, for example, the acquisition of basic data (big data) for transmitting information for increasing the willingness to purchase, transmitting information for impressive manipulation, or transmitting information for influencing behavior, and can be said to be an act of attempting to extract economic value from the basic data to be acquired (basic data as big data stored in the storage unit 11 of the server 10, including the operation information of the user device 20 for acquiring free-of-charge exchangeable value in the first economic activity, etc. This may enable a consumer user who intends to acquire paid consumption value belonging to the type II related to the pull type second economic activity to acquire economic value as actions for a user who acquires free-of-charge exchangeable value belonging to the type I in the first economic activity. In other words, as described above in connection with obtaining the free-of-charge exchangeable value, it can also be understood that the user who receives the "action to extract information arbitrarily" from the other consumption user has accepted (accepted) the "action to extract information arbitrarily" from the other consumption user, thereby paying (settlement the debt or debt the consumption user who acquires the paid consumption value) the (ideal) debt that occurs to the user who provided the free-of-charge exchangeable value by obtaining the free-of-charge exchangeable value, and (accept) the "action to extract information arbitrarily" from the other consumption user. In this way, the (ideal) debt generated by the user who provided the free-of-charge exchangeable value may be offset by the debt generated by the second economic activity by the consumer user acquiring the paid consumption value, and the first value exchange medium consumed may have a basis for issuance based on evaluation to the (ideal) creditor free-of-charge exchangeable value provider user. That is, in the value exchange medium circulation system 1, as will be described later, a settlement, which is a settlement act between a debt and a debt that occurs between a plurality of users who perform first economic activity and second economic activity, can be autonomously processed by using a issuance algorithm based on evaluation.

【0037】

(Others second economic activity Blocking Type)

The second economic activity may include, for example, a second economic activity of the other party second economic activity blocking type. Here, the "second economic activity of the other party second economic activity block type" is second economic activity as an action for blocking second economic activity (advertisement, collection of big data, etc) to be executed by the other party in relation to the first economic activity when the first economic activity of acquiring the free-of-charge exchangeable value belonging to the type I is performed by the other party itself. Here, the category of the type II to which the target paid consumption value of the second economic activity of the other party second economic activity block type belongs may be different from the category of the type II to which the target paid consumption value of the other second economic activity (push type, pull type, etc.) belongs. Specifically, for example, the server 10 may accept an execution request (other party second economic activity block request) for excluding a specified user ID (the server 10 itself is basically assumed) from execution targets included in an execution request of a second economic activity of a type (push type, pull type, etc) other than the other party second economic activity block type. At this time, when the server 10 executes the execution request on the basis of the execution request of the second economic activity such as the push type or the pull type received from the user device 20, for example, the server 10 may exclude the user ID included in the other-person second economic activity block request from the object of the execution request on the basis of the other-person second economic activity block request. When the server 10 records the operation information etc acquired from the user device 20 in a first evaluation table, a search history table, and the like described later, the server 10 may exclude the user ID included in the other-person second economic activity block request from the recording target based on the other-person second economic activity block request (for example, the server 10 may record the information relating to the first economic activity with the "user ID of the free-of-charge exchangeable value acquirer" in the first evaluation table described later as a blank space). As a result, the user who performs the other-party second economic activity block-type second economic activity can directly retrieve the economic value (paid consumption value) included in the act of acquiring the free-of-charge exchangeable value belonging to the type I by consuming first value exchange medium (i.e., without receiving an action of arbitrarily (intentionally) exerting influence from another user by the second economic activity of the push type of another user or receiving an action of arbitrarily (intentionally) extracting information from another user by the second economic activity of the pull type of another user). In other words, as described above, a user who does not receive an "arbitrarily influencing action" (push type) or an "arbitrarily extracting action" (pull type) from another consumer user as a result of obtaining the free-of-charge exchangeable value can be understood to be paying the debt (ideal) generated to the user who provided the free-of-charge exchangeable value by obtaining the free-of-charge exchangeable value by not receiving the action from the other consumer user (settlement the debt or replace the debt with the consumer user who obtains the paid consumption value) and paying the same by the second economic activity of the second economic activity block type of the other consumer, instead of receiving the action from the other consumer user (accept). In this way, the (ideal) debt generated by the user who provided the free-of-charge exchangeable value may be offset by the consumption of first value exchange medium associated with the second economic activity of the other party second economic activity blocking type, and the first value exchange medium consumed may have a basis for issuance based on evaluation to the (ideal) creditor free-of-charge exchangeable value providing user. That is, in the value exchange medium circulation system 1, as will be described later, a settlement, which is a settlement act between a debt and a debt that occurs between a plurality of users who perform first economic activity and second economic activity, can be autonomously processed by using a issuance algorithm based on evaluation.

【0038】

Thereafter, the paid consumption value belonging to the type II registered (set) in the server 10 can be arbitrarily acquired (used) with a compensation for consumption by requesting the server 10 of the user device 20 to execute the type II. Further, the compensation for consumption relating to the paid consumption value belonging to each category of the type II may be set as the base prices associated with each paid consumption value belonging to the type II and each constituent group, which are recorded in the the basic price of the second economic activity table stored in the storage unit 11 of the servers 10. The setting action may be a dedicated action of a system administrator, which may include artificial intelligence under the supervision of the system administrator. When the server 10 receives the execution request of the second economic activity from the user device 20, the server 10 may specify the base price related to the execution request from the the basic price of the second economic activity table by the user device 20, and may update the first ledger in accordance with the execution of the second economic activity by the user device 20 as the paid consumption value obtaining action.

【0039】

<3rd Economic Activities>

In the present embodiment, the act of providing or acquiring paid exchangeable value to the compensation for exchange through the servers 10 via the first value exchange medium between the user device 20 is referred to as "third economic activity". The paid exchangeable value provided and obtained by the user device 20 with compensation for exchange in the third economic activity may be registered in a value table, which will be described later. The type III to which the paid exchangeable value to be subjected to the third economic activity belongs can be arbitrarily subdivided. The type III may be subdivided by, for example, a data format of a paid exchangeable value to be subjected to third economic activity, which may include, for example, data formats created by certain software such as CAD data, in addition to common data formats such as written language data, moving image data, audio data, and image data. The paid exchangeable value belonging to the type III may include any information related to the commodities and services traded between the users, but the type III may be subdivided according to the type of such commodities and services.

【0040】

An example of subdivision of Type III is shown below. The type III may be further subdivided into, for example, type IIIA, IIIB, IIIC, IIICA, IIICAB..

(Written language Data System)

In the case of a written language data system, for example, "sub-classification: self-enlightenment book/medium classification: long book/large classification: book" or "sub-classification: IT paper/medium classification: short,article/large classification: paper" may be included

(Movie Data System)

In the case of a moving image data system, for example, "small classification: Suspense drama/medium classification: continuous drama/large classification: drama" or "small classification: SF cinema/medium classification: long cinema/large classification: cinema" may be included.

(Audio Data System)

The voice data system may include, for example, "Orchestral Music/Medium Class: Classical Music/Major Class: Music" or "Small Class: Pop Music/Medium Class: Major Music/Major Class: Music".

(Image Data System)

In the case of an image data system, for example, "small classification character illustration/middle classification: digital illustration/large classification: illustration" or "small classification: gravure photograph/middle classification: idle photograph/large classification: photograph" may be included.

(Work Data System)

In the case of the work data system, for example, "small classification: house construction CAD data/medium classification: construction CAD data/large classification: CAD data", and "small classification: group schedule management application/medium classification: business application/large classification: application" may be included.

(Product Systems with Distribution)

In the case of an article system accompanied by logistics, for example, "small classification: focal length/medium classification: monofocal lens/large classification: camera lens" and "small classification: stand speaker/medium classification: AV equipment (audiovisual)/large classification: auction" may be included.

(Contract System with Provision of Services)

Contract systems involving the provision of services may include, for example, "small classification: character/medium classification: design/large classification: illustrator", "small classification: web database/medium classification: Java programming/large classification: programming", etc.

【0041】

The user device 20 selects a target category from among the types III (the category of the types III may be set in advance by a system administrator, etc), and the number of first value exchange medium as a compensation for exchange linked to the respective paid exchangeable value to be value registered in the value table by a value registering operation described later may be registered in the value table.

【0042】

<Fourth Economic Activities>

In the present embodiment, the act of exchanging paid exchangeable value (arbitrary paid exchangeable value) belonging to the type IV (which cannot be managed by the server 10 or is not managed by the server 10) using the first value exchange medium or the second value exchange medium as a compensation for exchange is referred to as "fourth economic activity". In other words, the fourth economic activity may be a direct transfer (a direct transfer resulting from any direct transaction outside value exchange medium circulation system 1 (in other words, the real economy)).

【0043】

(1-2-1-3) free-of-charge exchangeable value

In the present embodiment, "free-of-charge exchangeable value" is, for example, a value set so as not to accept the provision of a predetermined quantity of first value exchange medium as a consideration for the provision of value, and may include value as an object to be evaluated by a issuance algorithm based on evaluation described later. Here, the setting of whether or not to accept the provision of a predetermined quantity of first value exchange medium may be performed by the value provider using the user device 20, for example.

【0044】

<first economic activity>

The act of providing or obtaining free-of-charge exchangeable value between the user device 20 via the servers 10 is referred to as "first economic activity". The free-of-charge exchangeable value provided and obtained by the user device 20 in the first economic activity without compensation for consumption such as compensation for exchange as third economic activity and second economic activity is registered in a value table, which will be described later. The type I to which the free-of-charge exchangeable value to be subjected to the first economic activity belongs can be arbitrarily subdivided. The type I may be subdivided by, for example, a data format of a free-of-charge exchangeable value to be subjected to first economic activity, which may include, for example, data formats created by certain software such as CAD data, in addition to common data formats such as written language data, moving image data, audio data, and image data.

【0045】

An example of subdivision of type I is shown below. The type I may be further subdivided into, for example, type IA, IAB, IABC,..

(Written language Data System)

The written language data system may include, for example, "small classification: IT articles/medium classification: technology articles/large classification: articles", and "small classification: finance columns/medium classification: economic columns/large classification: columns".

(Movie Data System)

In the case of a moving image data system, for example, "small classification: test driving review/middle classification: automobile review/large classification: review" and "small classification: business interview/middle classification: economic activity interview/large classification: interview" may be included.

(Audio Data System)

The voice data system may include, for example, "Piano Sonata Music/Medium Class: Classical Music/Major Classification: Music" or "Lock Music/Medium Classification: Indies Music/Major Classification: Music", etc.

(Image Data System)

In the case of an image data system, for example, "small classification character illustration/middle classification: digital illustration/large classification: illustration" or "small classification: mountain photograph/middle classification: landscape photograph/large classification: photograph" may be included.

(Work Data System)

In the case of the work data system, for example, "small classification: stationery 3D printer data/medium classification: simple-material 3D printer data/medium classification: 3D printer data", and "small classification: schedule-management application/medium classification: business application/large classification: application" may be included.

【0046】

Whenever the free-of-charge exchangeable value is acquired by the user device 20, the server 10 may associate the server 10 with each category of the type I to which the free-of-charge exchangeable value belongs in the value table, and evaluation score the free-of-charge exchangeable value from the operation information of the user device 20 based on the basic score recorded in the first economic activity basic score table. In the evaluation score by the server 10 performed here, it is preferable that basic score associated with the constituent group to which the user who acquires the free-of-charge exchangeable value belongs be used in the first economic activity basic score table.

【0047】

For example, the free-of-charge exchangeable value may include "opinions by the value acquiring user" such as "comments" (comments on news articles, etc.) or "reviews" (product reviews, etc.) by the user acquiring the free-of-charge exchangeable value or paid exchangeable value for the free-of-charge exchangeable value provided by the free-of-charge exchangeable value providing user in the first economic activity or the paid exchangeable value provided by the paid exchangeable value providing user in the third economic activity. In this instance, the "opinion by the value acquiring user" may be registered in the value table after specifying the category of the type I as the free-of-charge exchangeable value to which the opinion itself is provided, and may be treated as the free-of-charge exchangeable value thereafter.

【0048】

(1-2-2) Issuance

< Issuance based on evaluation >

In the present embodiment, the server 10 relatively evaluates the free-of-charge exchangeable value and the free-of-charge exchangeable value providing user transferred (provided and obtained) between the user device 20 by a predetermined issuance algorithm based on evaluation (to be described later). Then, based on the first economic activity and the second economic activity, the server 10 uses a predetermined issuance algorithm based on evaluation to issuance based on evaluation a predetermined number of pieces of first value exchange medium in association with the user ID of the free-of-charge exchangeable value providing users. The number of pieces of first value exchange medium to be issuance based on evaluation by the server 10 may be calculated so as to reflect the purchasing power of the constituent group to which the user who acquired the free-of-charge exchangeable value belongs, as described later. Here, the "constituent group" may be an aggregate of regional attributes (living sites or business sites) recorded in an account-information table, which will be described later. A "constituent group" may be, for example, a collection of users (generally) sharing at least one of the following: "legal currency", "applicable laws", "governance mechanisms", "purchasing power", and "languages of use". "Constituent group" may be defined by, for example, municipalities, prefectures, states, regions, nations, economic bloc, continents, etc. In the present embodiment, the description is made on the assumption of "state", but the present invention is not limited to this. The definition of regional attributes and constituent group may be determined by the systems administrator. In this way, the first value exchange medium places its value on universal energies that span times (times, etc.) and places (countries, etc.) based on the desire for human social and economic activities and the desire to contribute to communities, etc., referred to as the "free-of-charge exchangeable value" described above. In addition to the regional attributes recorded in the account information table, the server 10 may specify the constituent group to which the user ID belong based on the location information based on the GPS data or, etc acquired from the user device 20, the language used by the user device 20, the display language of the wallet management application X described later, or etc.

【0049】

<Issuance based on debt>

In the present embodiment, the server 10 performs issuance based on debt by associating a predetermined number of pieces of first value exchange medium with the user ID of the user device 20 in accordance with the second exchange request received from the user device 20 by a predetermined issuance algorithm based on debt, which will be described later. For example, in this embodiment, a user may obtain a predetermined quantity of first value exchange medium by providing a free-of-charge exchangeable value to another user in the first economic activity, or by providing a paid exchangeable value to another user in the third economic activity. However, the user may wish to second economic activity, third economic activity or fourth economic activity with more first value exchange medium than the first value exchange medium quantity so obtained. At this time, the user can acquire the first value exchange medium of the insufficient quantity by exchanging a predetermined quantity of second value exchange medium with a predetermined quantity of first value exchange medium by the second exchange request (issuance based on debt by the servers 10). In this way, the issuance based on debt can be said to have the effect of reducing the problem of the shortage of first value exchange medium in the first networks.

【0050】

(1-2-3) write-off

(1-2-3-1)second economic activity

In the present embodiment, first value exchange medium is a compensation for consumption of second economic activity. When the user performs second economic activity in the first network via the user device 20, the server 10 performs write-off (write-off from paid consumption) of the first value exchange medium of the predetermined quantity from the first network by write-off the predetermined quantity in the first value exchange medium linked to the user ID of the user in the first ledger. The amount of first value exchange medium consumed by the second economic activity and write-off from the first network serves as a basis for the amount of first value exchange medium to be issuance based on based on the first economic activity according to a predetermined issuance algorithm based on evaluation described later. That is, the quantity of first value exchange medium (or first economic activity as a user device inherent in the second economic activity) consumed by the economic value 20 in the first value exchange medium by the action of acquiring economic value (paid consumption value) that can be extracted from the "value" generated in the network based on the evaluation value and write-off from the network can be said to have a function as a basis for calculating economic value included in the evaluation (evaluation score by evaluation point) given to the free-of-charge exchangeable value in the first economic activity.

【0051】

Note that the first value exchange medium consumed in the second economic activity may be temporarily linked to an ID for temporary storage (ID for temporary storage of write-off from paid consumption) managed by, for example, a system administrator or the like in the first ledger, without write-off (write-off from paid consumption) from the first ledger, and may be allocated to the first value exchange medium to be issuance based on evaluation on the evaluation value calculated in relation to the assessment of the free-of-charge exchangeable value belonging to the type I in the first economic activity.

【0052】

<Second Economic Activities and Basic Prices>

The base prices of the paid consumption value belonging to the respective categories included in the type II of the second economic activity may be the same among the different constituent group. On the other hand, it is preferable that the basic prices relating to the acquiring actions of the paid consumption value belonging to each category included in the type II relating to the second economic activity are individually determined and updated for each constituent group. That is, it is desirable to optimize the basic prices for the paid consumption value acquiring actions belonging to the respective categories so as to match the value size (purchasing power) generated in the networks by the first economic activity of the users belonging to the respective constituent group subject to the second economic activity, for example, while making the modes of segmentation of the paid consumption value belonging to the respective categories included in the type II common among a plurality of constituent group.

【0053】

<Guidelines for Determining Basic Prices and Renewal Processes>

Basic prices for paid consumption value acquisition activities belonging to each category included in Type II of the second economic activity may be output by AI (machine-learning algorithms) or by human power (continuously) output if AI is not included in the configuration, so that the sum of the consumed quantities (integration of basic prices, etc.) for acquisition activities of paid consumption value belonging to the same category during a predetermined period varies the basic prices so as to maximize at all times, for each paid consumption value belonging to each category of each constituent group. More specifically, for example, the server 10 may output a coefficient for integrating the basic price recorded in the the basic price of the second economic activity table stored in the storage unit 11 and the activity content recorded in the second economic activity table as input data into the basic price related to the act of acquiring the paid consumption value belonging to the type II by using the scoring method by the machine-learning algorithms so that the number of the first value exchanging media consumed for each category of the type II of each subject group is maximized. Then, the outputted coefficients may be integrated into the base price as the original integrated reference value to fluctuate the base price related to the paid consumption value acquiring act belonging to the type II.

【0054】

Here, the server 10 may have, for example, a machine learning device as described below. That is, the machine learning device can learn to determine a basic price related to an acquiring action of a user device belonging to at least one type (e.g., type II) for consuming and extracting economic value generated in the network in a circulate network of a value exchange medium (e.g., first value exchange medium) issued based on a evaluation score to a economic value (e.g., free-of-charge exchangeable value belonging to type I) for which a consideration provided using the paid consumption value 20 is not accepted. The machine learning device may include an observation unit for observing a consumption trend composed of the consumption quantity of the value exchange medium according to the at least one type and the basic price according to the type in a predetermined period, and a learning unit for learning a change in the consumption quantity of the value exchange medium according to the at least one type observed by the observation unit in association with the basic price according to the type.

【0055】

The amount of value exchange medium issued based on the evaluation score may be determined based on the amount of value exchange medium consumed by the act of retrieving economic value generated in the networks.

【0056】

The consumption trend according to the at least one type of consumption observed by the observation unit may include at least one of a timing, a target user property, a target user property, and a target constituent group.

【0057】

The base price of the type observed by the observation unit may include at least one of a price per hour, a price per number of times, and a price per area.

【0058】

The learning unit may learn to determine the basic price of the type by updating a function for determining the basic price of the type based on the consumption trend of the at least one type.

【0059】

The learning unit may include a reward calculation unit for calculating a reward for a result of determining a basic price related to the type based on consumption trends related to the at least one type, and a function update unit for updating the function based on a reward calculated by the reward calculation unit.

【0060】

The function updating unit may learn the basic price of the type in which the reward is most obtained by repeating the updating of the function.

【0061】

The observation unit may observe a consumption trend composed of a value exchange medium consumption quantity in the predetermined period and a base price of the network type, independently of each type (and each constituent group) related to each act of extracting economic value generated in the network.

【0062】

The target data observed by the previous period observing unit may include operation data of a user device for acquiring a economic value for which the setting is made not to accept the consideration, which is the cause of the addition of the evaluation score, and basic score relating to the evaluation score.

【0063】

The object data to be learned in association with the previous term learning unit may include operation information of a user device for acquiring a economic value for which the setting is made not to accept the consideration, which is the cause of the point addition of the evaluation score, and basic score relating to the evaluation score.

【0064】

Further, another machine learning device included in the server 10 may learn a basic price of a consumption price related to at least one type (for example, an acquisition act of paid consumption value belonging to the type II) of an act of consuming and extracting economic value generated in the network by consuming the value exchange medium in a circulate network of a value exchange medium (for example, a first value exchange medium) issued based on an assessment of a economic value (for example, an acquisition act of free-of-charge exchangeable value belonging to the type I) for which a consideration provided by the server 10 is not accepted using the user device 20. The machine learning apparatus may include an observing unit for observing the total consumption price of the type in a predetermined period and the basic price as a state variable, and a learning unit for learning the basic price such that the total of the consumption prices in the predetermined period becomes larger in accordance with a data set created based on the state variable.

【0065】

The learning unit may further include a reward calculation unit that calculates a reward based on the sum of the consumption prices, and a function update unit that updates a function for determining the base price based on the reward.

【0066】

<Control of Unit Exchange Value>

In the present embodiment, the server 10 may uniformly vary (mainly reduce the exchange value per unit of the first value exchange medium and increase the price) all the basic prices relating to the acquiring action of the paid consumption value belonging to each category of the type II in each constituent group based on the input by the system administrator (the content of the commitments to the user). At this time, the server 10 may transmit (notify) the content of the updating process (the content of the commitments) to the user device 20 in advance or at the time of executing the process. Thereby, the first economic activity of the value can be controlled by the double anchoring effect of the exchange value per unit sense between the balance of the value sense between the paid consumption value and the first value exchange medium when acquiring the paid consumption value in the second economic activity of the user (the sense of value recognition and the sense of price first value exchange medium) and the balance of the value sense of the first value exchange medium (the sense of exchange value per unit recognition and the sense of price value) issuance based on evaluation when providing the free-of-charge exchangeable value in the exchange value per unit of the user. In addition, the double anchoring effect of the value sensation can also be applied to the balance of the paid exchangeable value sensation in the direct free-of-charge transaction by the user, that is, the balance of the value sensation of the value sales price (on the other hand, the purchase price) in the third economic activity of the user operating the user device 20 (the exchange value per unit perception and the value sensation of the price), and further, the balance of the value sensation of the direct transaction according to any paid exchangeable value in the fourth economic activity (the exchange value per unit perception and the value sensation of the price). The server 10 may execute the server 10 as a measure for arbitrarily varying the value (exchange value per unit) included per unit of each first value exchange medium, the total volume of circulation of the first value exchange medium in the first network, the total volume of circulation of the second value exchange medium in the second network (to be described later), and the price (the price of paid exchangeable value arbitrarily priced by the user) (a measure for controlling the size (exchange value per unit) of the value (e.g., economic value, exchange value, purchasing power, etc.) included per unit of value exchange medium). The systems administrator should determine the content of commitments (the rate at which the exchange value per unit changes, i.e., the amount of price fluctuations) as a macroeconomic policy in value exchange medium circulation system 1.

【0067】

<Basic price table>

The basic prices relating to the acquiring actions of the paid consumption value belonging to each category of each type II of each constituent group in the second economic activity may be defined, for example, in a "the basic price of the second economic activity table" to be described later. The "base price" recorded in the the basic price of the second economic activity table is "base price when second economic activity is performed for (a user belonging to) the constituent group" and is not "base price when a user belonging to the constituent group performs second economic activity for another constituent group". The the basic price of the second economic activity table may include categories of type II, constituent group, base prices, and cumulative magnitude criteria. In the determination and updating process of the basic price, the basic price may be determined by referring to the the basic price of the second economic activity table and the "second economic activity table" as the activity record of the second economic activity. The second economic activity table may include the date and time, the user ID, the constituent group to which the user ID belongs, the category of the type II, the consumed quantity, and the activity target constituent group.

【0068】

The "value" in the first economic activity that can be taken out from the network in the above-described second economic activity is, for example, when there is a free-of-charge exchangeable value B such as written language data or moving image data provided from the user device 20A as a first economic activity, and on the other hand, there is a "value" generated in the first network by a search action, a browsing action, or an acquiring action by the user device 20C attempting to acquire the free-of-charge exchangeable value B as a first economic activity. Here, in order to make it easy for the other user device 20D to find the economic value as the second economic activity in response to various actions as the first economic activity by the user device 20C, the system administrator can prescribe the mode of the acquiring action of the paid consumption value belonging to the type II in advance, determine the base price of the acquired paid consumption value for each constituent group as the object of second economic activity, and provide an environment in which the user device 20D can acquire the paid consumption value (economic value as the object (object) of second economic activity). It should be noted that the economic value to be obtained (generated) by performing the second economic activity is paid consumption value, and it can be said that the action of the second economic activity itself or the object of the second economic activity itself (the value itself generated in the first network by the first economic activity) is not paid consumption value. For example, the category of the type II may include the category of the use of the paid consumption value acquisition environment as the provision of the environment for performing the "push type" second economic activity described above, such as the category for providing the environment for the user device 20D to perform the advertisement to the user device 20C, and the category for the use of the paid consumption value acquisition environment as the provision of the environment for the second economic activity of the "pull type" described above, such as the category for providing the environment for the user device 20D to use the big data recorded by the servers 10 as various actions by the user device 20C in the first economic activity. Further, for example, the paid consumption value acquiring environment may include a category of the type II as a provision of the environment in which the user device 20D can perform the mixed second economic activity of the "push type" and the "pull type" described above. In this manner, the user device 20D trying to acquire the paid consumption value can acquire the paid consumption value by consuming first value exchange medium. That is, it can be understood that the economic value is found in the action of the user device 20C in the first economic activity and the free-of-charge exchangeable value B provided by the user device 20A in the first economic activity by the amount of the first value exchange medium consumed in the action of acquiring the paid consumption value belonging to the type II. In this way, the "value" generated in the first network by the first economic activity generates a economic value that can be quantified through the second economic activity, and a predetermined quantity of first value exchange medium corresponding to the evaluation value described later as the generated economic value can be issuance based on evaluation to the user device 20A. It should be noted that the act of acquiring paid consumption value belonging to the type II may include, for example, advertising in a manner of interrupting various acts in the first economic activity of the user device 20C (e.g., advertising in a manner of inserting it into a viewing line as in a conventional TV commercial, inserting it into a subscription line using advertising columns such as newspapers and magazines, inserting it into a web search list field line, or inserting it into a viewing line as in a signboard) or advertising in a manner of directly including it in the free-of-charge exchangeable value B when acquiring the free-of-charge exchangeable value B in the first economic activity of the user device 20C, and further, may be finely divided into categories for each category of the type II to which the paid consumption value belongs, and the convenience of the user device 20D may be improved. The system administrator may provide any paid consumption value to the user device 20D as long as the system administrator is in a paid consumption value acquisition environment belonging to the type II in which the economic value found by the second economic activity to the "value" caused by the first economic activity increases, and preferably adds, modifies, or deletes (categories of) the acquisition environment of the paid consumption value belonging to the type II so that the number of first value exchange medium consumed by the user device 20D increases and the number of first value exchange medium to be issuance based on evaluation in the first economic activity increases.

【0069】

(1-2-3-2) and others

It should be noted that the server 10 may set a write-off deadline to a first value exchange medium newly associated with the user ID, for example, at the time of updating the first ledger, and the server 10 may cancel (write-off due to expiration) from the first ledger when a preset deadline arrives. The write-off deadline may be different for each history of acquiring the first value exchange medium. Then, the server 10 may reduce the issuance based on debt balance recorded in the issuance based on debt table by the amount of first value exchange medium that has been write-off to the server 10, as will be described later. In this regard, the first value exchange medium may be configured to have or not have a "value storage function" of the currency’s basic functions, or to have any degree. The first value exchange medium is also write-off by offsetting purchases of issuance based on debt by the servers 10, which will be described later, i.e., by the user device 20 to make first exchange requests.

【0070】

(1-2-4) Transfer (fourth economic activity)

In the present embodiment, the user can transfer (assignment) first value exchange medium to another user (user ID) using the user device 20. The user can also transfer (settlement, assignment , and reimbursement) the first value exchange medium between the users using the user device 20 as a consideration for the paid exchangeable value to be arbitrarily acquired (fourth economic activity).

【0071】

(1-2-5) value circulation